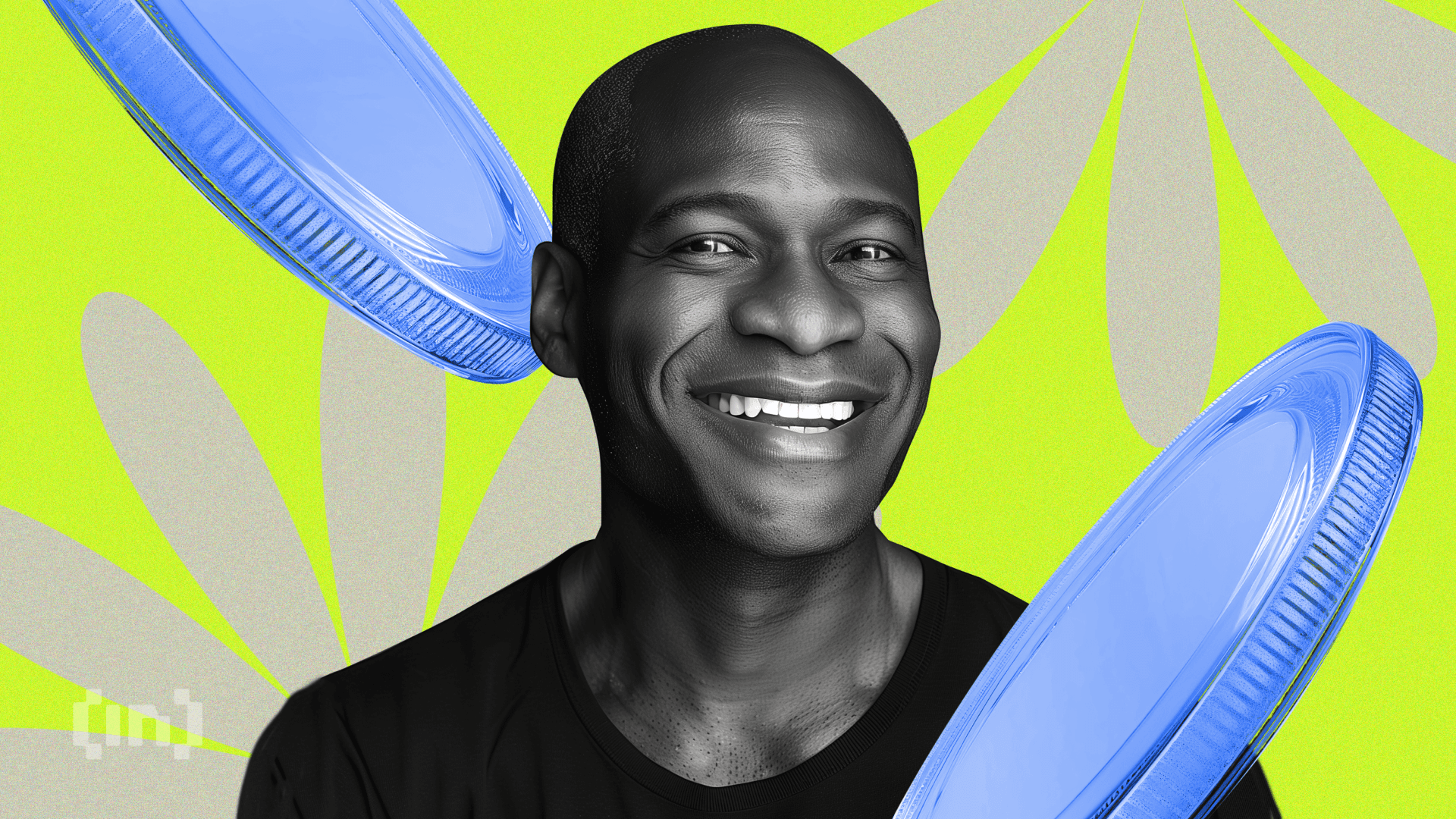

Arthur Hayes is looking for a return to the glory days of preliminary coin choices (ICOs). His name comes amid a enjoying area that’s more and more dominated by enterprise capital (VC) gatekeepers and centralized exchanges (CEXs).

The BitMEX co-founder’s manifesto, “The right way to Make ICOs Nice Once more,” critiques the present state of crypto capital formation. He advocates for a decentralized, community-driven method that prioritizes retail traders and revitalizes the trade’s speculative spirit.

The Business’s Malaise

Hayes paints a grim image of crypto’s progress, the place once-vibrant grassroots actions have succumbed to the affect of centralized entities. He likens at present’s venture founders to sufferers bothered with a “CEXually transmitted illness,” the place the whims of exchanges and VCs dictate their choices.

Hayes argues that crypto’s founders have forgotten its foundational ethos: decentralization, consumer empowerment, and wealth creation for retail contributors.

“Why did we as an trade neglect in regards to the third pillar of crypto’s worth proposition — making retail wealthy?” Hayes quipped.

He factors to the dismal efficiency of VC-backed tokens lately. He argues that these tasks typically debut with inflated, absolutely diluted valuations (FDVs) and low circulating provides. Nevertheless, they alienate retail traders by prioritizing institutional pursuits. As BeInCrypto reported, tasks like Hamster Kombat flip down VC assist for that reason.

However, Hayes attributes crypto’s meteoric rise to 3 key components:

- Authorities Seize: Decentralization serves as an antidote to the focus of energy by governments and huge companies. It presents a system free from conventional gatekeepers.

- Magical Expertise: Blockchain applied sciences like Bitcoin’s resilience and potential have confirmed their worth as revolutionary financial methods.

- Greed: The lure of great monetary returns has pushed adoption. Retail traders searching for life-changing positive factors are sometimes missed in conventional finance.

For instance the divide, Hayes contrasts the egalitarian nature of meme cash with the exclusivity of VC-backed tasks. Meme cash, he says, depend on “memetic content material virality,” permitting retail contributors to gamble on speculative belongings with out gatekeeping.

Conversely, VC cash are burdened by inflated valuations. A closed ecosystem of elite establishments and traders with little regard for the retail market perpetuates them.

“Retail would somewhat roll the cube on a $1 million market cap meme coin than a $1 billion FDV venture backed by probably the most ‘esteemed’ cohort of VCs,” Hayes defined.

The Case for ICOs

Hayes sees ICOs because the antidote to the trade’s malaise. Of their purest kind, ICOs empower groups from numerous backgrounds to boost funds straight from the group with out intermediaries. This mannequin embodies decentralization, enabling innovation whereas giving retail traders entry to early-stage alternatives.

Drawing classes from the 2017 ICO increase, Hayes highlights two intrinsic worth drivers:

- Memetic Worth: Tasks that resonate with the zeitgeist can entice customers and construct a robust group.

- Potential Expertise: ICOs fund groups to create groundbreaking applied sciences addressing international challenges, typically earlier than a single line of code is written.

Whereas acknowledging that many ICOs failed spectacularly, Hayes argues this speculative nature is a characteristic, not a bug. It permits retail traders to dream massive and purpose for transformative positive factors. In opposition to this backdrop, Hayes outlines a roadmap for revitalizing ICOs and making them nice once more.

- Sooner Token Issuance: New frameworks and liquid decentralized exchanges (DEXs) enable groups to distribute tokens inside days, enabling speedy buying and selling and value discovery.

- Improved Infrastructure: Advances in blockchain scalability and lowered transaction prices, notably on chains like Aptos (APT) and Solana (SOL), make ICOs extra accessible.

- Enhanced Consumer Expertise: Non-custodial wallets and streamlined platforms decrease boundaries to entry, guaranteeing broader participation.

- CEX Independence: By bypassing centralized platforms, ICOs eradicate gatekeeping, giving energy again to the group.

Additional, Hayes cautions traders to keep away from the traps of the present system, urging the crypto group to embrace the speculative, democratized nature of ICOs, which provide an opportunity for life-changing monetary returns with out the constraints of conventional finance.

“Simply say no to VC-backed excessive FDV, low float tasks, and overvalued tokens on CEXs,” he famous.

Because the crypto market enters a possible new bull cycle, Hayes predicts a resurgence of ICOs pushed by an engaged, risk-tolerant group. Platforms like Pump.enjoyable and Spot.canine exemplify the shift in direction of decentralized, retail-focused capital formation.

With these instruments, Hayes envisions a future the place crypto as soon as once more empowers people to take audacious bets and reap the rewards of decentralized innovation.

“Let’s return to the spirit of crypto’s early days. It’s time to make ICOs nice once more,” Hayes concluded.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.