Disclaimer: The opinions expressed by our writers are their very own and don’t symbolize the views of U.As we speak. The monetary and market data offered on U.As we speak is meant for informational functions solely. U.As we speak just isn’t answerable for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct your personal analysis by contacting monetary consultants earlier than making any funding choices. We consider that every one content material is correct as of the date of publication, however sure provides talked about could now not be obtainable.

XRP, the digital asset related to Ripple Labs, has decoupled from Bitcoin (BTC), showcasing exceptional worth progress. Whereas BTC elevated barely by 0.40% within the final 24 hours, XRP is up over 10%, demonstrating its independence from the main cryptocurrency.

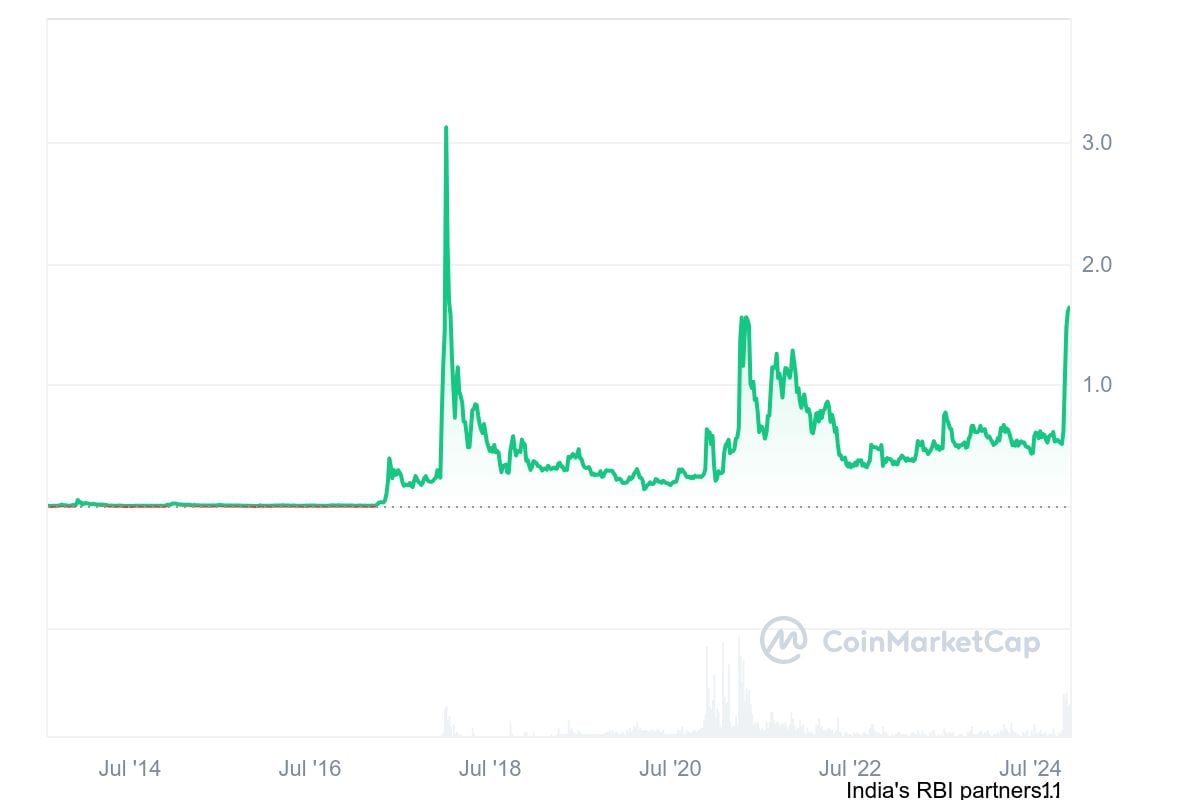

XRP hits six-year excessive

In keeping with CoinMarketCap information, XRP was up 10.05% within the final 24 hours to $1.62. This worth is a large achievement for XRP, the very best recorded since 2018.

It additionally reveals XRP’s resilience regardless of a broader market worth reversal and Ripple’s ongoing authorized challenges with the U.S. Securities and Trade Fee (SEC).

XRP rose from the day prior to this’s low of $1.44 to achieve an intraday excessive of $1.61 earlier than settling at its present worth. The day by day buying and selling quantity is up 10.6% to $8.4 billion, suggesting traders’ willingness to build up the coin.

In the meantime, the complete crypto market is exhibiting combined sentiment. For example, Ethereum (ETH) and SUI costs decreased by 1.6% and seven.03% within the final 24 hours. Alternatively, the costs of Solana (SOL), BNB and Avalanche (AVAX) rose by 2.09%, 0.12% and 1.18%, respectively, throughout the similar timeframe.

Renewed optimism towards XRP

The renewed optimism round XRP follows the potential overhaul of the U.S. crypto regulatory panorama.

The U.S. SEC chair, Gary Gensler, is about to depart workplace, boosting the group’s hope of coming reforms. With the U.S. SEC led by a extra pro-crypto chairman, the long-standing authorized battle between Ripple and the SEC might quickly conclude.

Moreover, the market is optimistic in regards to the approvals of XRP Trade-Traded Funds (ETFs) within the U.S. An ETF is anticipated to drive institutional curiosity for XRP, resulting in extra bullish worth outcomes.

U.As we speak reported that Bitwise not too long ago rebranded its XRP Trade-Traded Product (ETP) to the Bitwise Bodily XRP ETP. Different asset managers like Canary Capital and 21Shares have additionally made strikes for the XRP ETF product.