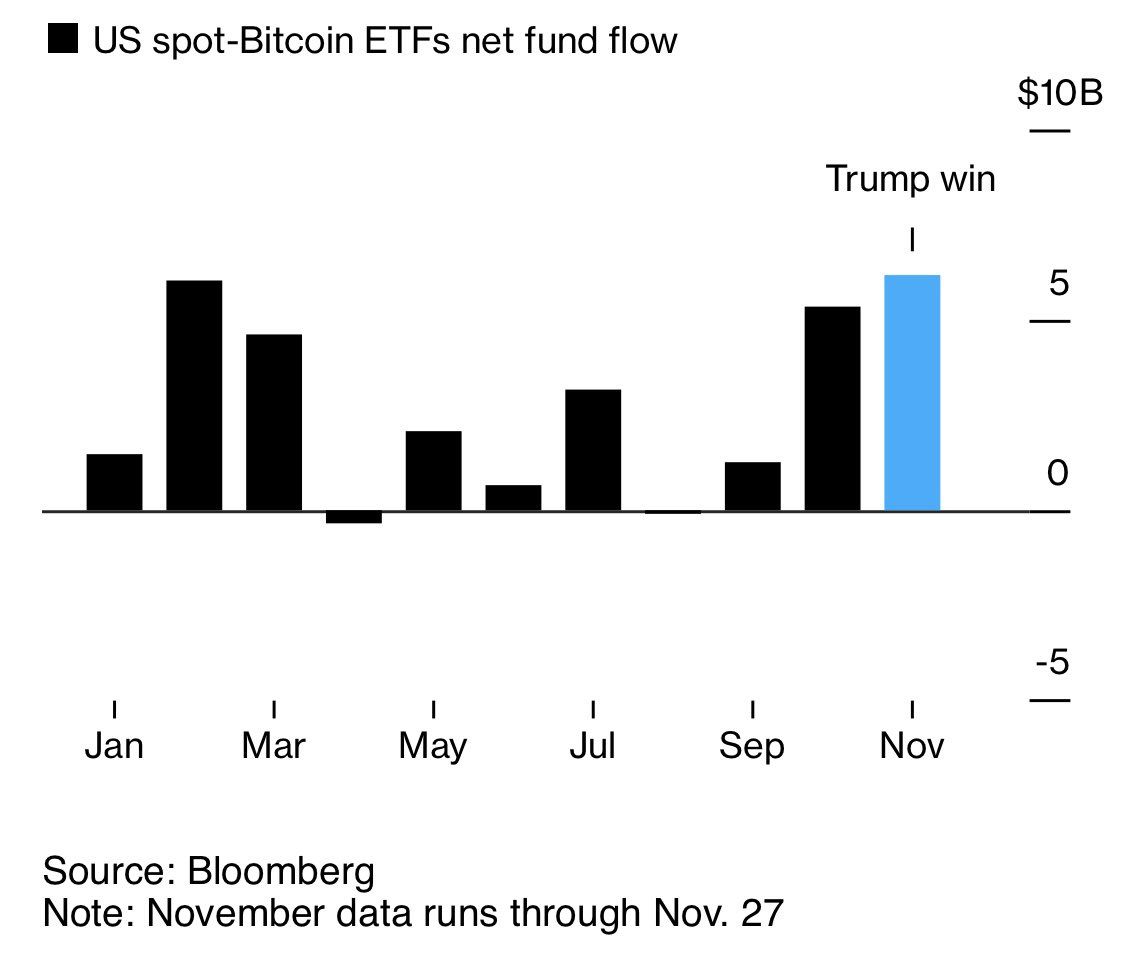

Bitcoin spot ETFs (exchange-traded funds) witnessed a landmark month in November, with web inflows surging to an unprecedented $6.2 billion. This monetary instrument, which affords institutional traders oblique entry to Bitcoin (BTC), broke the earlier document set earlier this 12 months.

The optimism driving this inflow coincides with President-elect Donald Trump’s pro-crypto agenda, which has spurred investor confidence in digital belongings and associated monetary merchandise.

Political Winds Increase Bitcoin ETFs Previous Key Milestones In November

Following the landmark approval of spot Bitcoin ETFs in January, the monetary devices have recorded a web $6.2 billion in mixed netflows in November, in line with information compiled by Bloomberg. With this, the US Bitcoin spot ETFs have breached the February peak of $6 Billion.

“Spot BTC ETFs set to interrupt month-to-month influx document… $6.2 billion to date in November. The earlier excessive was $6 billion in February,” stated Nate Geraci, president of The ETF Retailer.

Donald Trump’s electoral victory has been a important catalyst for the record-breaking inflows. His administration has promised a good regulatory surroundings for cryptocurrencies, together with reversing restrictive insurance policies enacted throughout the Biden period.

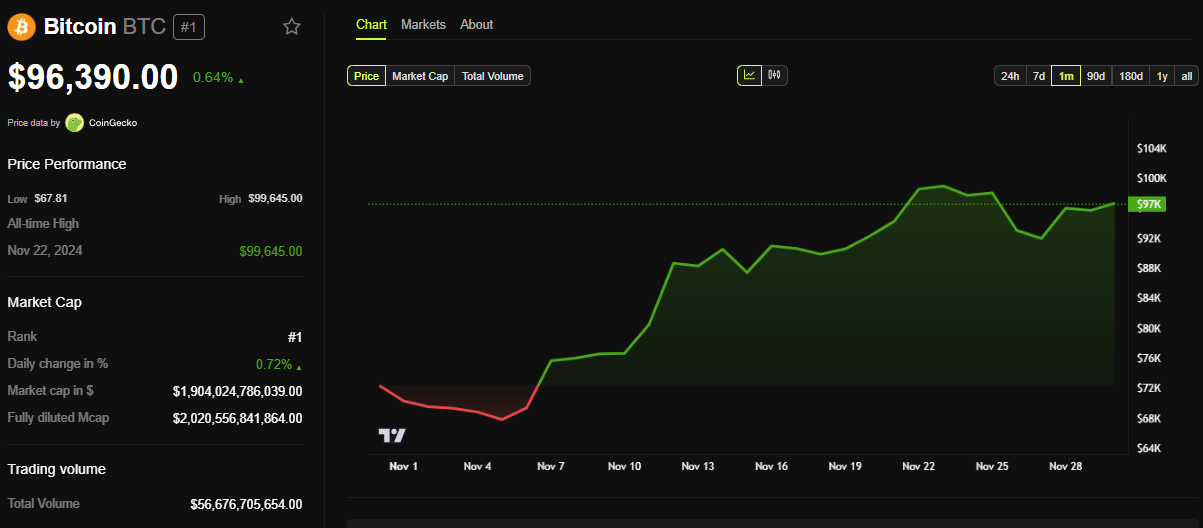

The announcement of plans to determine a strategic Bitcoin reserve and appoint crypto-friendly regulators has additional bolstered market sentiment. These drove Bitcoin near the $100,000 threshold.

This optimism extends to identify Bitcoin ETFs, which noticed their largest single-day influx of $1.38 billion instantly following the election. BlackRock, a frontrunner within the house, recorded over $1 billion in a single day, reflecting the numerous curiosity from institutional traders looking for publicity to Bitcoin by means of regulated avenues.

Past document inflows, Bitcoin ETFs have additionally witnessed fast accumulation of holdings, approaching 1 million BTC collectively. Analysts mission that by year-end, these ETFs may surpass the estimated holdings of Bitcoin’s creator, Satoshi Nakamoto. Such a milestone would solidify their dominance out there.

BlackRock’s iShares Bitcoin Belief (IBIT) stood out with its record-breaking volumes, just lately surpassing gold-based ETFs in market traction. This shift alerts a rising desire for digital belongings amongst conventional traders. Different ETFs, corresponding to these from Constancy and Bitwise, have additionally skilled notable inflows, additional increasing Bitcoin’s attain in mainstream finance.

Trump’s Insurance policies Pave Method for ETF Enlargement

Trump’s administration is anticipated to unlock additional alternatives for crypto-based monetary merchandise. Already, crypto markets have seen choices buying and selling for Bitcoin ETFs. Latest approvals by the Choices Clearing Company (OCC) have paved the way in which for the launch of choices buying and selling for Bitcoin ETFs. These developments offered traders with an extra device to hedge and speculate on Bitcoin value actions.

Matt Hougan, Chief Funding Officer at Bitwise, described the developments within the house as potential game-changers. Particularly, they’d permit institutional traders to enter the crypto house with larger confidence. This pattern aligns with the broader institutional adoption of Bitcoin as a strategic asset amid favorable regulatory alerts.

“A professional-crypto regulatory surroundings will present air cowl for institutional traders who’ve lengthy needed to allocate to the house. It’s a game-changer,” Hougan posted on X.

With ETFs enjoying a pivotal function in Bitcoin’s adoption, their continued progress may maintain BTC’s upward trajectory. Predictions counsel Bitcoin may attain new all-time highs, with some fashions concentrating on $117,000 if the present momentum persists. On the time of writing, BTC is buying and selling for $96,390, a modest 0.64% acquire since Friday’s session opened.

In the meantime, the document inflows into US Bitcoin spot ETFs in November mirror a convergence of political and regulatory occasions with investor sentiment. Trump’s pro-crypto stance has reignited enthusiasm amongst traders, driving each value and adoption milestones.

As these ETFs develop in significance, they’re reshaping the enjoying area of Bitcoin investing, positioning the pioneer crypto for broader acceptance within the monetary system.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.