Knowledge exhibits the Bitcoin HODLer stability has registered a drop of round 9.8% this bull run. Right here’s how this determine regarded for earlier cycles.

Bitcoin HODLers Have Seen Their Holdings Go Down Just lately

In accordance with knowledge from the market intelligence platform IntoTheBlock, the Bitcoin long-term holders have regularly been reducing their whole stability just lately.

The “long-term holders” (LTHs) right here consult with the BTC traders who’ve been holding onto their cash for at the very least one 12 months, with out transferring or promoting them a single time.

Statistically, the longer a holder retains their cash nonetheless, the much less probably they develop into to promote the tokens at any level. As such, the LTHs, who maintain for vital durations, might be thought of persistent entities. The aspect of the market with weak fingers is called the “short-term holders” (STHs).

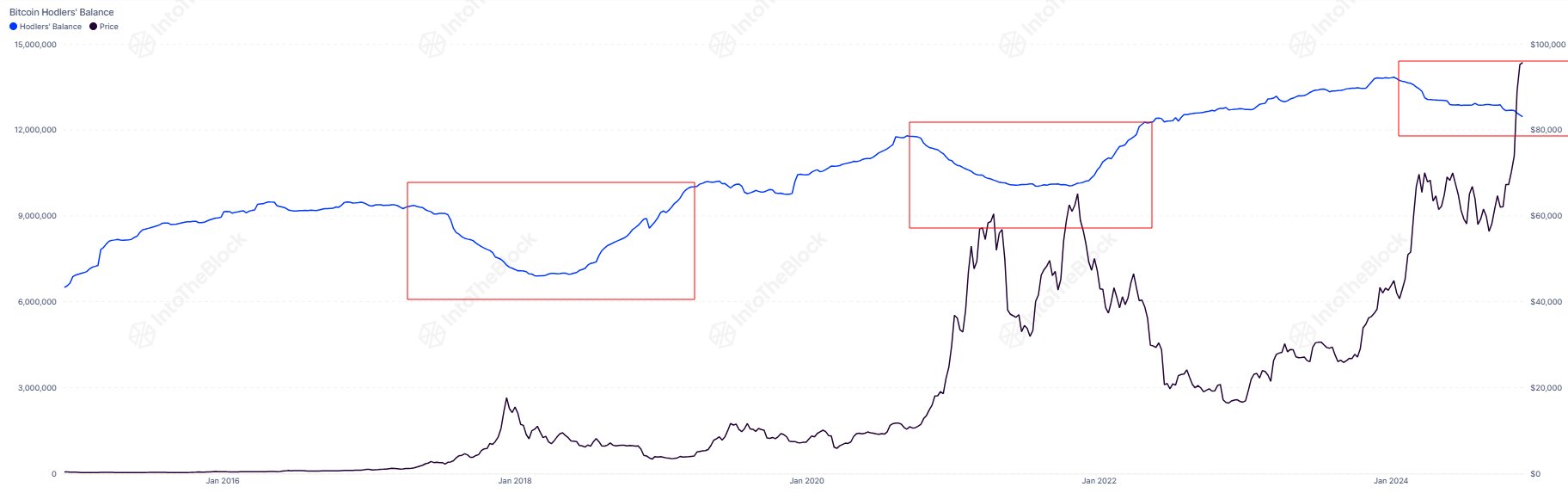

Now, right here is the chart shared by IntoTheBlock that exhibits the pattern within the mixed holdings of the Bitcoin LTHs over the previous decade:

The worth of the metric seems to have been on the decline in latest months | Supply: IntoTheBlock on X

The above graph exhibits that the Bitcoin LTHs have been lowering their provide this 12 months. Extra particularly, the entire stability of those HOLDers has decreased by round 9.8% throughout this downtrend.

The LTHs have determined to interrupt their dormancy at any time when this metric registers a decline. Typically, this occurs as a result of they wish to take part in some promoting.

One thing to notice is that whereas promoting is one thing that may immediately seem on the indicator, the identical isn’t true for purchasing. LTH provide has a 1-year delay connected by way of this, as cash can solely develop into part of the cohort after they’ve been held for at the very least a 12 months.

As talked about earlier, LTHs are typically dedicated fingers, so that they don’t are inclined to promote too usually. That mentioned, even these traders are pressured into promoting when the earnings of a serious Bitcoin bull run begin rolling in.

The analytics agency has highlighted within the chart how this promoting regarded through the earlier cycles. It might seem that the diploma of the decline has been much less on this cycle to date than within the final bull markets.

“Lengthy-term holder balances have fallen by 9.8% this cycle, in comparison with 15% in 2021 and 26% in 2017,” notes IntoTheBlock. Thus, it’s doable that the HODLer distribution might have extra room to proceed earlier than the Bitcoin rally ends.

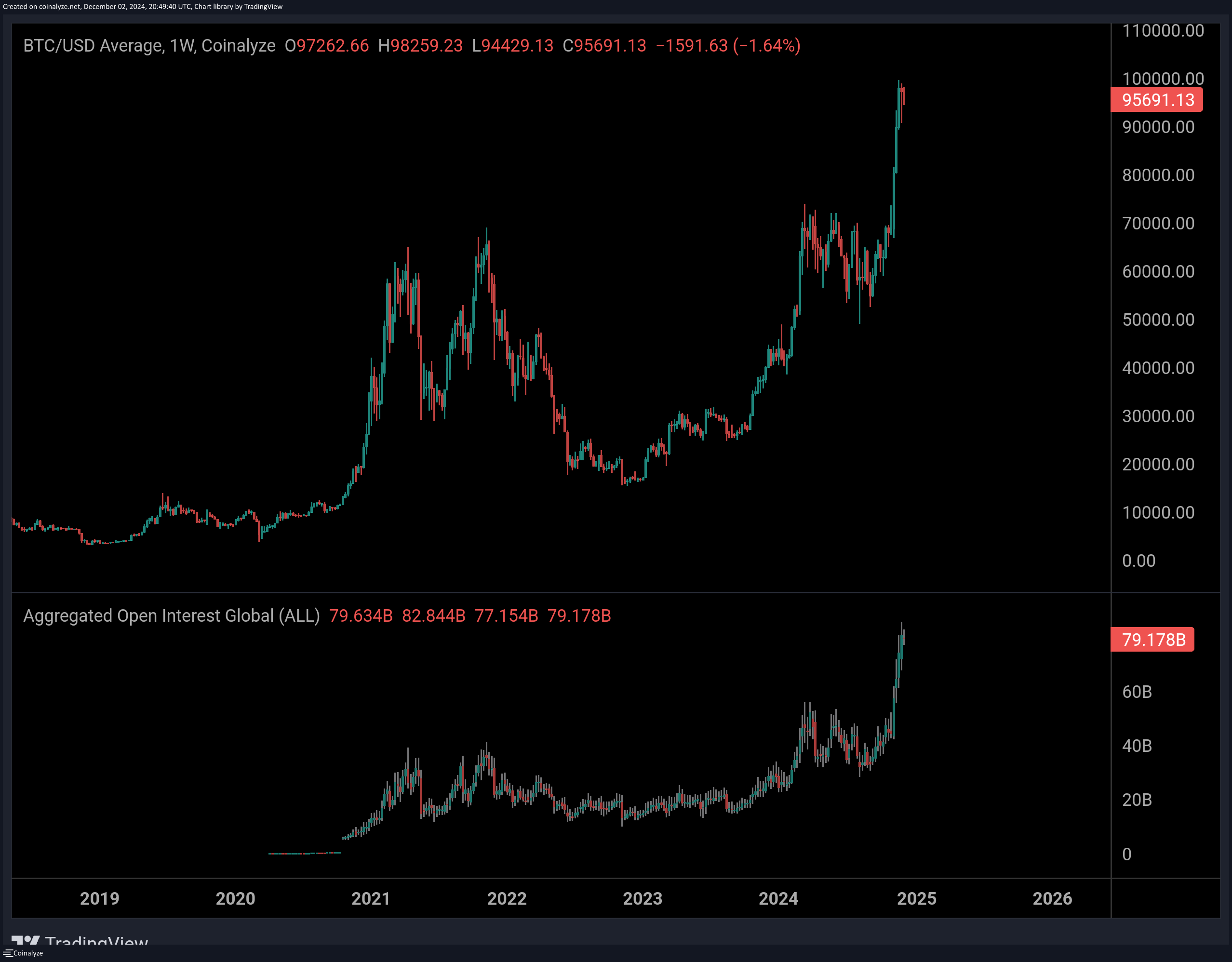

In another information, as CryptoQuant neighborhood analyst Maartunn has identified in an X put up, the entire Open Curiosity for the cryptocurrency sector has shot as much as a brand new all-time excessive of $79.2 billion.

Appears to be like like the worth of the metric has noticed a pointy surge just lately | Supply: @JA_Maartun on X

The “Open Curiosity” refers to a measure of the variety of derivatives positions that customers have opened on all centralized exchanges. A spike on this indicator usually corresponds to increased volatility for the market.

BTC Worth

The Bitcoin rally has gone chilly as its value has been consolidating sideways across the $95,800 mark just lately.

The worth of the coin has been caught in sideways motion over the previous few weeks | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com