Token unlocks are extra than simply scheduled occasions; they’re essential market drivers. Whether or not inflicting value suppression, volatility, or ecosystem development, their impression is plain. Keyrock, a cryptocurrency market maker, printed a report on token unlocks and the way these occasions have an effect on the market.

The analysis highlights that token unlocks, although predictable, have important impacts. Leveraging insights from the examine allows crypto market individuals to navigate these occasions extra successfully, remodeling potential disruptions into alternatives.

Keyrock Analysis Unveils Insights on Token Unlocks

The examine examined greater than 16,000 token unlocks, shedding mild on the substantial results these occasions have on market conduct. The findings of the analysis present invaluable insights for merchants and buyers alike. Each week, over $600 million price of tokens enter circulation as a consequence of unlocks. Regardless of their frequency, the market response to those occasions is sort of uniform.

“Understanding unlock schedules is now not non-obligatory for merchants. It’s important for timing market entries and exits successfully,” the analysis highlighted.

In response to Keyrock, 90% of unlocks create unfavorable value stress. That is true whatever the measurement, sort, or recipient of the tokens. Apparently, value impacts typically start nicely earlier than the unlock date, doubtless as group members front-run the occasion. Greater unlocks amplify this impact, inflicting sharper value drops (as much as 2.4 occasions better) and elevated volatility.

Of observe is that token unlock occasions sometimes comply with structured schedules outlined in vesting tables. These schedules can vary from single giant releases (cliffs unlocks) to steady month-to-month distributions (linear unlocks). Keyrock’s analysis categorizes these occasions by measurement, establishing that smaller unlocks, whereas much less impactful individually, can create cumulative value suppression.

- Nano (<0.1%) and Micro Unlocks (0.1%-0.5%): Minimal impression.

- Small (0.5%-1%) and Medium Unlocks (1%-5%): Able to influencing market sentiment.

- Giant (5%-10%) and Enormous Unlocks (>10%): Important occasions with excessive market impression.

For merchants, the dimensions of an unlock determines its significance. Enormous token unlocks, although initially disruptive, typically unfold their results over time, resulting in a extra gradual value restoration.

In addition to measurement, the kind of recipient receiving the unlocked tokens additionally considerably influences value dynamics. Assessing the unlock recipient’s profile is essential for figuring out the potential market impression. Keyrock has recognized 5 main classes on this context.

Workforce Unlocks

These are probably the most detrimental, resulting in common value drops of as much as 25%. Uncoordinated promoting by group members, coupled with an absence of strategic measures to attenuate market impression, exacerbates the scenario. Typically handled as compensation, these tokens are offered shortly to deal with monetary wants, leading to sharp value declines.

“Workforce unlocks exemplify how lack of planning can amplify market disruption,” the report famous.

Subsequently, merchants ought to keep away from coming into positions throughout these unlock durations and even throughout the linear distribution that usually follows.

Investor Unlocks

Managed strategically and exhibited managed impacts as a consequence of superior hedging and liquidation methods. Apparently, investor unlocks exhibit extra managed value conduct in comparison with group unlocks.

Early buyers, typically from enterprise capital (VC) backgrounds, make use of superior methods equivalent to OTC offers, derivatives, and choices to mitigate the impression of token gross sales. These strategies scale back fast sell-side stress and guarantee orderly market situations.

Keyrock’s analysis factors out, that the adoption of comparable methods by venture groups might considerably scale back the unfavorable impacts of token unlocks.

“Sophistication in planning and execution can flip unlocks into alternatives somewhat than liabilities,” Keyrock added.

Ecosystem Growth Unlocks

Uniquely constructive, these typically end in value will increase (+1.18% on common) as they inject liquidity or incentivize ecosystem development. The tokens sometimes serve for infrastructure growth, contributing to long-term ecosystem development.

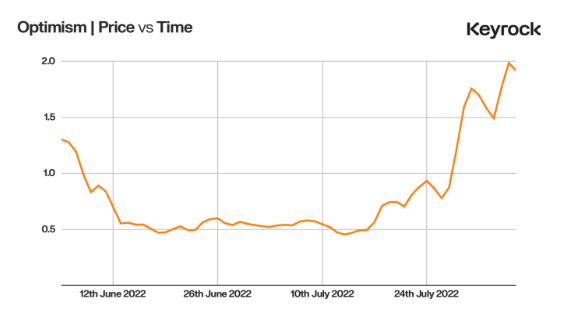

Keyrock cites the instance of Optimism (OP), which strategically allotted $36 million in tokens to 24 tasks following a significant unlock in June 2022. This method not solely stabilized the market but in addition drove community growth.

“Unlocks aligned with ecosystem development methods can act as catalysts somewhat than disruptors,” Keyrock mentioned.

Neighborhood or public unlocks typically exhibit combined impacts, with many tokens held or offered by recipients, reflecting average value pressures. However, burn unlocks are uncommon and, subsequently, excluded from the evaluation.

Key Takeaways: Patterns and Methods Round Unlocks

In the meantime, two phenomena ceaselessly drive pre-token unlock value suppression. First, is retail anticipation, the place merchants promote early to keep away from dilution, additional driving down costs. Second, is institutional hedging, the place refined holders preemptively lock in costs, minimizing their impression on unlock days.

Submit-unlock, costs typically stabilize inside two weeks as market dynamics regulate. For ecosystem growth unlocks, the stabilization is coupled with tangible development advantages, as seen in tasks like Optimism, which successfully used token unlocks to fund ecosystem growth.

“Optimism’s technique following its aggressive June 2022 unlock provides a textbook instance of how ecosystem unlocks, when well-designed, can drive each fast utility and long-term development. Regardless of an preliminary selloff, Optimism demonstrated how aligning unlocks with focused incentives can rework a provide shock right into a springboard for growth,” an excerpt from the analysis said.

eyrock’s analysis highlights the significance of monitoring unlock schedules and understanding recipient conduct. For merchants, timing is essential. Exiting positions 30 days earlier than main unlocks and re-entering 14 days later can scale back dangers and maximize returns. For tasks, fastidiously deliberate unlock schedules and techniques, equivalent to phased releases and liquidity assist, can reduce market disruptions and align with long-term development targets.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.