Prior to now 30 days, Ethereum’s (ETH) value has surged by 33%, fueling hypothesis in regards to the cryptocurrency’s potential to hit new highs. Whereas it appears unlikely as this month attracts to a detailed, analysts’ Ethereum December prediction may convey in additional positive factors for holders.

BeInCrypto explores these forecasts, uncovering the important thing drivers behind the bullish sentiment surrounding ETH.

Analyst Bullish on Ethereum, however Give Circumstances

In accordance with Juan Pellicer, Senior Researcher at IntoTheBlock, Ethereum’s December prediction may see the cryptocurrency hit a brand new all-time excessive. Nonetheless, in his opinion, Pellicer mentioned that this may solely come to cross if ETH may break via $4,000.

Apart from that, the researcher talked about that ETH may intently comply with Bitcoin’s efficiency on this case, indicating that enormous holders’ accumulation and retail participation may very well be key to the potential.

“The outlook for Ethereum intently mirrors Bitcoin’s constructive trajectory, with important potential for an end-of-year rally that might collect much more momentum if it efficiently breaks via the earlier $4,000 ATH. Our on-chain evaluation is taking a look at developments in accumulation by giant holders, which might point out spot buys from each institutional and retail buyers,” Pellicer instructed BeInCrypto.

However as of this writing, Ethereum’s giant holders’ netflow has decreased, suggesting that whales are now not accumulating as a lot as they have been some days again. If this continues, ETH’s value may discover it difficult to succeed in $4,000 subsequent month.

Alternatively, if these holders start to build up once more, this may change, and the Ethereum December prediction may find yourself being bullish.

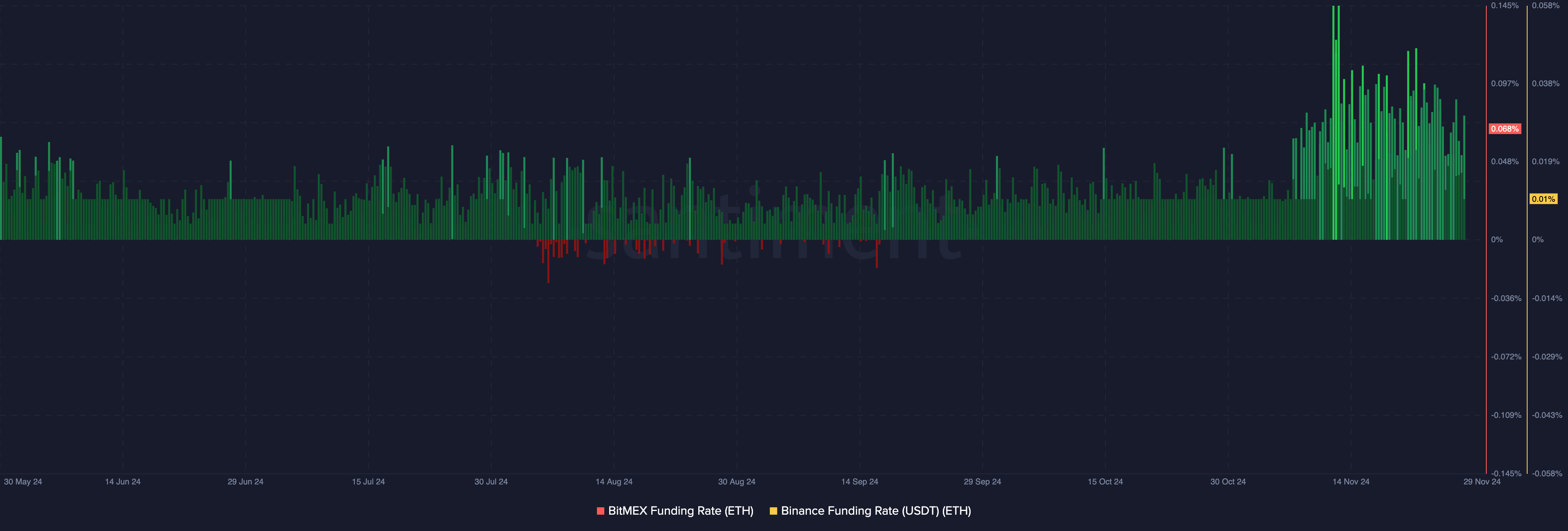

For Brian Quinlivan, Lead Analyst at Santiment, one key metric to observe is Ethereum’s funding fee on BitMex and Binance. The funding fee reveals if longs (patrons) are dominating shorts (sellers) within the derivatives market.

When it’s constructive, longs have the higher hand. However whether it is damaging, shorts do. As of this writing, the funding charges on each exchanges are extremely constructive. This means that longs are dominant, and most merchants anticipate ETH’s value to extend in December.

Nonetheless, Quinlivan believes the metric wants to remain comparatively impartial in order that Ethereum’s value can catch BTC.

“However with the longs dominating the shorts on these prime exchanges, it signifies that a major climb right here could be overcoming loads of odds. Traditionally, we’d like funding charges to remain impartial and even lean towards shorting to be able to justify future main rises,” the analyst instructed BeInCrypto.

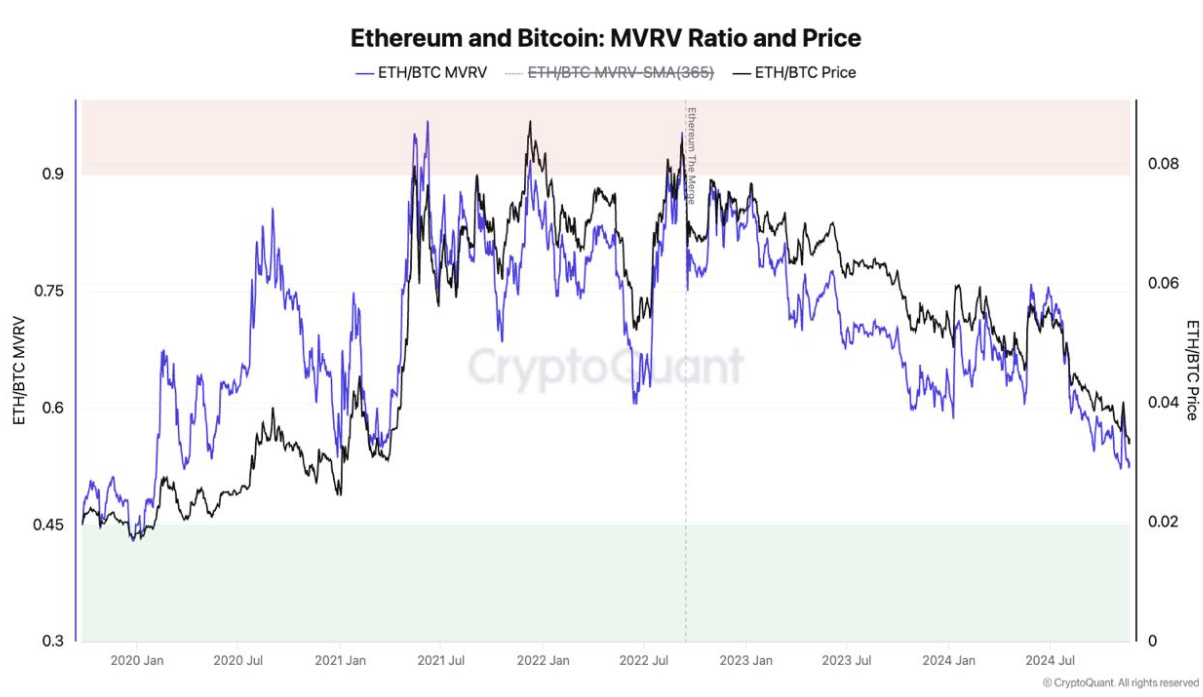

One other analyst who spoke to BeInCrypto about ETH’s potential subsequent month is Julio Moreno, Head of Analysis at CryptoQuant. Utilizing the Market Worth to Realized Worth (MVRV) ratio, Moreno says ETH is approaching an undervalued state relative to BTC.

The MVRV ratio is a key metric that reveals if an asset is undervalued or overpriced.

Based mostly on the picture above and historic information, Moreno means that ETH might quickly replicate its value motion from February 2020, a interval that marked the start of its rise to an all-time excessive in 2021.

“Presently, the relative valuation of ETH towards Bitcoin (violet line within the chart) is approaching excessive undervalued territory (inexperienced space). The final time that ETH was this undervalued towards Bitcoin was again in February 2020.” Moreno mentioned within the dialog with BeInCrypto.

ETH Worth Prediction: 4,000 or Extra on the Desk

From a technical perspective, Ethereum has fashioned a bull flag on the each day chart. The bull flag sample includes a sharp rise, sometimes called the “flagpole,” adopted by a decent, rectangular consolidation part referred to as the “flag.”

This formation sometimes signifies an upcoming breakout, throughout which the worth rests and gathers energy earlier than making an upward transfer. As seen above, ETH’s value has damaged out of the consolidation part.

Whereas it has confronted resistance round $3,600, it’s prone to bounce once more. If this occurs, Ethereum’s December prediction may see the worth rise above $4,000. Nonetheless, if the cryptocurrency faces promoting strain, the development may change, and ETH may drop to $3,003.

Disclaimer

According to the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.