Disclaimer: The opinions expressed by our writers are their very own and don’t characterize the views of U.Immediately. The monetary and market data offered on U.Immediately is meant for informational functions solely. U.Immediately will not be answerable for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct your personal analysis by contacting monetary consultants earlier than making any funding choices. We consider that every one content material is correct as of the date of publication, however sure affords talked about could not be accessible.

Monday began with blood on the cryptocurrency market. Based on information from CoinGlass, greater than $500 million in lengthy and brief positions in crypto asset futures had been liquidated over the previous 24 hours. Curiously, nonetheless, even on this tsunami of liquidations, there have been some cryptocurrencies that confirmed not solely steady however even discouraging value habits. Over the previous 24 hours, there have been three such crypto belongings – XRP, HBAR and IOTA.

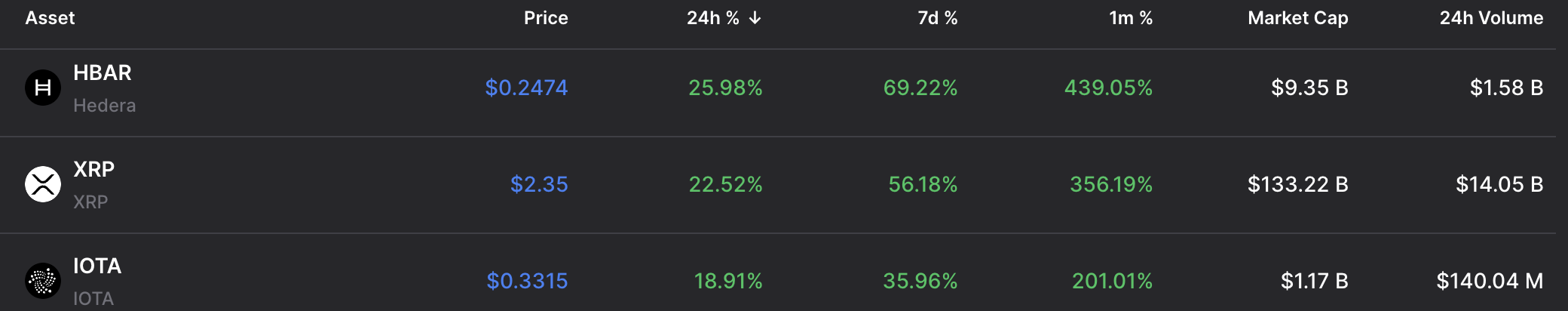

Based on Dropstab’s desk of high performers, these cryptocurrencies elevated their value by a mean of twenty-two% throughout this era. Curiously, all of those digital currencies belong to tasks which might be extra centered on working with companies and crypto options for institutional traders.

It’s seemingly that the revaluation of such belongings was primarily set by XRP, which has seen a staggering development of a whole lot of % over the previous month, including over $100 billion in capitalization and ultimately changing into the third largest cryptocurrency proper now.

Now, XRP will be known as the headliner of this sector of enterprise-oriented cryptocurrencies, and all such belongings are in a development that positively impacts their costs, even in occasions of elevated market turbulence.

Market chooses to be “critical”

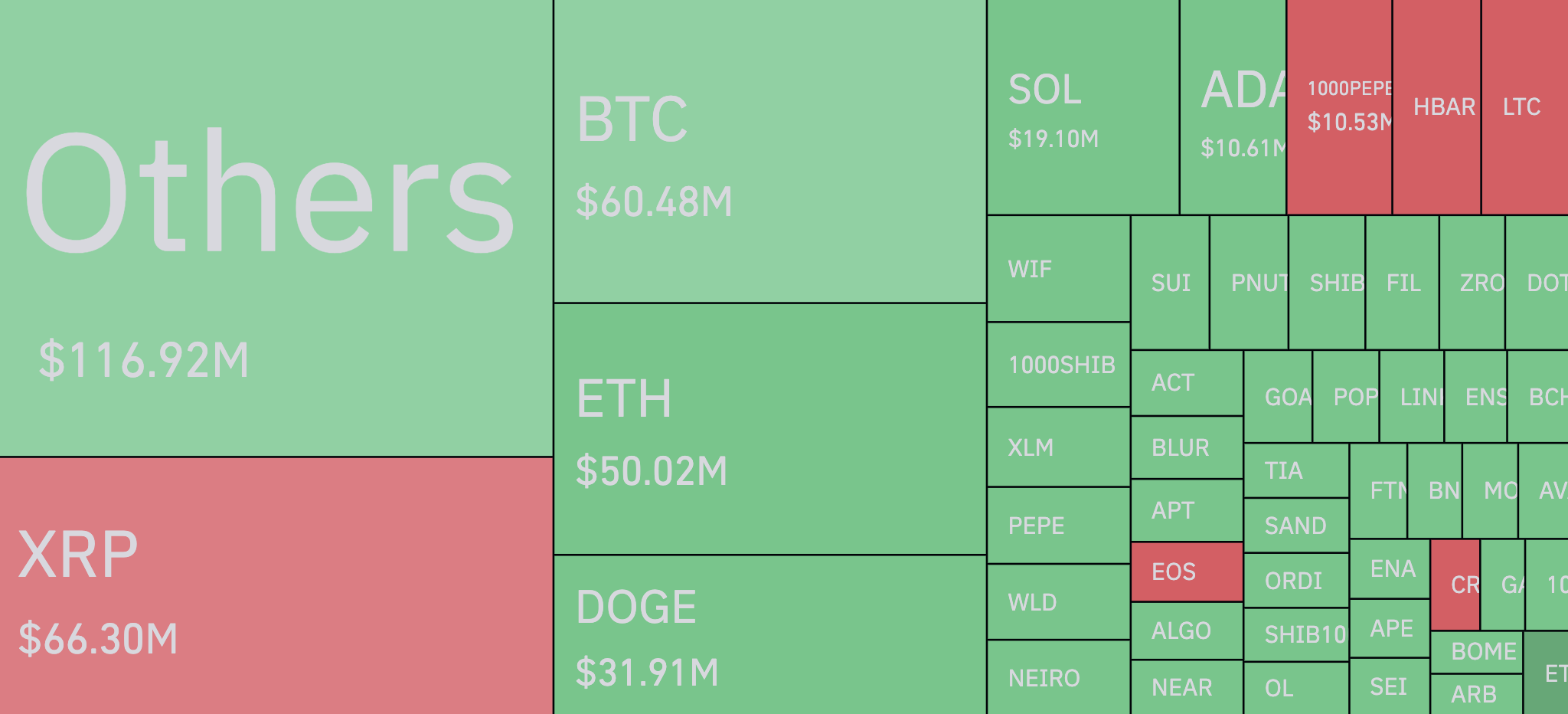

As for liquidations, judging by the CoinGlass warmth map, we are able to see that traders and merchants in meme cryptocurrencies are essentially the most affected. This additionally confirms that “critical” tasks like Hedera and XRP are actually within the development.

As well as, Bitcoin (BTC) and Ethereum (ETH) are on the high, which isn’t shocking given the phenomenon of those two main cryptocurrencies as market markers or indices.

Total, nonetheless, bullish merchants are most affected by this half-billion greenback wave of liquidation, with 63.3% of pressured positions being lengthy.