Este artículo también está disponible en español.

Though Bitcoin stays the world’s high digital asset, its worth oscillating between $90k and $96k this week, some specialists are trying forward and past Bitcoin.

Associated Studying

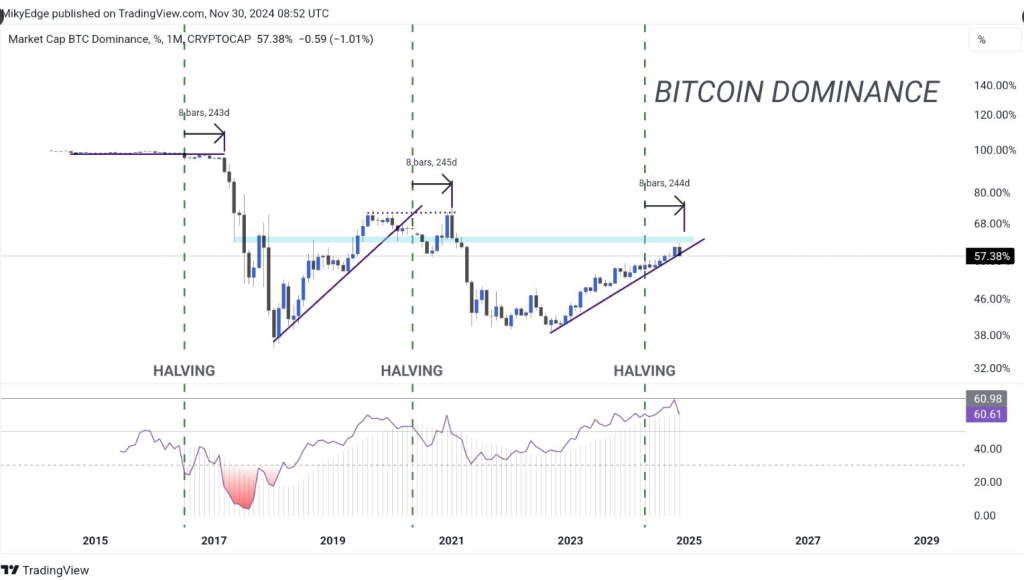

In keeping with some crypto commentators over Twitter/X, Bitcoin’s market dominance is dipping, which signifies that altcoin season is about to begin. In a put up by MikyBull Crypto, Bitcoin’s market dominance falls under its two-year assist line, creating loads of alternatives for holders and merchants.

In keeping with TradingView, Bitcoin’s present dominance is 56.67%, from final week’s 57%, breaking by means of its assist degree for 2 years. Analysts say that the continual dip in Bitcoin’s dominance will influence the final crypto market this December and onwards.

On-chain and market information counsel that altcoins are poised for a market run, with MikyBull Crypto saying that its season began November thirtieth.

Wow, Bitcoin dominance has simply damaged down the 2-year assist.

We’re certainly formally in #ALTSEASON people! https://t.co/IYfQF7P7XI pic.twitter.com/fVysBYuOKn

— Mikybull 🐂Crypto (@MikybullCrypto) November 30, 2024

A Look At Bitcoin Market Dominance

In crypto, analysts and market contributors use quite a lot of metrics to evaluate Bitcoin’s efficiency. Bitcoin dominance is one dependable metric used to find out the relative market share of the asset within the crypto sector. The upper the share share of BTC, the higher it’s for holders and traders.

Nevertheless, Bitcoin’s dominance rating has been dipping in latest weeks. As of December 2nd, it’s at 55.3%, in comparison with 58.9% final month. In keeping with MikyBull Crypto, Bitcoin has dipped under its two-year assist.

A declining Bitcoin dominance gives insights into the merchants’ and traders’ methods. One takeaway is that traders are reallocating their money to different digital belongings. Many analysts say that a few of these traders are reallocating funds to altcoins, like XRP, which is now surging.

Analysts say traders are doubtlessly diversifying their funds and different high-growth coin alternate options.

Analysts And Crypto Commentators Supply Differing Insights

Just a few altcoins are at the moment main the market surge. Ether is experiencing a spike in worth and elevated demand for leveraged ETH exchange-traded funds. On-chain information exhibits the product skilled a 160% improve in demand instantly after the November fifth US elections. Analysts stay bullish on ETH, and lots of anticipate the asset to hit $4k quickly. Then, there’s XRP, which trades above the $2 degree.

Pav Hundal of Swyftx gives a conservative opinion, saying that Bitcoin’s dominance rating should still hit 65%, 67%, and even 70% earlier than it declines. He argues that advanced components make it unimaginable to select the suitable date for altcoin’s surge or Bitcoin’s decline.

Associated Studying

Not All Analysts See An Altcoin Surge Quickly

In the meantime, not all crypto commentators agree that altcoins’ surge will are available in days. Ki Younger Ju of CryptoQuant advises warning on instances like this. The CryptoQuant CEO stays bullish on Bitcoin, including that there’s nonetheless institutional assist for Bitcoin, and it’s unlikely that they are going to refocus on speculative belongings.

The CEO added that for altcoins to achieve all-time excessive market caps, these belongings want a substantial capital influx to cryptocurrency exchanges. He stated that altcoins should develop methods to earn capital as a substitute of counting on Bitcoin’s lack of momentum.

Featured picture from Finimize, chart from TradingView