Este artículo también está disponible en español.

Ethereum is lastly seeing a notable rebound in its worth because the second-largest cryptocurrency by market capitalization, which continues to interrupt by vital resistance ranges.

Following its upward trajectory, seeing an almost 10% enhance prior to now week, discussions about Ethereum probably reaching a brand new all-time excessive by the 12 months’s finish have gained momentum.

Notably, aligning with the continued ETH rally is renewed curiosity in Ethereum futures, with market metrics pointing to a bullish sentiment amongst merchants.

Associated Studying

Extra Room For Development?

A CryptoQuant analyst generally known as ShayanBTC lately shared insights into the continued rally in Ethereum, emphasizing the function of funding charges—an important metric in futures buying and selling. Funding charges mirror the sentiment of merchants and point out whether or not the market is predominantly bullish or bearish.

In line with Shayan, Ethereum’s funding charges have seen a noticeable uptick in latest weeks, suggesting that demand for lengthy positions is rising.

Regardless of this bullish sentiment, the analyst talked about that funding charges stay under the height of Ethereum’s earlier all-time excessive of $4,900, signaling that “it has not but entered an overheated state.”

In the meantime, whereas indicative of bullish sentiment, funding charges additionally act as a warning signal for potential market corrections. Traditionally, sharp will increase in funding charges have been adopted by sudden market corrections or liquidation cascades.

Nevertheless, Shayan notes that Ethereum’s present funding charges are nonetheless manageable, implying that the market has extra room to develop earlier than such dangers turn out to be important.

Ethereum Market Efficiency And Outlook

Ethereum is at present experiencing an upward trajectory, posting notable double-digit good points of roughly 15.6% over the previous two weeks. This bullish efficiency has propelled ETH to interrupt by the important $3,500 resistance stage, setting its sights on the following main resistance on the $4,000 mark.

Presently, Ethereum is buying and selling at $3,563, reflecting a 1.3% enhance within the final 24 hours. Nevertheless, this worth represents a slight pullback from its 24-hour excessive of $3,682 recorded earlier at the moment.

Moreover, Ethereum’s present worth is simply 26.78% under its all-time excessive of $4,878, highlighting its gradual restoration inside the market.

Associated Studying

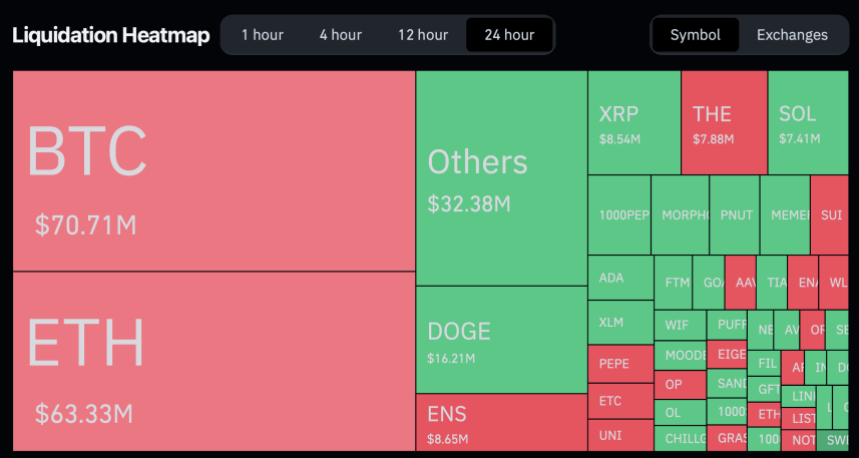

Whatever the bullish sentiment, Coinglass knowledge exhibits that previously 24 hours alone, 98,389 merchants have been liquidated, with the overall liquidations coming in at $278.03 million.

Out of this complete quantity of liquidations, Ethereum accounts for roughly $63.33 million, with $40 million of this liquidation coming from brief positions and $23.3 million from lengthy positions.

Amid the present worth efficiency from Ethereum, the famend crypto analyst generally known as Ali on X has reiterated his goal for ETH. Ali mentioned the mid-term goal stays $6,000 and long-term goal $10,000.

Our mid-term goal for #Ethereum $ETH stays $6,000… Lengthy-term goal: $10,000! https://t.co/X4lodGGIVY pic.twitter.com/siQsJzelzE

— Ali (@ali_charts) November 27, 2024

Featured picture created with DALL-E, Chart from TradingView