Cardano (ADA) whales, who’ve been instrumental in driving the cryptocurrency’s value by 270% within the final 30 days, have now offered a bunch of tokens. This sell-off comes forward of this week’s token unlock, which market contributors count on will trigger volatility.

As of this writing, ADA trades at $1.23. Will this sell-off draw the value down additional?

Cardano Key Holders Offload Some Tokens

On Monday, December 2, Cardano’s massive holders’ netflow reached 63.58 million ADA, reflecting a powerful shopping for development amongst whales. The netflow metric tracks the distinction between tokens purchased and offered by these key gamers. A rising netflow signifies accumulation, whereas a decline signifies promoting stress.

As of now, the netflow has plunged to 7.62 million ADA, in line with IntoTheBlock, suggesting that whales offloaded 55.96 million ADA — both to take income or rebalance their portfolios. At Cardano’s present value, this sell-off quantities to a staggering $69 million.

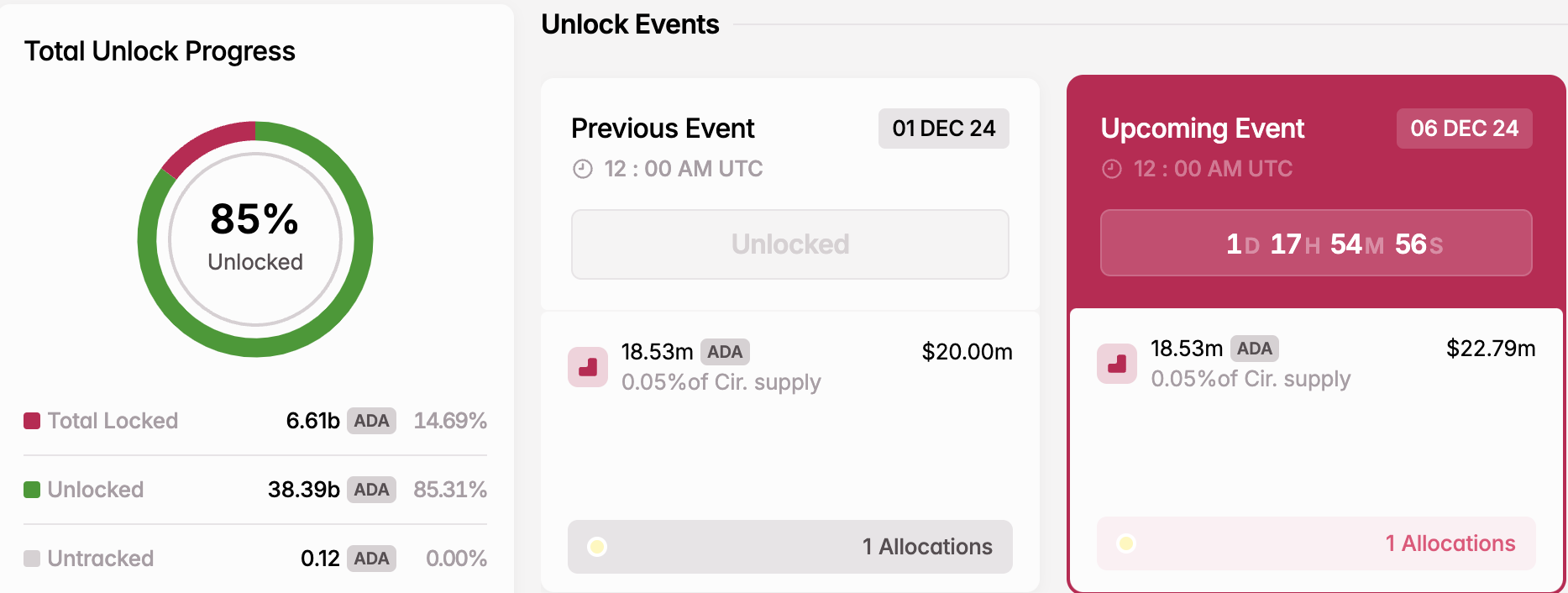

From BeInCrypto’s remark, the latest sell-off could also be tied to the upcoming token unlock on December 6.

Token unlocks, which launch beforehand restricted tokens into circulation, usually drive vital value actions by altering provide and demand dynamics.

Based on Tokenomist (previously Token Unlocks), Cardano is about to launch 18.53 million ADA on that date, valued at $22.79 million. This anticipated provide shock might introduce volatility, doubtlessly hindering the altcoin’s means to maintain an uptrend throughout this era.

ADA Worth Prediction: Overbought, Retracement Possible

On the day by day chart, Cardano’s Bollinger Bands (BB) have widened, indicating heightened volatility. The BB additionally highlights whether or not an asset is overbought or oversold.

When the value touches the higher band, it alerts an overbought situation, whereas contact with the decrease band signifies oversold territory. Subsequently, the picture under confirms the thesis that ADA is overbought.

The Relative Power Index (RSI), which measures momentum, additionally aligns with the bias. When the RSI studying is above 70.00, it’s overbought. Then again, when the studying is under 30.00, it’s oversold.

At press time, Cardano’s RSI stands at 82.15, firmly inserting ADA in overbought territory. Given this situation, a value correction to $0.92 might be subsequent. Nonetheless, if Cardano whales resume accumulation, the development might shift, doubtlessly pushing the value above $1.33

Disclaimer

In keeping with the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.