Volatility rocked the Korean crypto markets on Tuesday after the federal government briefly declared martial regulation, sending Korean Received (KRW)-priced digital belongings into low cost territory.

South Korean President Yoon Suk Yeol declared martial regulation in a seemingly politically motivated transfer, prompting the navy to aim to enter parliament in Seoul.

Nonetheless, shortly thereafter, each single member of Korean parliament voted towards the president’s declaration, making it invalid.

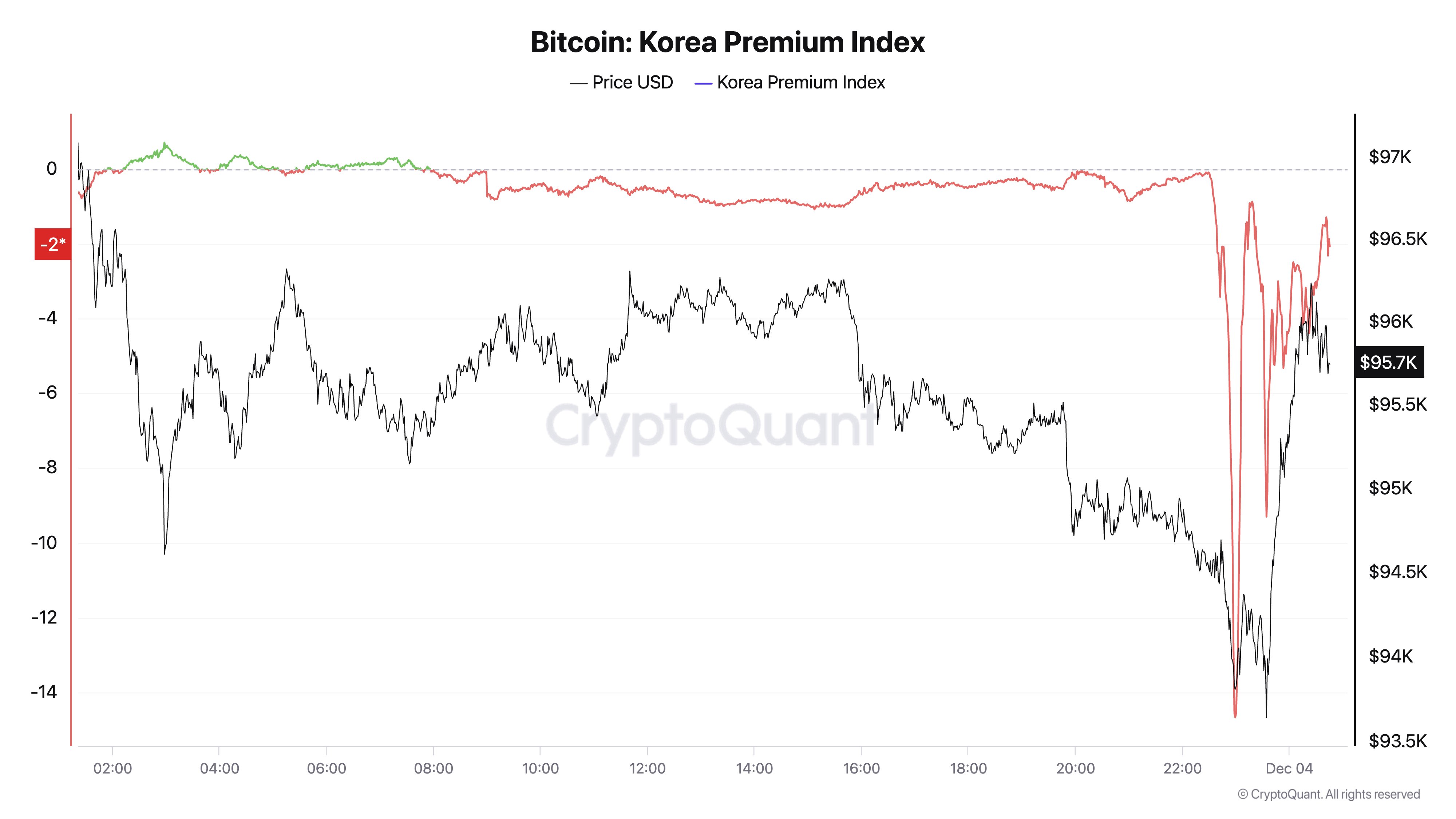

Through the commotion, BTC costs in KRW dipped dramatically.

Says Korean-based CryptoQuant CEO Ki Younger Ju,

“South Korea’s monetary markets are in chaos due to the president’s political present.”

Merchants usually watch the worth of Bitcoin in South Korea to identify arbitrage alternatives with the “kimchi premium,” which refers back to the hole between BTC’s worth within the nation and US markets. In response to Ju, the political scuffle in Seoul pushed the kimchi premium right down to all-time lows.

“Bitcoin kimchi premium hits an all-time low.

Shouldn’t Bitcoin go up throughout instances of political instability?

Why did the individuals promoting now even purchase Bitcoin within the first place?”

In response to blockchain monitoring agency Lookonchain, many whales deposited stablecoins into Upbit, considered one of South Korea’s largest crypto exchanges, attempting to catch “bottom-fishing alternatives” amid the worth crash in Bitcoin.

“The Korean crypto market has plummeted following South Korea’s declaration of ‘martial regulation.’

Many whales transferred massive quantities of USDT to Upbit, seemingly aiming for bottom-fishing alternatives.

Inside 1 hour after the declaration of ‘martial regulation’ over 163M USDT flowed into Upbit.”

At time of writing, Bitcoin is buying and selling at $95,772.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Worth Motion

Observe us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any losses you might incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in internet online affiliate marketing.

Featured Picture: Shutterstock/iurii/Sensvector