The chief government of blockchain intelligence platform CryptoQuant believes a possible incoming altseason is not going to be like prior ones for one key cause.

On-chain analyst Ki Younger Ju tells his 381,200 followers on the social media platform X that, in contrast to previous cycles, liquidity can not movement on the identical ranges from Bitcoin (BTC) into altcoins, sending them hovering.

The analyst says there may be now large conventional finance participation in Bitcoin, together with by spot market BTC exchange-traded funds (ETFs) and elevated shopping for by software program firm MicroStrategy (MSTR).

“This alt season received’t be what you anticipated. It’s going to be bizarre and difficult. Solely a selected few will win the sport. Market sentiment is sweet, however there isn’t a lot contemporary liquidity. Bitcoin is drifting away from the crypto ecosystem. Bitcoin has constructed its personal paper-based layer-2 ecosystem by ETFs, MSTR, funds and extra. On this paper-based L2 Bitcoin bridging to different altcoins is unimaginable.”

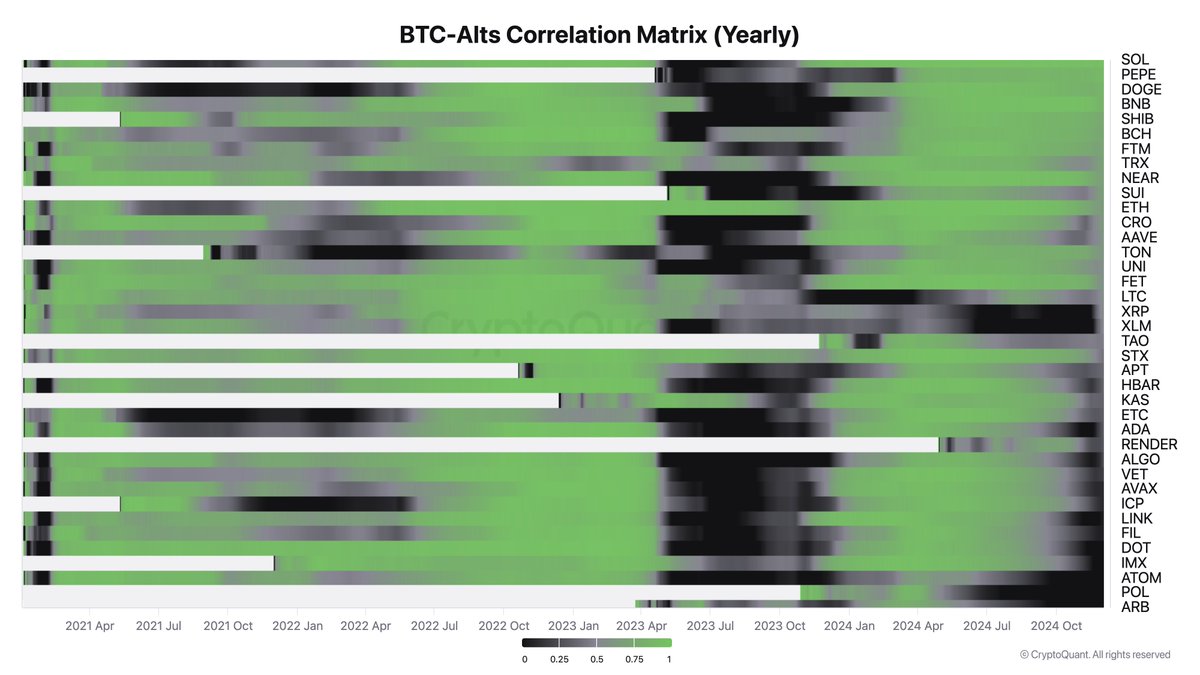

He additionally shares a chart exhibiting Bitcoin’s worth correlation with alts. A rating of 1 is the best correlation, whereas the bottom correlation attainable is 0.

“Altcoins used to maneuver collectively based mostly on their correlation with BTC, however that sample has now damaged. Only some are beginning to present unbiased developments as they appeal to new liquidity.”

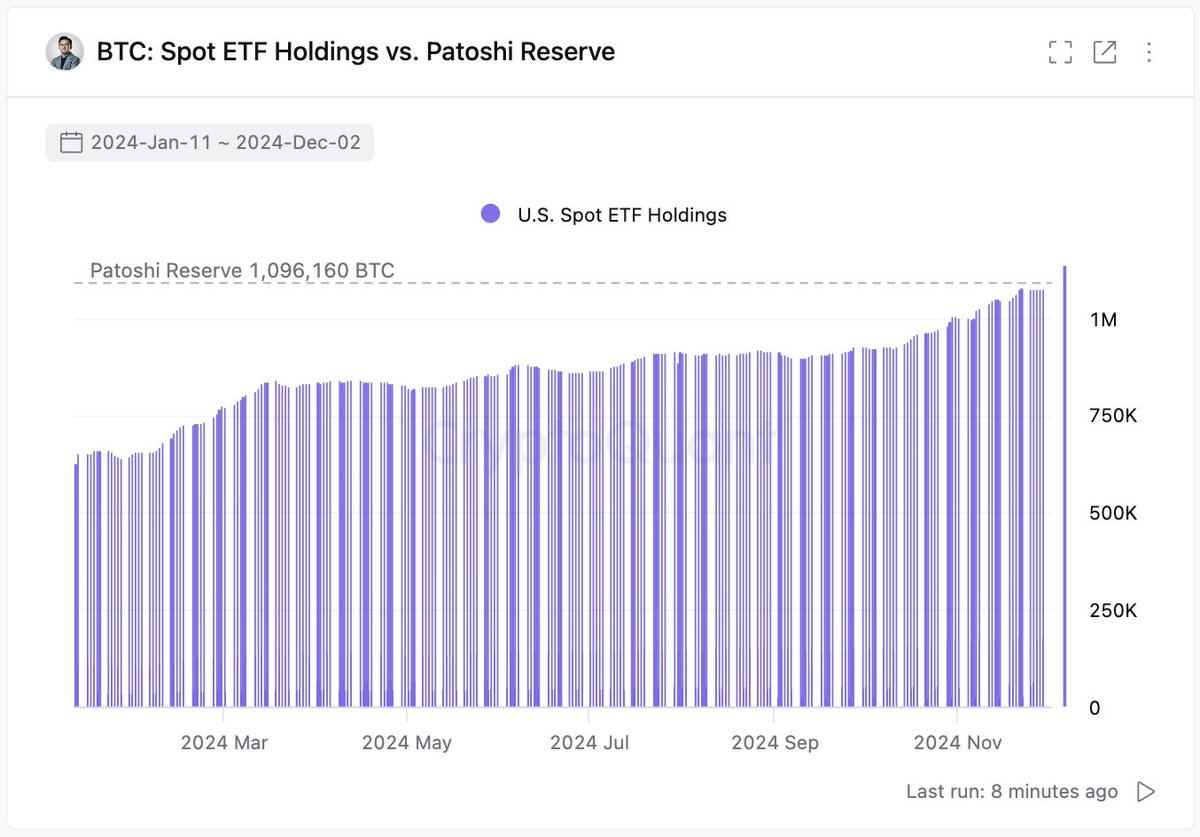

The analyst notes that spot market BTC ETFs have accrued as a lot as is believed to have been mined by Bitcoin’s pseudonymous founder Satoshi Nakamoto within the early days of the cryptocurrency’s existence.

“Bitcoin spot ETFs now maintain as a lot BTC as Satoshi Nakamoto (Patoshi).”

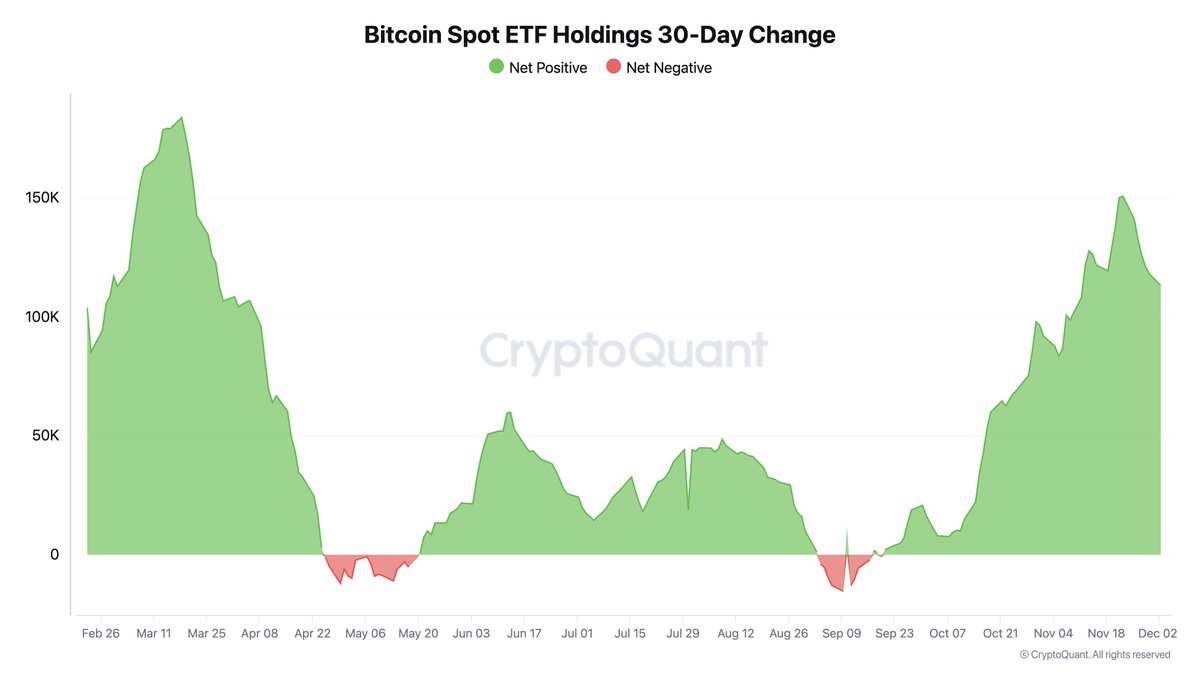

He additionally says that investor demand for the ETF product is returning to its historic excessive.

“Bitcoin ETF demand is as sturdy as at their preliminary approval this 12 months.”

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on X, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl will not be funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any losses you could incur are your duty. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please observe that The Day by day Hodl participates in online marketing.

Generated Picture: Midjourney