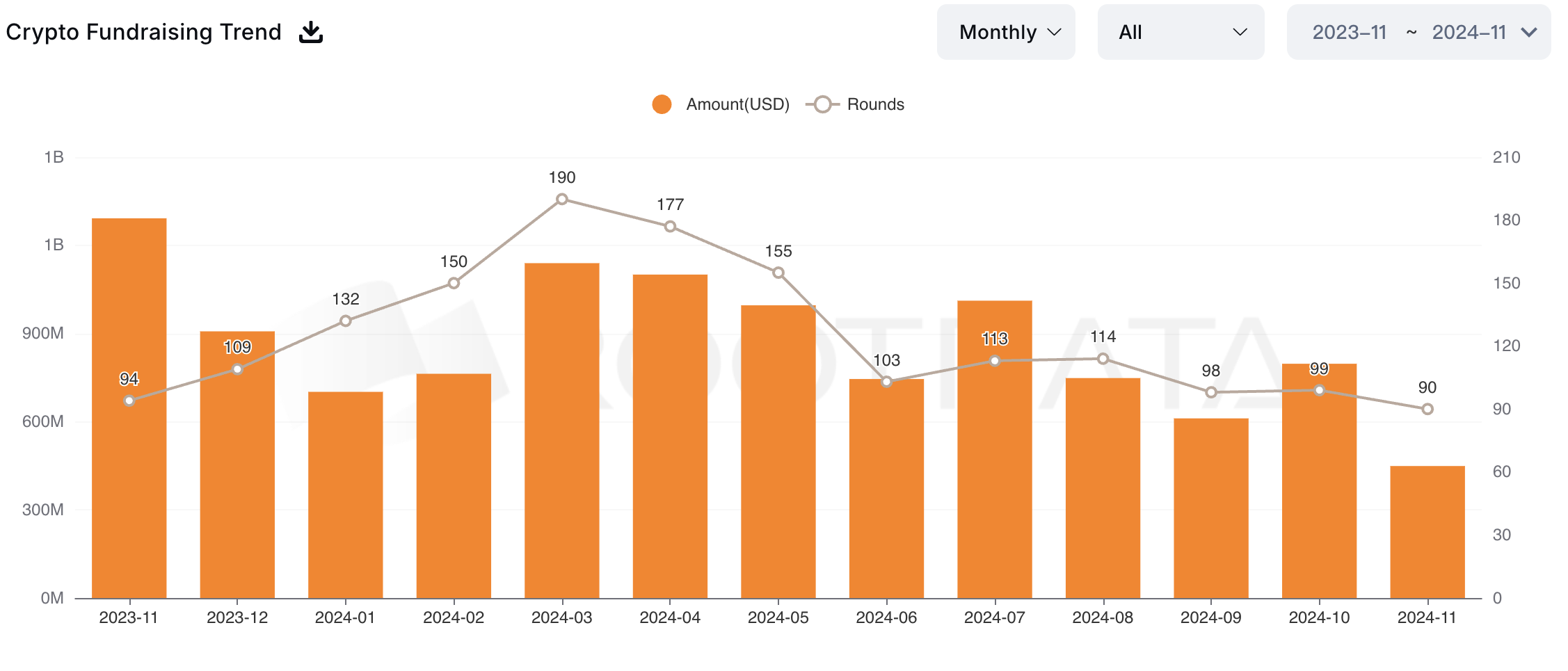

In accordance with RootData statistics, 90 publicly disclosed crypto enterprise capitalist (VC) investments occurred in November, representing a 9% lower from October’s 99 rounds.

November’s complete fundraising quantity reached $449 million, a whopping 43.66% lower in comparison with the $797 million raised in October.

Notable Decline in Crypto VC Investments

Enterprise capital funding exercise acts as a vital barometer of main traders’ curiosity and confidence within the crypto market. Though November noticed a dramatic bull marketplace for crypto asset valuation, these positive aspects didn’t translate into elevated VC exercise. Offers and the full quantity raised each decreased dramatically in November.

In actual fact, November returned the bottom variety of offers and capital raised all through 2024. In an additional twist, the biggest particular person offers have been a lot decrease than in earlier months: September noticed 12% much less funding than August, however one deal raised $100 million. The standouts in November have been all lower than $50 million.

The allocation of funds throughout sectors bore a number of resemblances to October: as soon as once more, infrastructure, DeFi, and video games noticed the very best returns. Nevertheless, it was a lot decrease, and CeFi funding has apparently cratered.

usdx.cash Leads a Battered Market

On November 29, stablecoin issuer usdx.cash introduced a profitable fundraising spherical of roughly $45 million. The agency claimed that this funding introduced its complete valuation to $275 million.

A number of of its largest traders embrace NGC, BAI Capital, and Generative Ventures. usdx.cash will use these funds to speed up ecosystem improvement.

A detailed runner-up was Zero Gravity Labs (0G Labs), a modular AI chain which introduced a $40 million seed funding spherical on November 13. Nevertheless, the agency managed to safe even additional investments: it secured a $250 million dedication to future token purchases and launched a profitable node sale the identical day.

“We’re thrilled to announce that the 0G AI Alignment Node Sale has hit $10 million in help! This can be a enormous step ahead for decentralized AI as a public good, the place transparency, safety, and neighborhood come first. Because of our unbelievable neighborhood for believing in a trustless future for AI,” claimed the corporate in a November 13 social media put up.

Moreover, two different crypto companies tied for third place with investments of $30 million. Monkey Tilt, a web based playing platform, managed to safe this quantity in Collection A funding on November 19. Canaan, a Chinese language mining tools producer, raised the identical quantity the day past, regardless of struggling downward tendencies final yr.

These 4 have been the one crypto corporations to earn greater than $25 million in enterprise capital funding this November. In comparison with earlier months, it is a very dramatic decline.

Nonetheless, the crypto market could be very bullish, which could assist clarify this better shift. In any case, a number of companies are investing straight in main BTC purchases, not crypto corporations.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.