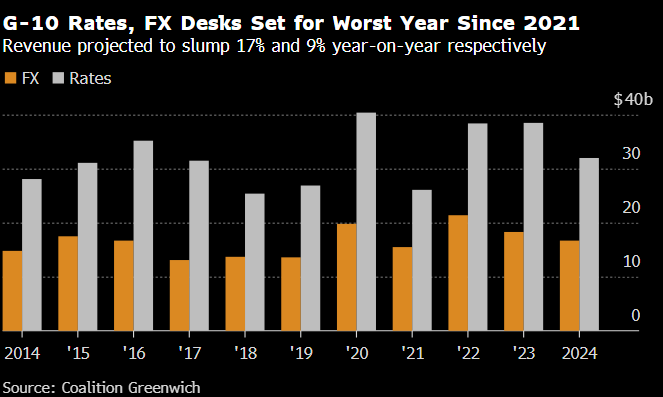

Banks are experiencing a major decline in international change and charges buying and selling income, whereas stablecoins are gaining traction in its place for cross-border transactions. World banks are on monitor to report the bottom FX and fee buying and selling income since earlier than the pandemic, with projections exhibiting a 17% year-on-year droop and a 98% decline, particularly in FX desks, in accordance with Head of digital Belongings Analysis at VanEck, Matthew Sigel.

In the meantime, stablecoins had a market capitalization of $188 billion as of Nov. 2024, with Tether (USDT) and USD Coin (USDC) accounting for almost all. Month-to-month stablecoin transactions averaged $425 billion in 2024, indicating rising adoption past digital asset buying and selling. A survey discovered that 69% of respondents in rising markets use stablecoins for forex substitution and 39% for cross-border funds.

Matthew Sigel famous that “World Banks are on monitor to Report the Lowest Income from FX and Charges Buying and selling Since Pre-Pandemic,” highlighting the impression of tighter margins and digital buying and selling developments. In a thread, Sigel agreed with LondonCryptoClub that it’s “insane to think about any financial institution not constructing out a crypto desk,” emphasizing the necessity for adaptation within the banking sector.

The distinction between declining conventional FX revenues and the regular progress of stablecoins illustrates a shift within the monetary panorama. As stablecoins provide quicker and extra accessible cross-border transactions, banks might need to combine digital property into their companies to stay aggressive.