Solana (SOL) worth is at the moment 12% under its all-time excessive, which was reached on November 22. Regardless of this latest pullback, SOL stays one of many 12 months’s prime performers, boasting a powerful 275.85% achieve year-to-date.

Latest technical indicators, together with the BBTrend, DMI, and EMA traces, counsel the market could also be coming into a consolidation part. This might set the stage for SOL to check key assist and resistance ranges because it seeks its subsequent main transfer.

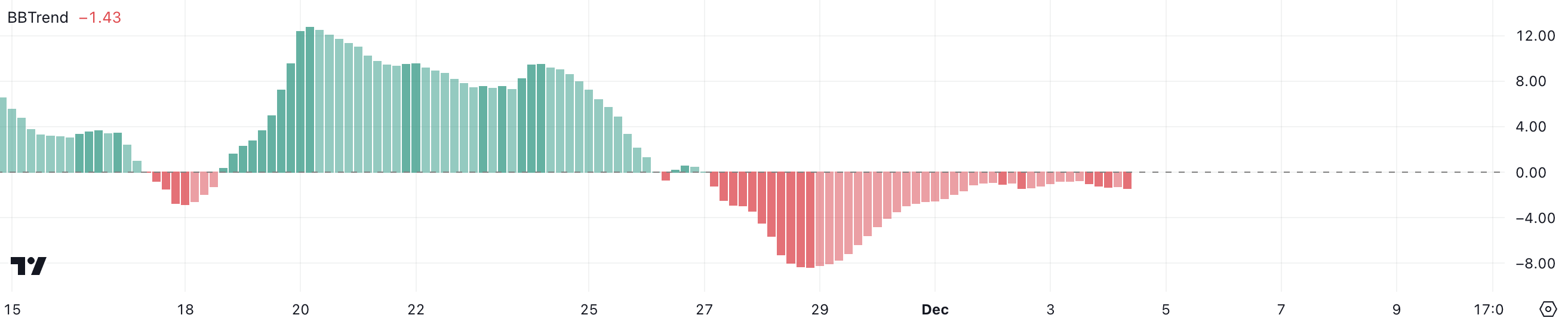

SOL BBTrend Is Unfavourable, However Removed from Its Peak

SOL’s BBTrend is at the moment at -1.43, recovering from its peak detrimental stage of -8.34 on November 28. Though it has remained detrimental since November 27, this much less excessive studying suggests SOL could also be coming into a consolidation part.

SOL worth may now stabilize inside a narrower vary because the bearish stress seems to be easing.

BBTrend measures worth momentum relative to Bollinger Bands, with detrimental values indicating downward stress and constructive values signaling upward developments.

Solana present BBTrend stage, whereas nonetheless detrimental, is much much less bearish than its earlier lows. This may increasingly mirror a transition part, the place the market is pausing to resolve its subsequent main transfer.

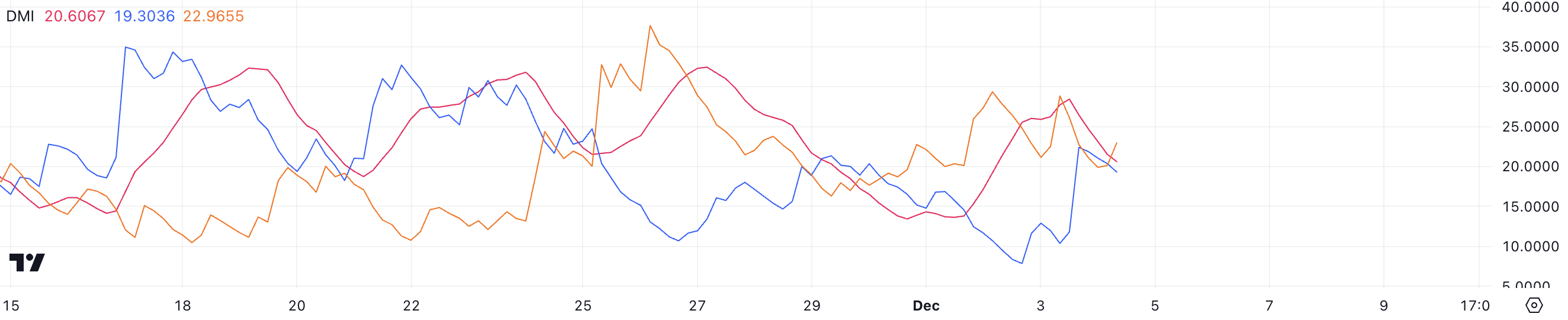

Solana Development Isn’t Sturdy

SOL’s DMI chart signifies that its ADX has dropped to twenty.6, down from almost 30 only a day in the past. This decline suggests weakening pattern power, doubtlessly signaling lowered market momentum.

In the meantime, the D+ is at 19.3 and the D- is barely greater at 22.9, implying a slight bearish benefit as sellers keep management over consumers.

The ADX (Common Directional Index) measures pattern power, no matter path. Values above 25 point out a robust pattern, whereas values under counsel a weak or consolidating market.

With D+ representing shopping for stress and D- promoting stress, SOL present DMI readings spotlight a market nonetheless leaning bearish however with much less conviction, suggesting potential for consolidation or a shift in momentum.

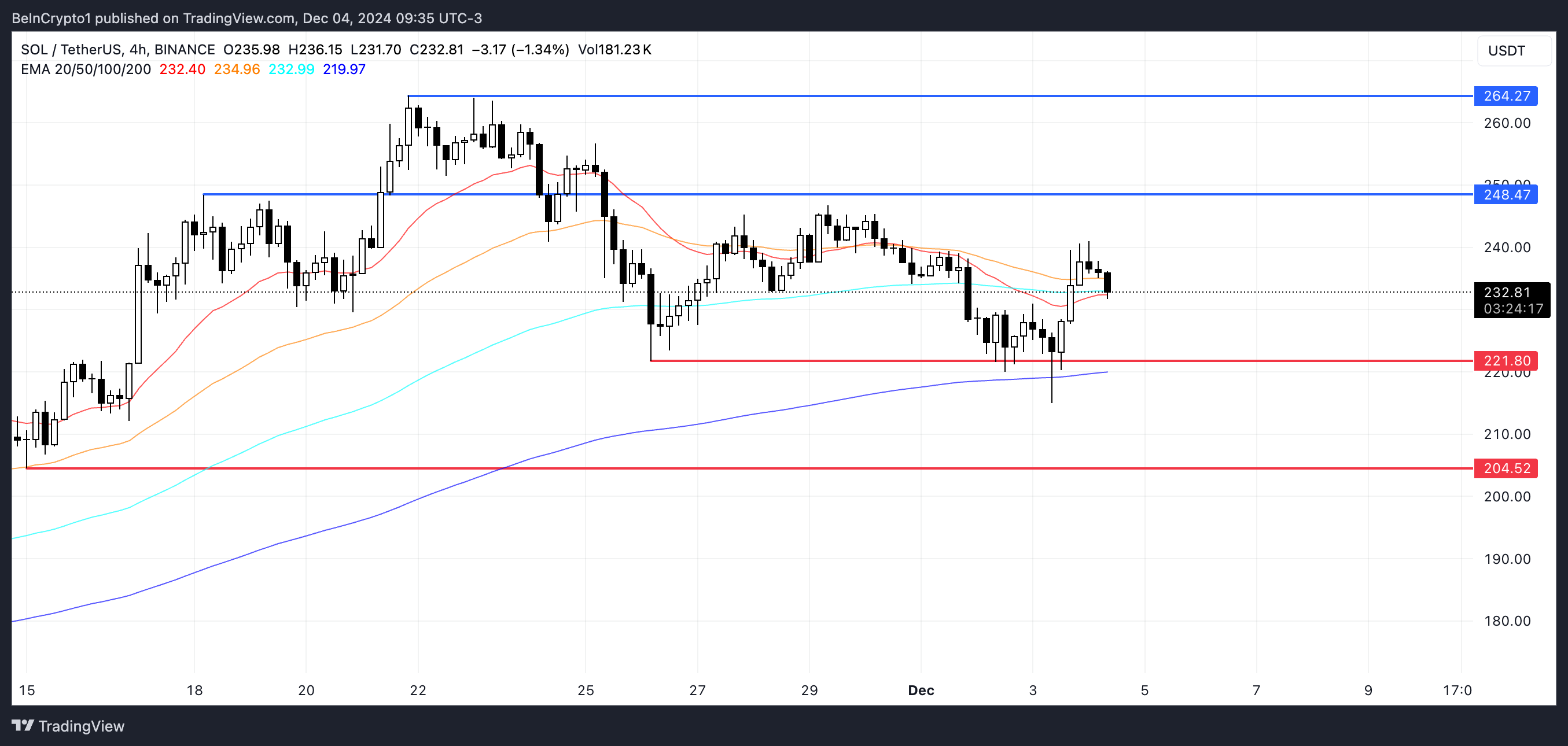

SOL Value Prediction: A Consolidation Earlier than Attempting New All-Time Excessive?

Solana EMA traces just lately displayed a bearish sign as a short-term line crossed under a long-term line. Nonetheless, the slender hole between the traces suggests consolidation slightly than a robust downtrend.

This might point out a pause in market path as merchants await additional cues.

If a downtrend develops, SOL worth may take a look at assist at $221, with an extra drop to $204 if this stage fails. Alternatively, a restoration may push Solana towards a key resistance at $248.

Breaking this stage may open the trail to retesting its earlier all-time excessive close to $264.

Disclaimer

In keeping with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.