The newest perception from consultants has revealed that Bitcoin is poised to profit from an enormous liquidity injection projected for 2025, doubtlessly drawing $2 trillion in new investments into BTC.

This prediction stems from expectations that the US Federal Reserve will considerably improve the worldwide cash provide, which may increase BTC’s market cap and value efficiency.

Liquidity Development And Bitcoin’s Market Implications

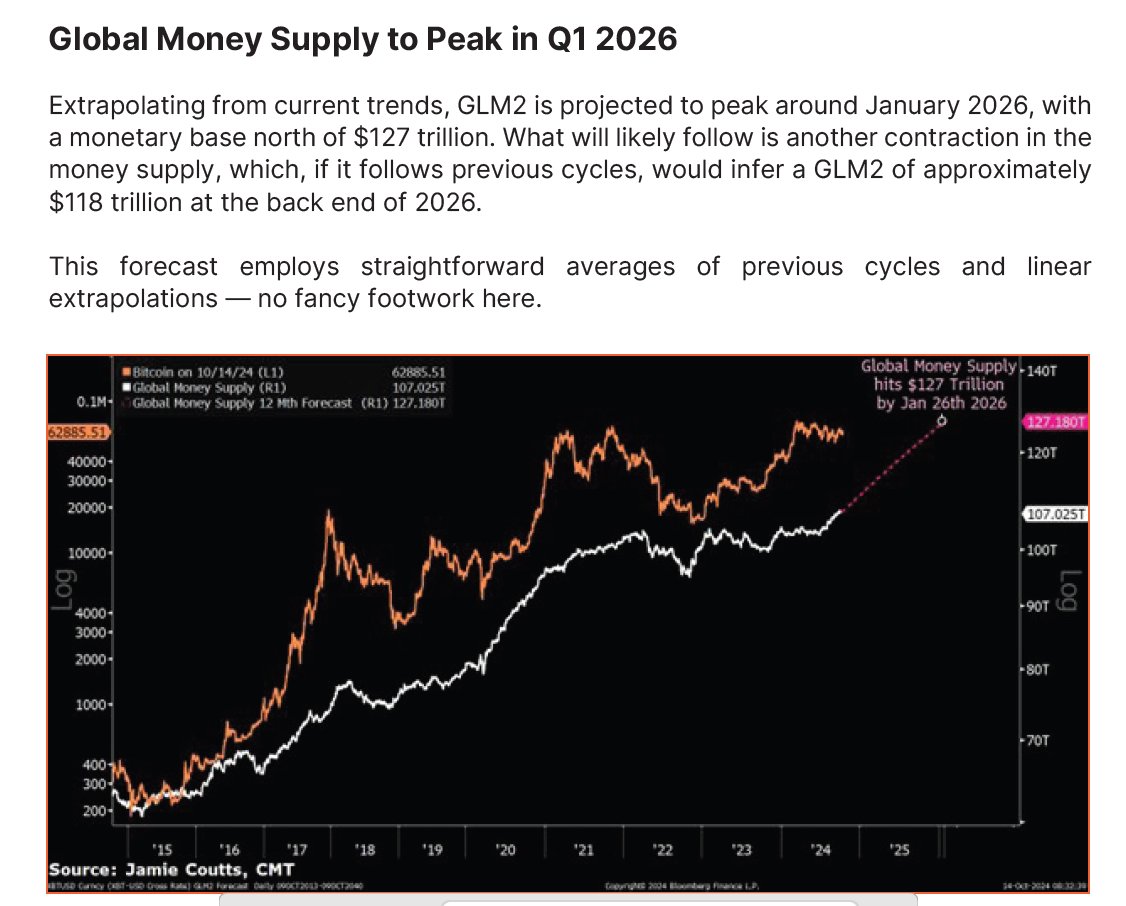

In keeping with Jamie Coutts, a chief crypto analyst at Actual Imaginative and prescient, the worldwide cash provide, often known as M2, is anticipated to develop from its present $107 trillion to over $127 trillion in 2025. This 18% improve in liquidity, spurred by financial components and financial insurance policies, could act as a crucial catalyst for BTC.

Coutts highlights that BTC has traditionally captured round 10% of newly injected liquidity, suggesting that the cryptocurrency may see vital inflows throughout this upcoming interval.

Coutts defined that BTC’s efficiency is carefully tied to liquidity actions within the international monetary system. Historic information reveals that between This fall 2022 and the current, the worldwide M2 cash provide rose from $94 trillion to $105 trillion.

World M2 bottomed at $94T in This fall 2022 and has since climbed to $105T. Throughout this era, Bitcoin’s market cap 5x’ed, including $1.5T. In different phrases, 10% of the brand new cash provide has leaked from the fiat system into the rising international reserve asset of Bitcoin (gold, equities and so forth… pic.twitter.com/w0vWIMufbg

— Jamie Coutts CMT (@Jamie1Coutts) November 28, 2024

Throughout the identical interval, Bitcoin’s market cap elevated fivefold, including $1.5 trillion. These figures point out that Bitcoin absorbed roughly 10% of the brand new liquidity getting into the system, reinforcing its position as an rising international reserve asset.

With the projected $20 trillion liquidity increase in 2025, Bitcoin may doubtlessly appeal to $2 trillion in new investments. Coutts’ evaluation highlights that financial debasement, alongside Bitcoin’s superior annualized returns exceeding 113%, will possible improve the cryptocurrency’s institutional adoption.

This pattern positions BTC as an “more and more enticing various” to conventional funding automobiles, notably as issues over fiat foreign money power persist.

Bitcoin’s 2025 Prospects and Institutional Adoption

Coutts additional predicts that the worldwide M2 cash provide will peak on January 26, 2026, as financial insurance policies proceed to increase financial bases.

This timeline aligns with forecasts of BTC’s value doubtlessly reaching $150,000 in 2025. This progress is anticipated to be fueled by weakening confidence within the US greenback and the broader fiat system, encouraging buyers to hunt various shops of worth.

Notably, institutional curiosity in BTC can also be prone to rise because the asset demonstrates its resilience and profitability. With a rising popularity as a hedge towards inflation and financial debasement, Bitcoin could appeal to a wider array of buyers searching for stability amidst financial uncertainty.

Featured picture created with DALL-E, Chart from TradingView