Retail buyers are again in full power with Bitcoin (BTC), and this time, their demand surpasses what was seen in Could 2020. This surge comes as BTC eyes the elusive $100,000 mark, a value stage it has struggled to succeed in.

However is the return of retail demand sufficient to push Bitcoin to new heights? This on-chain evaluation evaluates the potential affect.

Bitcoin Now Carries Everybody Alongside

Traditionally, Bitcoin’s value surged following a rise in retail demand, although whales and institutional buyers have sometimes pushed this present cycle.

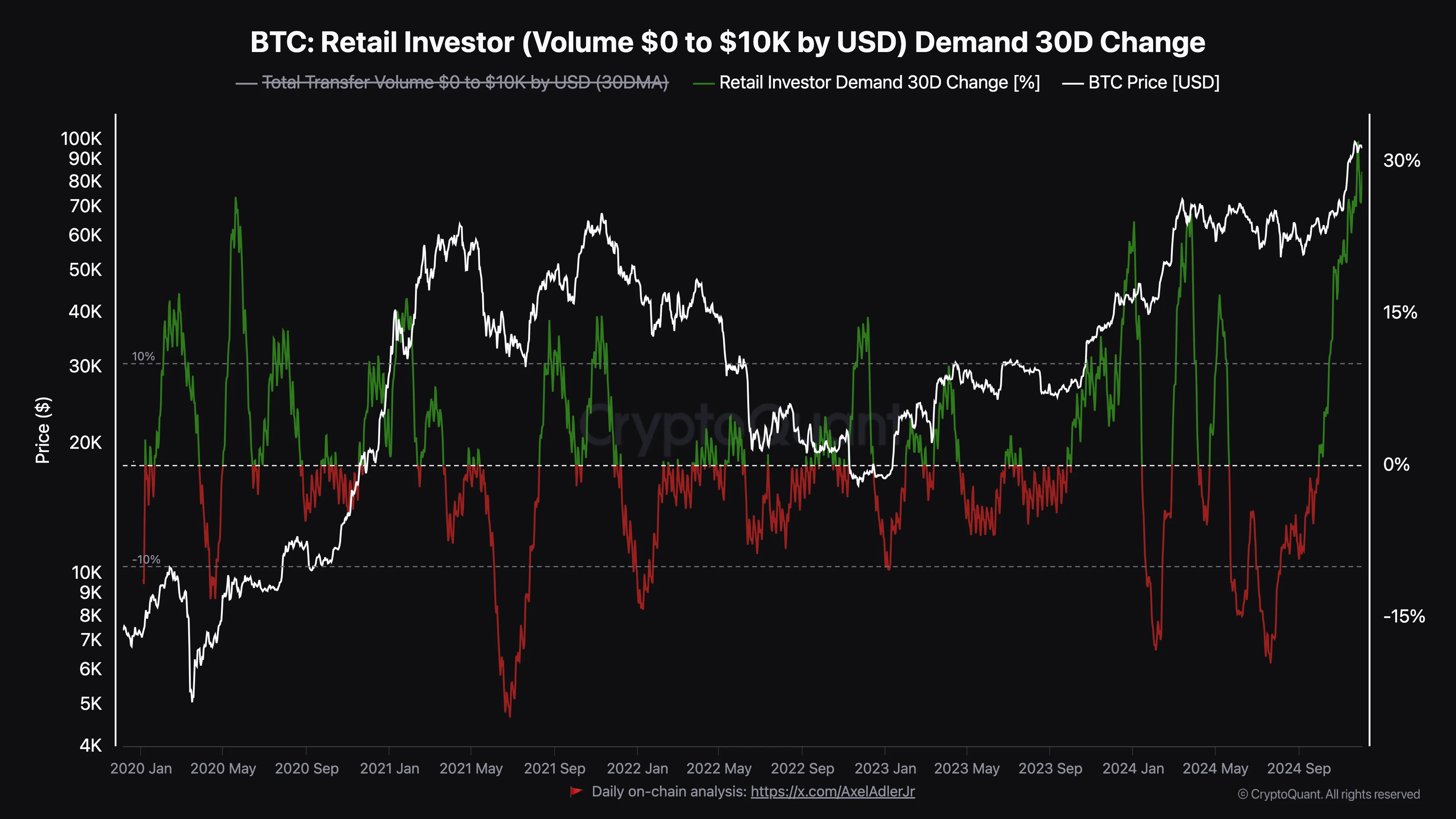

Nevertheless, based on CryptoQuant, this pattern could also be shifting. Knowledge from the 30-day retail investor demand metric reveals a big change, monitoring the stream of volumes underneath $10,000 into Bitcoin, suggesting a rising affect from retail buyers

At press time, the metric reached $27.15, the very best stage it has reached in over 4 years. The final time the studying neared this stage, Bitcoin’s value climbed from $9,500 to $37,000 in lower than six months.

Subsequently, if historical past rhymes, then BTC may rally to and surpass $100,000 inside a number of months. Nevertheless, Darkfost, a pseudonymous analyst on CryptoQuant, opined that the run above $100,000 won’t occur very quick.

In response to the analyst, the hike in Bitcoin retail investor demand may sign a neighborhood high. In his submit, Darkfost talked about that the cryptocurrency may consolidate for some time earlier than the uptrend returns.

“Bitcoin might proceed to vary for some time, with minor corrections, earlier than making its subsequent transfer upward to interrupt the 100,000 psychological key. This breakthrough may reignite retail demand, probably fueling a euphoric part out there,” the analyst defined.

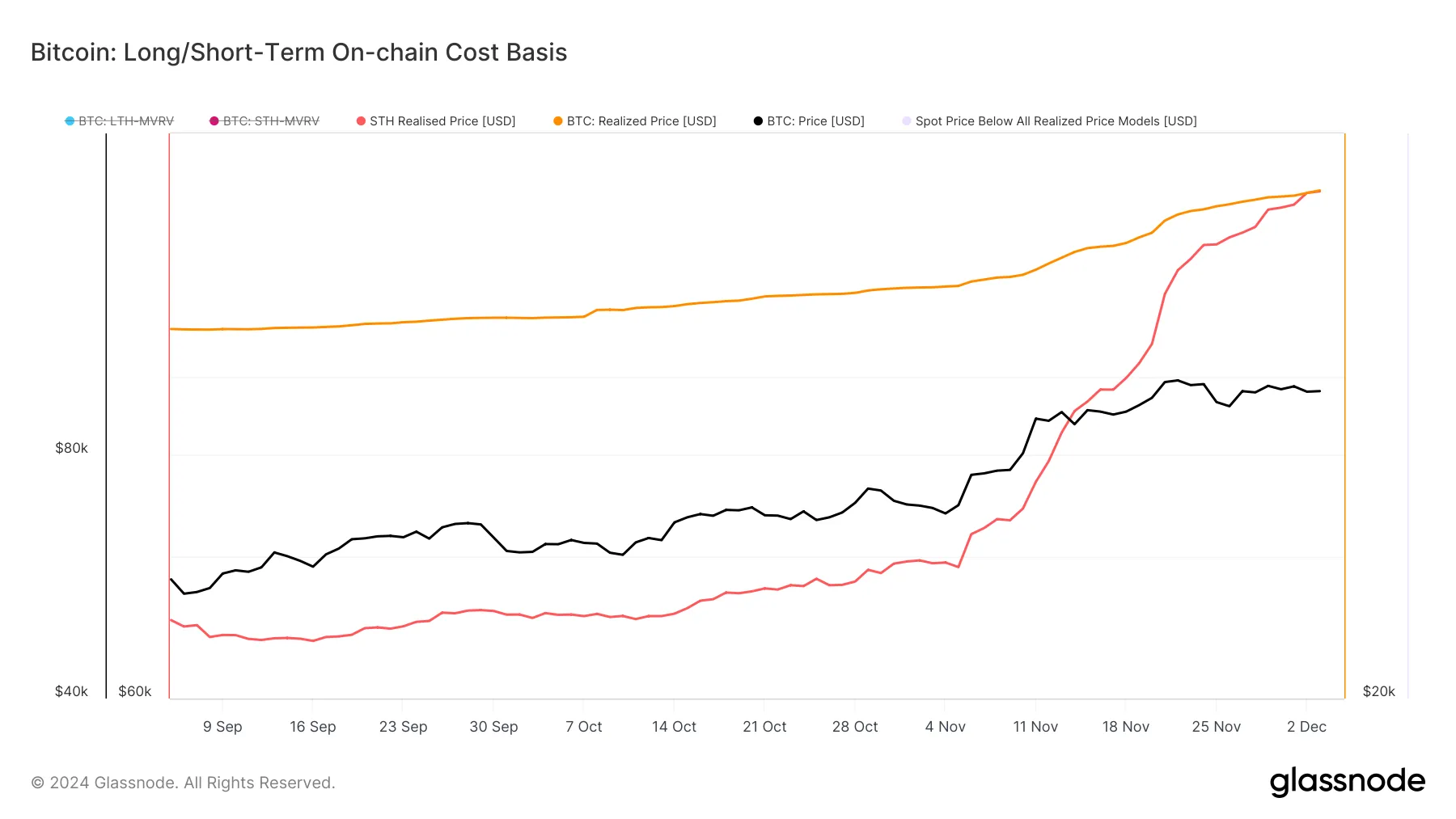

Furthermore, knowledge from Glassnode reveals that Bitcoin’s short-term realized value, which is the common on-chain acquisition worth, is $77,675.

Sometimes, when the realized value is above Bitcoin’s market worth, the pattern is bearish. Nevertheless, with BTC buying and selling above $96,000, it means that the pattern across the coin is bullish, and the worth may improve.

BTC Value Prediction: $110,000 Doable within the Brief Time period

On the weekly chart, Bitcoin has fashioned a bull flag. A bull flag is a bullish chart sample characterised by two robust rallies, separated by a short consolidation part.

The sample begins with a pointy, virtually vertical value spike, creating the ‘flagpole.’ That is adopted by a pullback that kinds parallel higher and decrease trendlines, creating the ‘flag’ itself, as seen under.

Since BTC has damaged out of the sample, the coin’s value may hit larger values within the brief time period. If validated, Bitcoin’s value may climb to $100,274 quickly. In a extremely bullish state of affairs, it may rally above $110,000.

Alternatively, if the demand for Bitcoin by retail buyers drops, this prediction won’t occur. In that case, the worth may lower to $90,275.

Disclaimer

Consistent with the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.