BRETT’s worth has confronted important strain following the hacking of its official Twitter profile, which posted suspicious hyperlinks to an airdrop. The hacking occasion sparked panic amongst traders, with BRETT worth lowering greater than 10% within the final 24 hours.

Regardless of this setback, BRETT stays the largest meme coin on the Base ecosystem, commanding appreciable consideration and market share. Whereas technical indicators counsel potential moderation within the downtrend, the coin’s dominance within the ecosystem may assist it climate this storm and regain momentum.

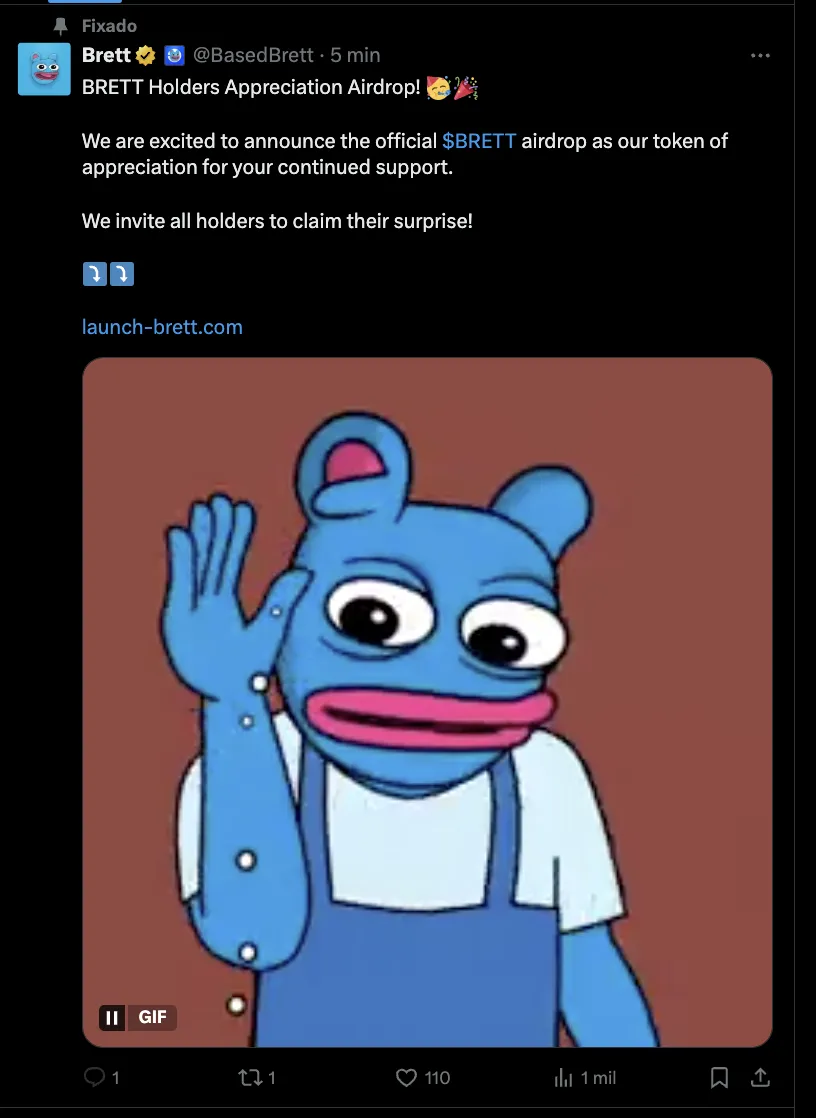

BRETT’s Twitter Profile Hacking Sparked a Sturdy Correction

BRETT Twitter profile began posting an odd hyperlink to an airdrop a couple of hours in the past. It saved posting once more, and that tweet was inserted as a hard and fast one on its profile. After the market turned conscious of the potential hacking, BRETT worth began to fall.

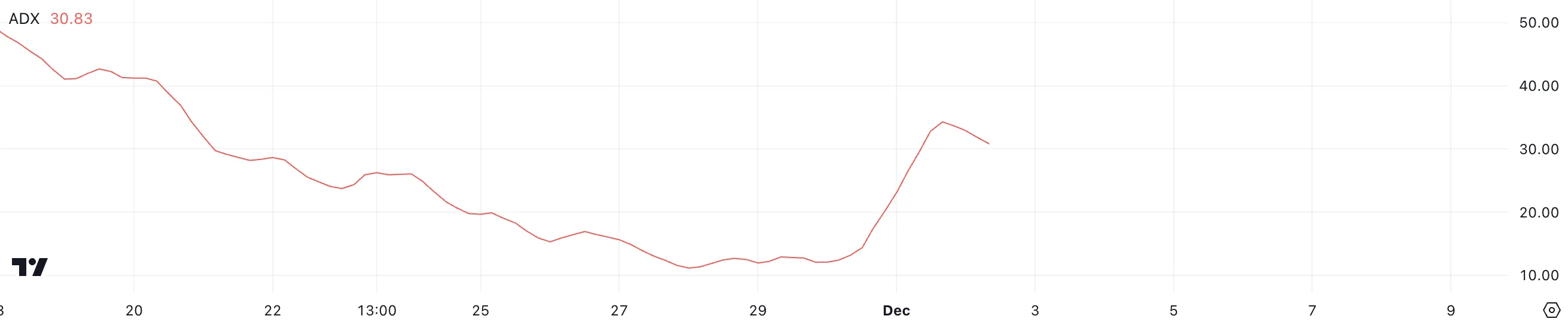

That worth dump strongly impacted BRETT’s metrics. BRETT Common Directional Index (ADX) has decreased from 34 to 30.8, indicating a possible shift in pattern power.

The ADX measures the depth of a market pattern, serving to merchants perceive whether or not an asset is experiencing a powerful directional transfer or consolidating.

The ADX ranges from 0 to 100, with key interpretations at completely different thresholds. A studying above 25 suggests a powerful pattern, whereas values between 25-50 point out a sturdy pattern. BRETT’s present ADX of 30.8, although nonetheless indicating a powerful pattern, has barely weakened from 34.

This delicate decline may sign a possible moderation within the present downtrend, suggesting the correction could possibly be dropping some momentum whereas nonetheless sustaining important directional power.

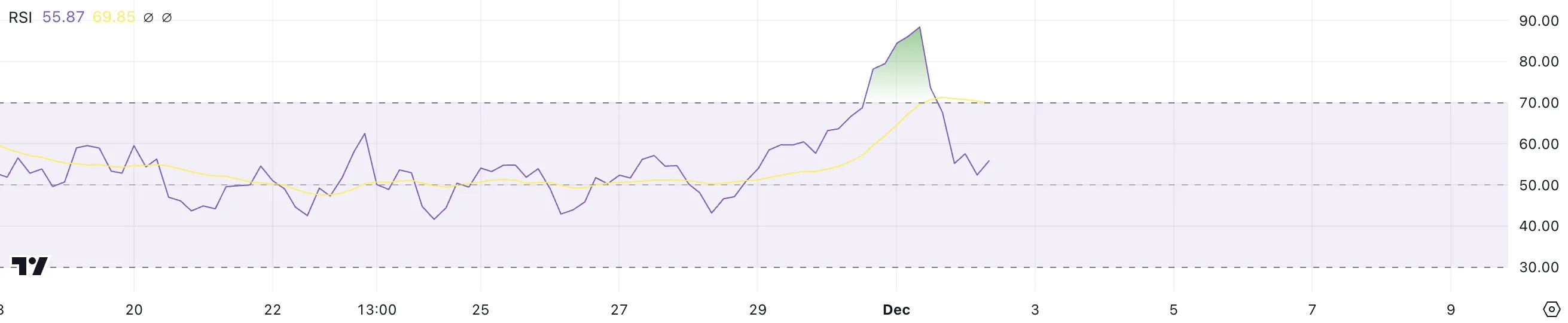

BRETT Is Not Within the Overbought Zone Anymore

BRETT’s Relative Energy Index (RSI) plummeted from practically 90 to round 55 in simply 24 hours. This dramatic drop coincides with a worth decline of over 10%.

The RSI is a momentum indicator that measures the magnitude of latest worth modifications to judge overbought or oversold situations in a buying and selling asset.

The RSI usually ranges from 0 to 100, with key thresholds at 30 and 70. An RSI beneath 30 suggests an asset may be oversold and due for a worth rebound, whereas an RSI above 70 signifies potential overvaluation.

At 55, BRETT RSI suggests the asset is transferring in direction of a extra impartial territory after being beforehand thought of extraordinarily overbought.

BRETT Value Prediction: A Get better After The Latest Dump?

BRETT’s technical indicators counsel a doubtlessly bearish situation. If the value drops beneath its shortest Exponential Shifting Common (EMA) line whereas short-term EMA traces stay above long-term traces, this might sign additional downward momentum.

If the present downtrend continues, the potential help degree at $0.158 may be examined, indicating a extra extreme market correction. Nonetheless, even after the latest worth dump, BRETT remains to be the largest meme coin within the Base ecosystem.

Regardless of the latest damaging sentiment doubtlessly stemming from hacking information, BRETT worth may expertise a fast restoration. The market’s resilience may permit the asset to rebound and take a look at the resistance degree at $0.236 once more.

Disclaimer

Consistent with the Belief Venture tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.