Este artículo también está disponible en español.

Bitcoin has been consolidating beneath the $100,000 stage for twelve consecutive days, marking a pause in its latest historic rally. The aggressive surge since November 5 seems to be cooling off, with market consideration progressively shifting towards altcoins. Regardless of the slowdown, Bitcoin stays a cornerstone of market power, holding firmly above the vital $90,000 assist stage.

Associated Studying

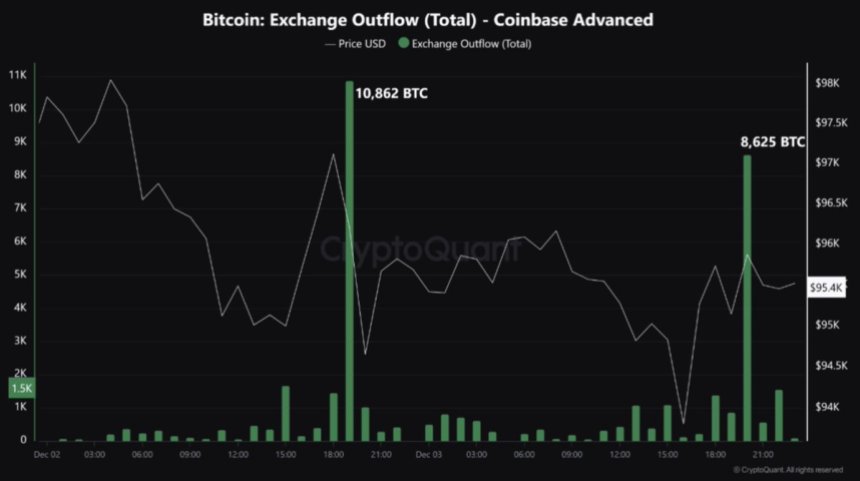

Key information from CryptoQuant highlights two vital outflows exceeding 8,000 BTC every from Coinbase up to now 24 hours, signaling sustained institutional curiosity and potential accumulation. These outflows counsel that main gamers stay optimistic about Bitcoin’s long-term trajectory, whilst short-term value motion steadies.

As Bitcoin maintains its consolidation section, the broader crypto market is poised for dynamic modifications. Analysts are carefully watching whether or not this stabilization interval will pave the way in which for BTC’s subsequent leg upward or sign a possibility for altcoins to take the highlight. The following few days will likely be essential in figuring out whether or not Bitcoin reclaims momentum or continues its present range-bound motion.

Bitcoin Main A Heated Market

Bitcoin continues to guide the crypto market with exceptional positive factors, even because it halts just under the extremely anticipated $100,000 stage. The present pause in its rally has triggered a liquidity shift, progressively pumping capital into the altcoin market. Nonetheless, analysts and traders anticipate that Bitcoin might decelerate within the brief time period after its aggressive latest surge, offering a possibility for different cryptocurrencies to shine.

Metrics from CryptoQuant spotlight notable exercise on Coinbase, the place two large outflows, exceeding 8,000 BTC every, had been recorded within the final 24 hours. A complete of 19,487 BTC, valued at a median value of $96,043, was withdrawn in these transactions, amounting to roughly $1.87 billion. Such vital actions point out the involvement of institutional gamers or whales who could also be positioning themselves for Bitcoin’s subsequent main transfer.

Traditionally, market dips have adopted related outflows, as giant transactions typically sign profit-taking or redistribution of holdings. Nonetheless, these transactions may additionally counsel rising confidence amongst main traders in Bitcoin’s long-term potential.

Associated Studying

If BTC maintains its place above $90,000 and demand continues to construct, the market might even see a renewed push towards six-figure territory within the weeks forward.

Value Ranges To Watch

Bitcoin is buying and selling at $96,700, persevering with a range-bound motion between $93,500 and $98,700 with out establishing a transparent route. This consolidation follows a interval of aggressive rallies, with BTC approaching however not but surpassing its all-time excessive.

Market contributors are carefully watching the $90,000 mark, which has confirmed to be a vital stage of assist. Holding above this stage has been important in signaling market power and sustaining bullish momentum.

If Bitcoin maintains its place above the $95,000 mark over the subsequent few days, the chance of a breakout to new all-time highs turns into considerably stronger. A steady consolidation above this stage would gas consumers to push BTC previous the psychological $100,000 barrier.

Conversely, shedding the $95,000 assist would increase issues, doubtlessly prompting a take a look at of the $90,000 stage once more. Ought to this key stage fail, Bitcoin may expertise a deeper correction with decrease assist zones.

Associated Studying

Bitcoin’s skill to stay above $95,000 will likely be essential in figuring out its subsequent transfer. Bulls are eyeing one other rise, whereas bears are on the lookout for indicators of exhaustion to capitalize on.

Featured picture from Dall-E, chart from TradingView