Stellar (XLM) worth has skyrocketed 459% within the final 30 days, capturing vital market consideration. Regardless of this rally, the RSI has cooled to 50.5, suggesting impartial momentum after a short interval of overbought situations in late November.

In the meantime, XLM faces key resistances at $0.53 and $0.56. Its EMA traces nonetheless present bullish patterns however trace at weakening short-term momentum. The Ichimoku Cloud suggests a possible shift in sentiment.

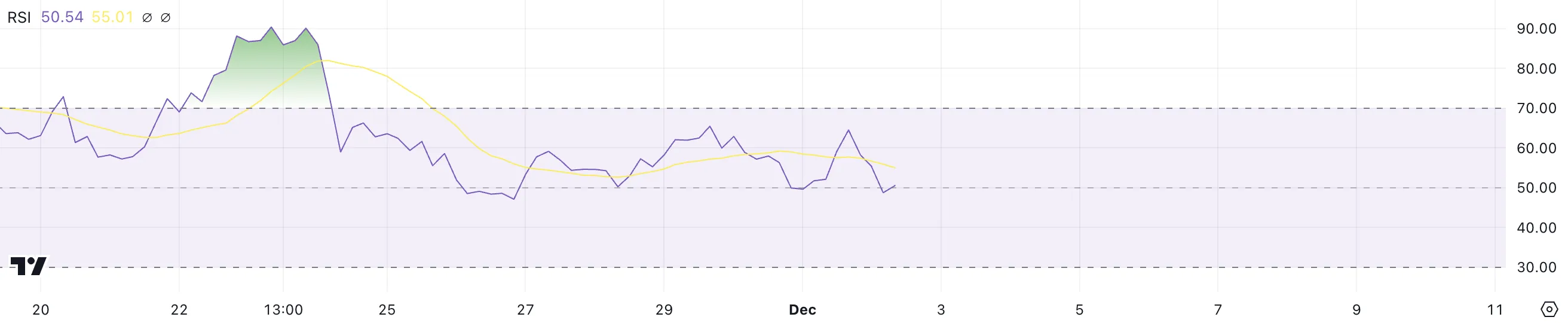

XLM RSI Is Within the Impartial Zone

Stellar RSI at present sits at 50.5, dropping from 64 only a day earlier. Between November 21 and November 24, the RSI remained above 70, coinciding with XLM’s worth reaching its highest stage since Could 2021.

This era of overbought situations highlighted sturdy bullish momentum earlier than the latest cooldown.

The RSI, or Relative Energy Index, measures the pace and alter of worth actions, providing perception into whether or not an asset is overbought or oversold. RSI values above 70 sometimes point out overbought situations and the potential for a pullback, whereas values under 30 counsel oversold situations and attainable worth restoration.

With XLM RSI now at 50.5, it displays a extra impartial stance, indicating a steadiness between shopping for and promoting stress. This might imply the value is consolidating, awaiting additional market cues to outline its subsequent transfer.

Stellar Ichimoku Cloud Reveals the Present Sentiment Might Be Shifting

This Ichimoku Cloud chart for Stellar exhibits worth motion at present positioned close to the cloud, indicating a possible check of assist.

The main span (inexperienced and pink shaded space) displays a impartial to barely bullish pattern. The cloud is comparatively flat however nonetheless provides assist across the $0.50 stage. The Tenkan-sen (blue line) is under the Kijun-sen (pink line), suggesting short-term weak spot in momentum.

If XLM stays above the cloud, the general pattern can keep bullish, with potential for restoration towards the Tenkan-sen and Kijun-sen ranges.

Nonetheless, a breakdown under the cloud may sign a bearish shift, with worth doubtless retesting decrease assist zones. The cloud’s flat nature suggests indecision out there, so merchants might search for a breakout or breakdown as the following clear sign.

XLM Value Prediction: Can It Attain $0.7 In December?

XLM at present faces two close by resistances at $0.53 and $0.56, whereas its EMA traces stay bullish, with short-term averages above long-term ones.

Nonetheless, Stellar worth has lately dropped under the shortest-term EMA, signaling a possible lack of short-term momentum. This implies that the continuing uptrend is weakening, and with out a fast restoration, additional draw back may observe.

If the uptrend regains power and XLM worth breaks via these resistances, it may retest $0.638, with the potential to climb towards $0.65 and even $0.7, revisiting worth ranges final seen in 2021.

Alternatively, the Ichimoku Cloud and EMA patterns present indicators of a attainable pattern reversal. If this bearish shift materializes, XLM worth may check assist close to $0.41, marking a major correction from present ranges.

Disclaimer

Consistent with the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.