In per week filled with ups and downs for digital belongings, XRP stole the highlight with a whopping $95 million in inflows, marking the best weekly whole ever recorded by CoinShares for funding merchandise primarily based on this in style cryptocurrency. This 621% week-over-week improve is a good instance of how the token is attracting increasingly consideration, particularly as monetary market contributors are speaking increasingly about U.S.-based ETFs on XRP.

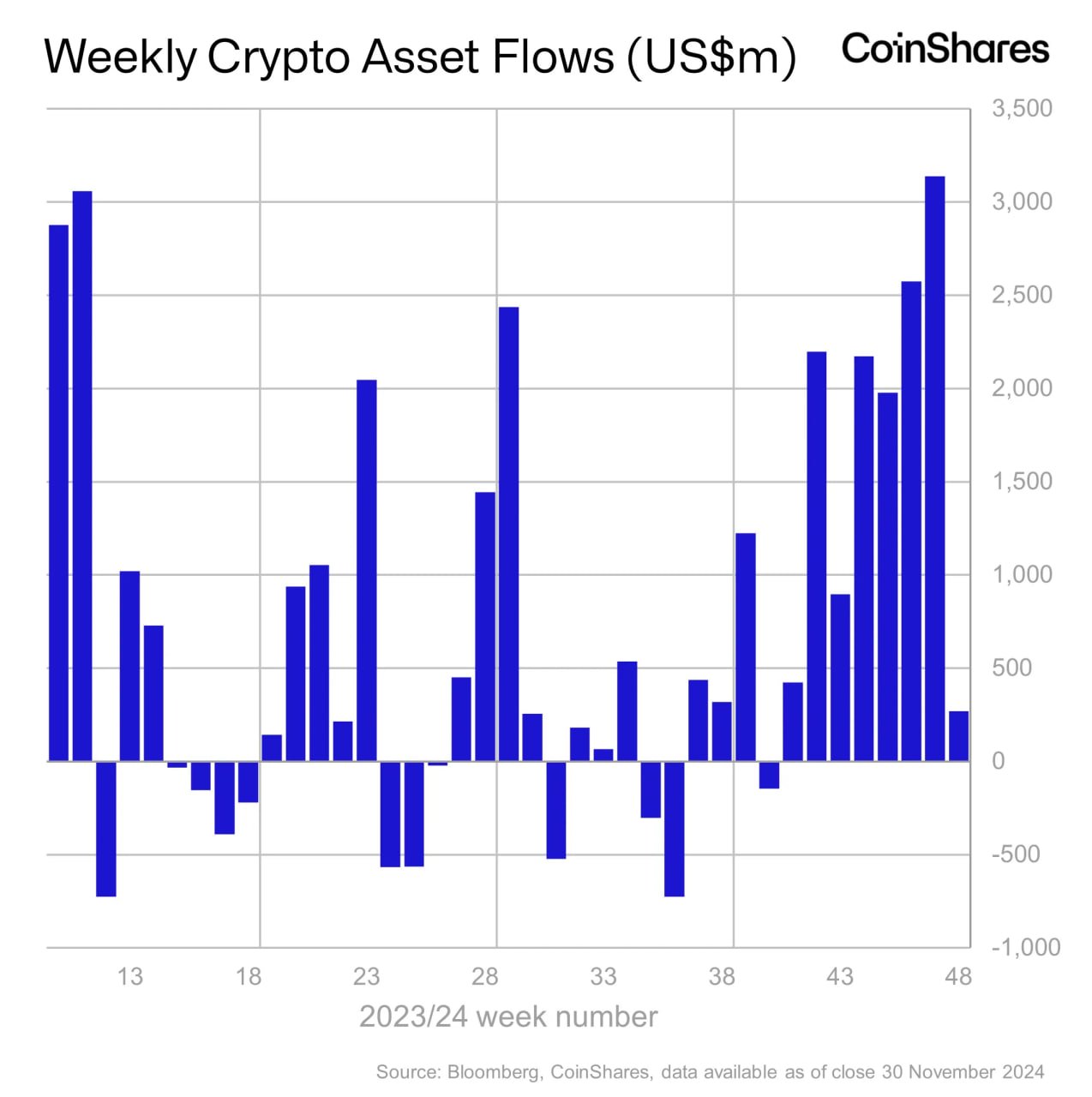

It’s price noting that digital asset funding merchandise attracted a complete of $270 million in inflows final week, which is kind of exceptional within the broader context of the crypto market.

But it surely was the efficiency of XRP that basically caught folks’s consideration. It’s now the third largest digital asset by market capitalization, valued at over $135 billion. XRP’s value is as much as $2.50, which is a virtually 400% improve since final month, and that’s fueling much more curiosity within the asset.

Bitcoin, regardless of its dominant standing, had a contrasting week with $457 million in outflows, which consultants say was resulting from revenue taking after reaching the symbolic $100,000 value stage.

Ethereum additionally made headlines by securing $634 million in inflows, reaching a year-to-date report of $2.2 billion and surpassing its 2021 peak. With all this in thoughts, it’s much more spectacular how a lot XRP is attracting funding.

As talked about above, a lot of this development might be attributed to what’s taking place within the ETF area. With corporations like WisdomTree, 21Shares and Canary Capital submitting with the SEC for an XRP ETF, it appears to be like like it’s getting nearer to changing into a actuality.

WisdomTree’s submitting, with the Financial institution of New York Mellon because the belief’s administrator, is especially noteworthy. There’s additionally pleasure round mixture crypto ETFs from Bitwise and different companies that embrace XRP with different main cash.