Shiba Inu (SHIB) value continues to point out excessive volatility amid combined technical indicators. With a 19.01% achieve previously seven days, SHIB maintains its place because the second-largest meme coin by market cap, trailing solely Dogecoin (DOGE).

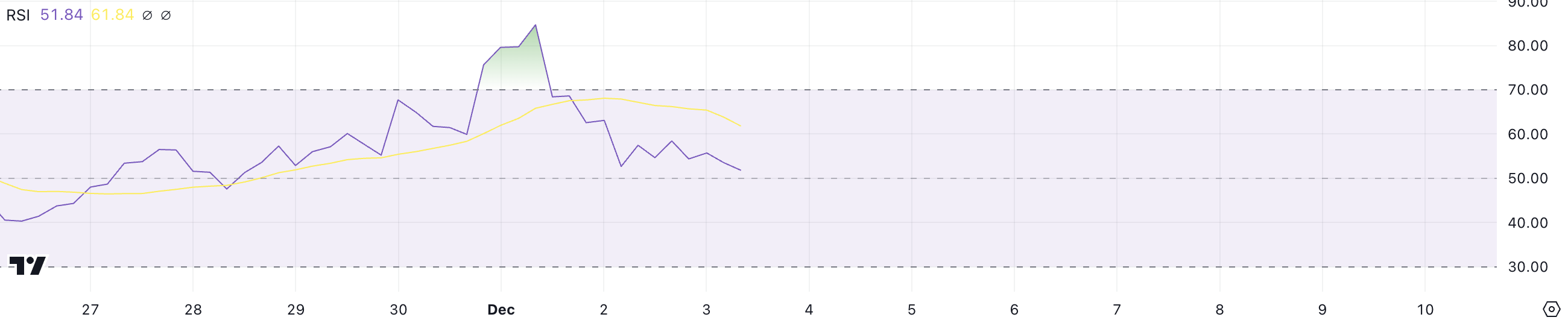

The coin’s technicals paint a fancy image, with RSI cooling off from overbought ranges and reducing whale accumulation suggesting potential short-term corrections. Nonetheless, robust EMA indicators nonetheless go away room for vital upside potential, making SHIB’s subsequent value transfer notably essential for merchants.

SHIB RSI Is Down From Overbought

SHIB’s RSI (Relative Power Index) decline from 85 to 51.8 signifies a major cooling off in shopping for momentum. When RSI was at 85, it confirmed SHIB was closely overbought, with patrons dominating the market.

The present RSI of 51.8 suggests a extra balanced market, the place shopping for and promoting pressures have equalized following a interval of merchants’ profit-taking.

The historic RSI of practically 90 throughout SHIB’s peak at $0.000033 represented an excessive overbought situation that was unsustainable. The present drop to 51.8 suggests a wholesome consolidation section quite than a pattern reversal, as readings between 40-60 usually point out secure market circumstances.

Whereas this cooling off may result in a short-term value correction, it doesn’t essentially sign the tip of the uptrend. It permits for extra sustainable value progress by stopping market exhaustion.

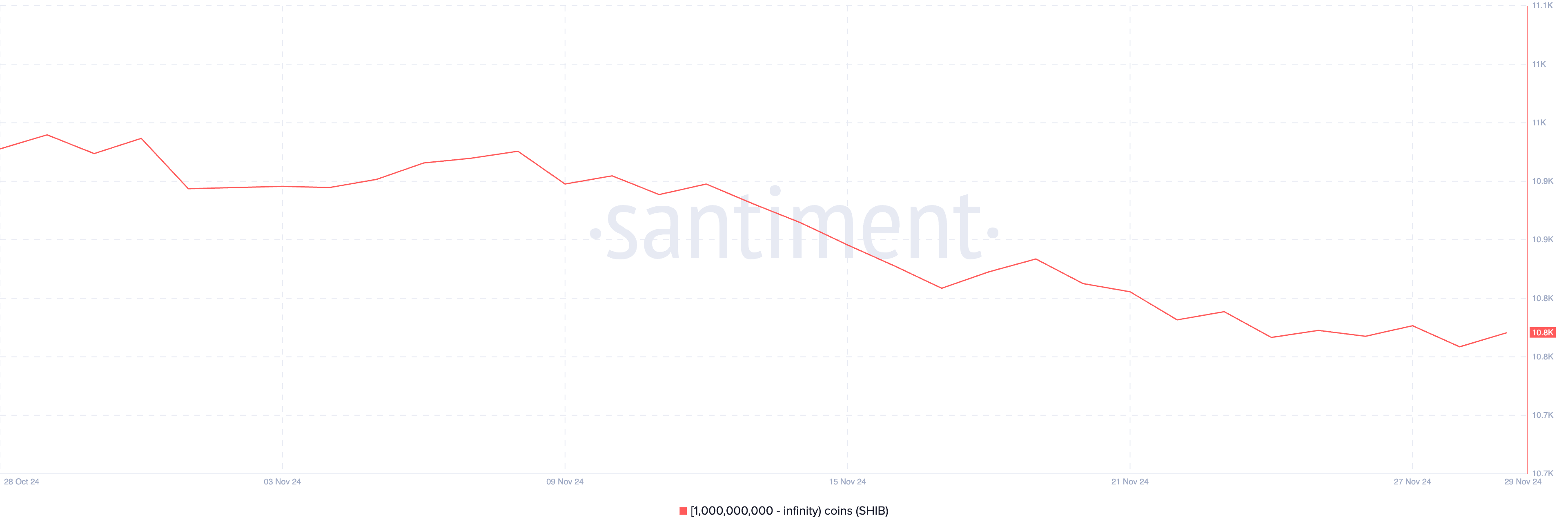

Whales Are Not Accumulating Shiba Inu

The declining variety of SHIB whales signifies massive holders are taking income or lowering publicity throughout current value will increase.

Whales, who can considerably affect the market as a result of their massive holdings, usually set market developments that smaller traders observe. Their gradual exit suggests warning about SHIB’s present valuation ranges.

The drop from 11,013 to 10,858 wallets holding over 1 billion SHIB represents a lack of 155 main holders in only one month. This distribution of tokens from massive to smaller holders usually creates promoting strain and will sign a weakening bullish sentiment.

Nonetheless, this redistribution additionally means SHIB possession is turning into extra decentralized, which might be wholesome for long-term value stability regardless of short-term promoting strain.

SHIB Worth Prediction: Is a 17% Correction Imminent?

Shiba Inu value falling beneath the shortest EMA line indicators momentum loss in its current bullish pattern.

Whereas longer-term EMAs stay bullish, the worth motion beneath the fastest-moving common means that short-term bearish strain is constructing.

The worth is now at a crucial junction with vital value swings doable in both path. A bearish situation might drive SHIB value down to check $0.000026 and $0.000023 assist ranges, representing a 17.8% decline.

Conversely, if bulls regain management, SHIB value might retest its current excessive of $0.000033 and probably surge to $0.000040, providing a 42% upside from present ranges.

Disclaimer

According to the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.