The world’s largest asset supervisor BlackRock has rapidly change into a significant participant within the cryptocurrency area after the U.S. Securities and Change Fee (SEC) accredited the launch of varied spot Bitcoin exchange-traded funds again in January, to the purpose it now holds over 500,000 BTC.

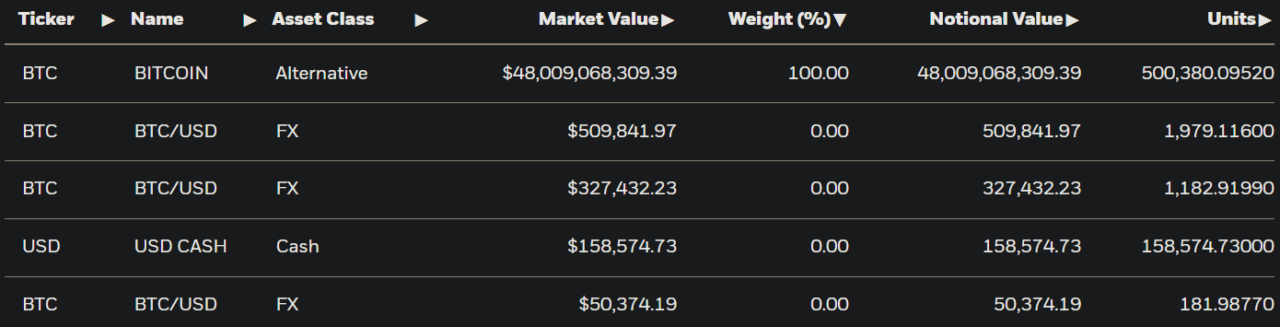

In line with knowledge from the agency’s web site its spot Bitcoin ETF, the iShares Bitcoin Belief ETF (IBIT) now holds a complete of 500,380.09 BTC with a market worth above the $48 billion mark, making it one of many largest holders of the cryptocurrency.

The fast accumulation, amounting to 2.38% of all Bitcoin ever to be created in just below a yr, displays a big shift in BlackRock’s stance on the digital asset. CEO Larry Fink, as soon as a vocal critic, now views Bitcoin as an “unbiased asset class” with transformative potential.

It’s value noting that BlackRock’s IBIT doesn’t maintain BTC for the agency straight, however quite for buyers leveraging its fund to achieve publicity to the flagship cryptocurrency. A few of these buyers embrace shoppers of Wall Avenue giants, together with Goldman Sachs.

As CryptoGlobe reported the most important company holder of Bitcoin, MicroStrategy, has not too long ago introduced it acquired an extra 15,400 Bitcoin for $1.5 billion, at a mean worth of $95,976 per coin, which helped its complete BTC stability surpass 402,100 cash.

In line with a submit shared on the microblogging platform X (previously referred to as Twitter) by the corporate’s co-founder and chairman, Michael Saylo, MicroStrategy has achieved a BTC Yield of 38.7% thus far this yr, and 63.3% year-to-date and now holds 402,100 BTC that had been acquired for $23.4 billion.

The corporate has acquired its BTC at a mean of $58,263 per coin and its whole BTC stash is now value $37.4 billion.

The transfer comes at a time through which Bitcoin whales have been profiting from the flagship cryptocurrency’s latest worth dip to carry on accumulating BTC after short-term holders moved practically $4 billion within the cryptocurrency to exchanges.

In line with CryptoQuant analyst Cauê Oliveira, Bitcoin whales took benefit of the “panic promoting” to build up, with 16,000 BTC value practically $1.5 billion entered whale reserves in a single day after short-term holders’ gross sales.

In a submit, the analyst famous that the determine was “mirrored in institutional addresses on the community” however recommended extra BTC was amassed, because the funds that weren’t withdrawn from cryptocurrency exchanges and stay in customers’ accounts aren’t counted.

Per his phrases, the whale accumulation hasn’t been enough to exhibit a “extra widespread buy-the-dip” sample,” which he stated stays concentrated amongst institutional buyers.

Featured picture through Unsplash.