Information from CryptoQuant has revealed how institutional buyers have been the drivers behind the most recent Bitcoin surge above $100,000.

Bitcoin Coinbase Premium Index Has Been Constructive Just lately

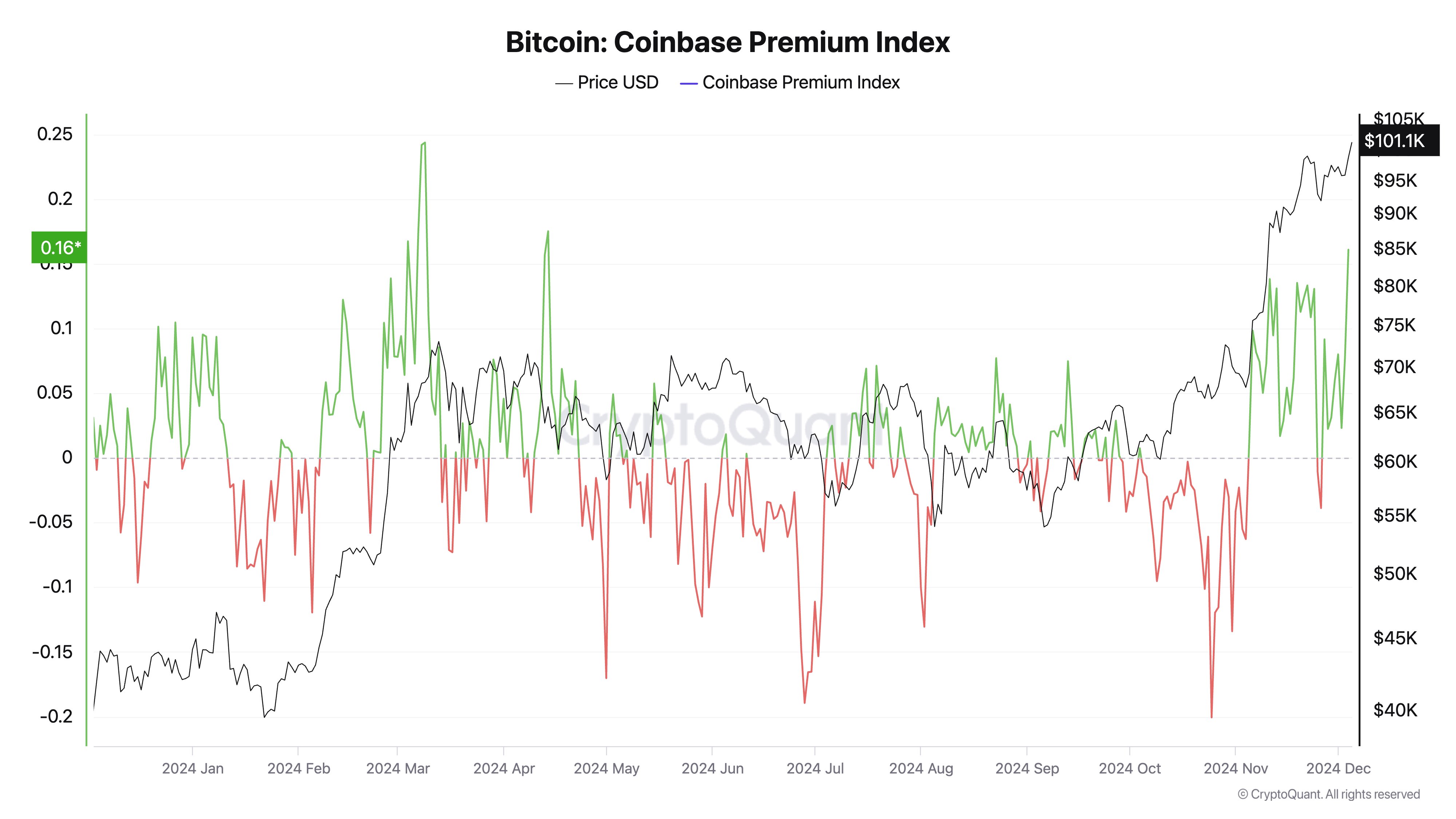

In a brand new put up on X, the on-chain analytics agency CryptoQuant has mentioned the most recent pattern within the Bitcoin Coinbase Premium Index. The “Coinbase Premium Index” refers to a metric that retains observe of the share distinction between the BTC worth listed on Coinbase (USD pair) and that on Binance (USDT pair).

The indicator tells us about how the shopping for or promoting behaviors differ between the person bases of those cryptocurrency trade giants. Coinbase’s primary visitors contains US-based buyers, particularly giant institutional entities, whereas Binance hosts customers worldwide.

When the Coinbase Premium Index has a constructive worth, the asset trades at the next charge on Coinbase than on Binance. Such a pattern implies that American whales have been making use of a larger shopping for or decrease promoting stress than the worldwide buyers.

However, the destructive indicator means that Binance customers could also be shopping for greater than Coinbase customers as BTC goes for the next worth there.

Now, right here is the chart shared by the analytics agency that reveals the pattern within the Bitcoin Coinbase Premium Index over the previous yr:

The worth of the metric seems to have been fairly constructive in latest weeks | Supply: CryptoQuant on X

As displayed within the above graph, the Bitcoin Coinbase Premium Index registered a pointy surge into the constructive territory in the beginning of November and has since maintained inside this territory, save for a quick dip.

This pattern naturally implies that the shopping for stress on Coinbase has constantly been larger than that on Binance. The asset’s worth loved a sharp rally throughout this era, so it will additionally seem that this accumulation from US-based buyers has fueled the surge.

The chart reveals that this sample has additionally been witnessed on a number of cases all through the previous yr, with constructive spikes within the Coinbase Premium Index usually being bullish for Bitcoin.

The most recent rally to the brand new all-time excessive (ATH) above $104,000 has additionally come because the indicator has registered one other sharp inexperienced spike. Thus, American institutional buyers appear to play a pivotal position out there.

Given this sample, the Coinbase Premium Index is of course an indicator to control shortly, as new modifications could once more foreshadow the destiny of Bitcoin’s worth.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $100,800, up greater than 6% over the previous week.

Seems like the worth of the coin has noticed a pointy surge throughout the previous day | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com