Bitcoin (BTC) noticed excessive volatility up to now 24 hours, shaking the crypto market. A flash crash triggered over $1 billion in liquidations, marking one of many largest sell-offs since FTX’s 2022 collapse.

Coinglass knowledge reveals practically $900 million in Bitcoin positions had been liquidated as its value plummeted from $100,000 to $90,000 earlier than rebounding to $97,000.

Bitcoin Marks Largest Multi-12 months Liquidation Occasion

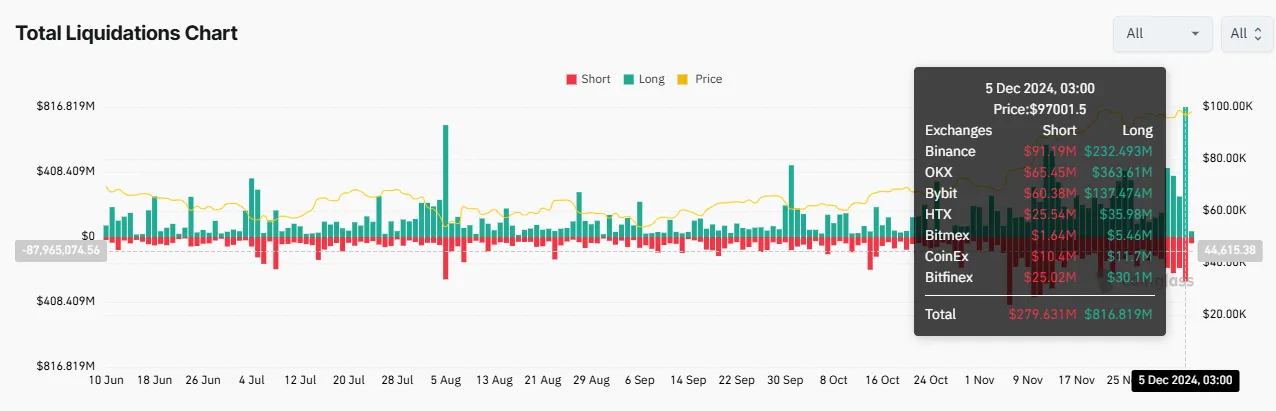

This dramatic liquidation cascade affected over 156,000 merchants globally, with $816.819 million longs and $279.631 shorts blown out of the water. In keeping with Coinglass, the biggest single liquidation, valued at nearly $19 million, occurred on the OKX trade.

Analysts are drawing parallels to the FTX disaster. McKenna, a preferred voice within the crypto neighborhood, states that that is essentially the most substantial liquidation occasion since FTX’s insolvency. A number of different neighborhood members supported this outlook.

“Spot patrons are actually stepping in, hovering up the liquidation cascade,” McKenna famous.

Including to the turmoil, Web3 knowledge evaluation instrument Lookonchain highlighted that Mt. Gox moved 3,620 BTC valued at $352.69 million to 2 new wallets. The transaction occurred solely hours after the defunct trade moved $2.43 billion in Bitcoin to unknown wallets after Bitcoin’s value shattered the $100,000 milestone.

Hypothesis round whether or not the US authorities could have offloaded Bitcoin throughout this era has additional fueled market uncertainty.

“Did the US authorities hit the promote button on the BTC they despatched to Coinbase?” one person quipped.

Regardless of these transactions, a number of elements drove the huge liquidations. BeInCrypto recognized profit-taking, giant promote orders at key milestones, and overleveraged positions as vital contributors. Many merchants relied on borrowed funds to guess on Bitcoin’s continued rise, leaving them uncovered when costs dropped.

Monetary analyst Jacob King of WhaleWire criticized overleveraged retail traders for opening lengthy positions at all-time highs.

“That is what occurs when retail traders succumb to FOMO and open leveraged lengthy positions at all-time highs, whereas whales offload their holdings,” King wrote.

Whales Capitalize on the Bitcoin Dip

Regardless of the chaos, some giant traders noticed a chance. Blockchain analytics agency Lookonchain revealed {that a} whale bought 600 BTC, valued at $58.85 million, in the course of the sharp decline. This introduced their two-week whole accumulation to 1,300 BTC value $127 million. This opportunistic shopping for demonstrates the attract of Bitcoin even amid turbulence.

“After BTC dropped from $100,000, a whale seized the chance and acquired 600 BTC value $58.85 million! Over the previous 2 weeks, this whale has collected a complete of 1,300 BTC valued at $127 million,” Lookonchain reported.

Regardless of the liquidation, some analysts view this occasion as a crucial correction in Bitcoin’s bull market, able to marking a short-term backside. Others argue that the long-term fundamentals stay intact, as evidenced by renewed whale exercise and regular accumulation.

The broader crypto market echoed Bitcoin’s volatility, with Ethereum and different main cash additionally experiencing heightened liquidation ranges. As merchants work round these developments, the main focus shifts to Bitcoin’s capability to reclaim vital assist ranges round $97,000 and maintain its historic rally.

In keeping with BeInCrypto knowledge, Bitcoin was buying and selling for $98,404 as of this writing, representing a 4% drop since Friday’s session opened.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.