Right this moment, over $10 billion price of Bitcoin (BTC) and Ethereum (ETH) choices are as a result of expire.

Market watchers are notably attentive to this occasion as a result of its potential to affect short-term traits by way of the amount of contracts and their notional worth. Analyzing the put-to-call ratios and most ache factors can present insights into merchants’ expectations and attainable market instructions.

Bitcoin and Ethereum Choices Expiring Right this moment

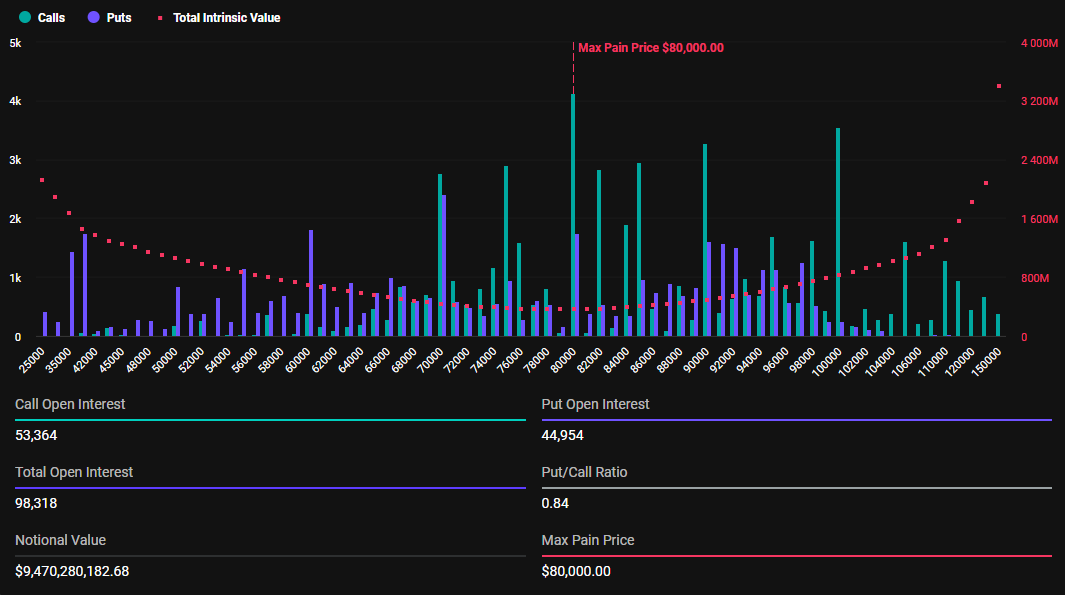

The notional worth of immediately’s expiring BTC choices is $9.47 billion. In line with Deribit’s information, these 98,309 expiring Bitcoin choices have a put-to-call ratio of 0.84. This ratio suggests a prevalence of buy choices (calls) over gross sales choices (places).

The info additionally reveals that the utmost ache level for these expiring choices is $80,000. In crypto choices buying and selling, the utmost ache level is the worth at which most contracts expire nugatory. Right here, the asset will trigger the best variety of holders’ monetary losses.

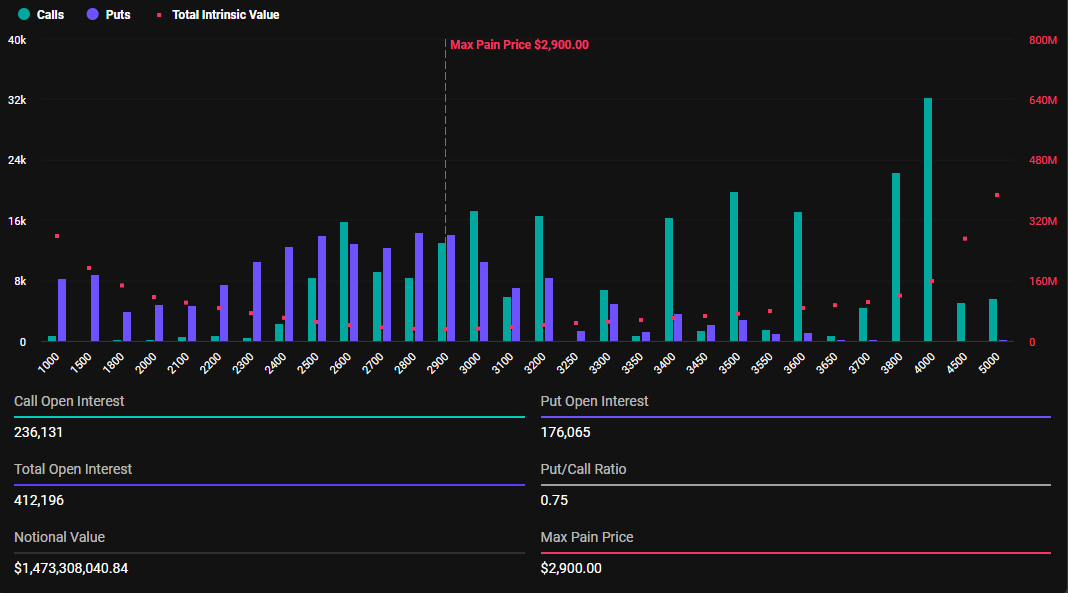

Along with Bitcoin choices, 412,116 Ethereum choices contracts are set to run out immediately. These expiring choices have a notional worth of $1.47 billion and a put-to-call ratio of 0.75. The utmost ache level is $2,900.

The present market costs for Bitcoin and Ethereum are above their respective most ache factors. BTC is buying and selling at $96,353 whereas ETH sits at $3,573. This means that if the choices had been to run out at these ranges, it will typically signify losses for choices holders.

The result for choices merchants can fluctuate considerably relying on the precise strike costs and positions they maintain. To evaluate potential good points or losses at expiration precisely, merchants should contemplate their complete choices place, together with present market situations.

Insights on Right this moment’s Expiring BTC and ETH Choices

Analysts at choices buying and selling software supplier Greeks.reside reveal an attention-grabbing investor outlook that exhibits complete analysis is important earlier than drawing conclusions.

“We bought an 11% pullback on BTC and individuals are saying the top is imminent. It was lower than 10 days in the past when the identical folks had been asking for a pullback to purchase,” they wrote.

Jeff Liang, CEO and co-founder of Greeks.reside expresses optimism, saying that he’s ready to carry till the choices expire at 8:00 UTC, Friday.

“Though the unfold is important, the supply implied volatility is on par with current 1-month historic volatility, so it’s not overpriced. A 5% spot worth improve can offset the unfold. I’m ready to carry till expiration. I purchased a batch of name choices final evening, and the market has made some strikes this morning,” Liang mentioned.

In the meantime, crypto markets stay subtly optimistic. In an announcement shared with BeInCrypto, Bybit mentioned the optimism may very well be attributed to hopeful buyers’ expectation of a extra crypto-friendly SEC Chair after Gary Gensler’s resignation.

In opposition to this backdrop, Bybit additionally commented on the present market outlook, citing a correction in Bitcoin worth and that expiring ETH choices sign moderated bullish sentiment.

“BTC’s ebbing from the $100,000 mark has flattened the ATM volatility time period construction, with short-tenor choices dipping beneath 60%. This mirrors a sample noticed because the US election. Decrease realized volatility explains the drop. Whereas open curiosity in calls and places stays unchanged, calls for for short-term choices this week have stagnated. ETH choices present barely extra bullish sentiment than BTC choices. Markets have recalibrated after the post-election excessive, however name choices stay within the lead in each buying and selling volumes and open pursuits,” Bybit added.

ATM IV refers back to the implied volatility of an possibility contract whose strike worth is the same as the present market worth of the underlying asset. Analysts and merchants usually use this particular sort of IV (implied volatility) to gauge market sentiment and volatility expectations for the underlying safety.

Merchants are subsequently suggested to stay cautious, as traditionally, choices expiration usually results in short-term instability out there. The weekend may even be essential as it’s usually characterised by excessive volatility as a result of low buying and selling volumes.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.