Hedera (HBAR) open curiosity has hit a brand new all-time excessive following its 600% worth enhance within the final 30 days. This rise signifies the best dealer interplay with the token since its inception.

Trying forward, a number of key indicators counsel HBAR’s worth rally and bullish momentum could persist. Based mostly on this on-chain evaluation, here’s what could possibly be subsequent for the cryptocurrency.

Hedera Has Merchants’ Consideration on Lock

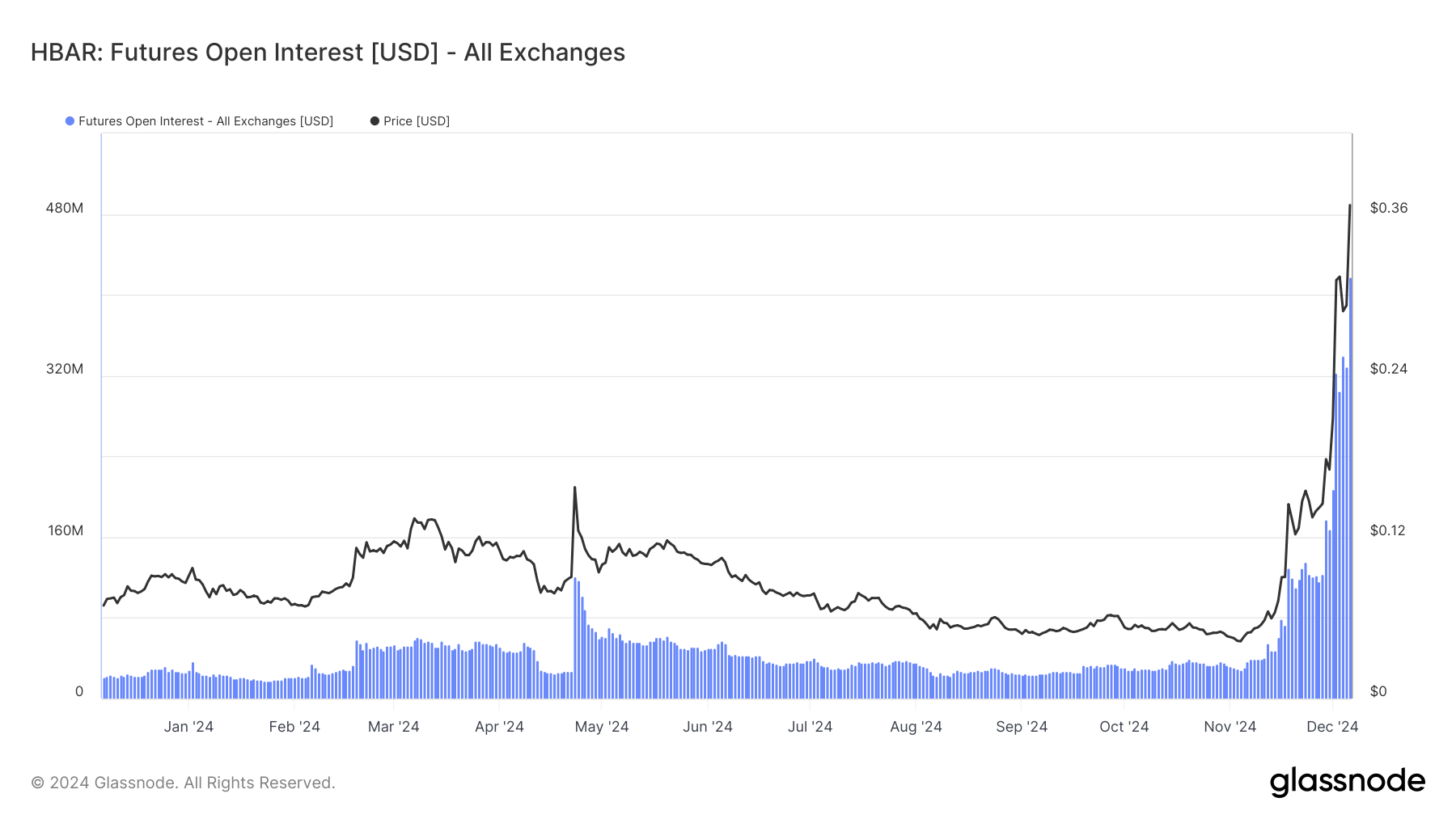

Some days again, BeInCrypto reported how HBAR’s open curiosity surged to $220 million. However as of this writing, the identical indicator, in response to Glassnode, has risen to $417.98 million. OI, as it’s fondly referred to as, represents the entire variety of open positions in a contract, with every place having an equal purchaser and vendor.

A rise in OI means that merchants are actively rising their market positions, with patrons turning into extra aggressive than sellers, driving the general web positioning larger. Conversely, when OI decreases, it signifies that market individuals are lowering their positions, signaling much less market exercise.

Moreover, the rising worth paired with rising OI could seem to counsel extra longs (patrons) than shorts (sellers). The true takeaway is that individuals are both ramping up or unwinding their positions, with a rising OI usually indicating a stronger pattern.

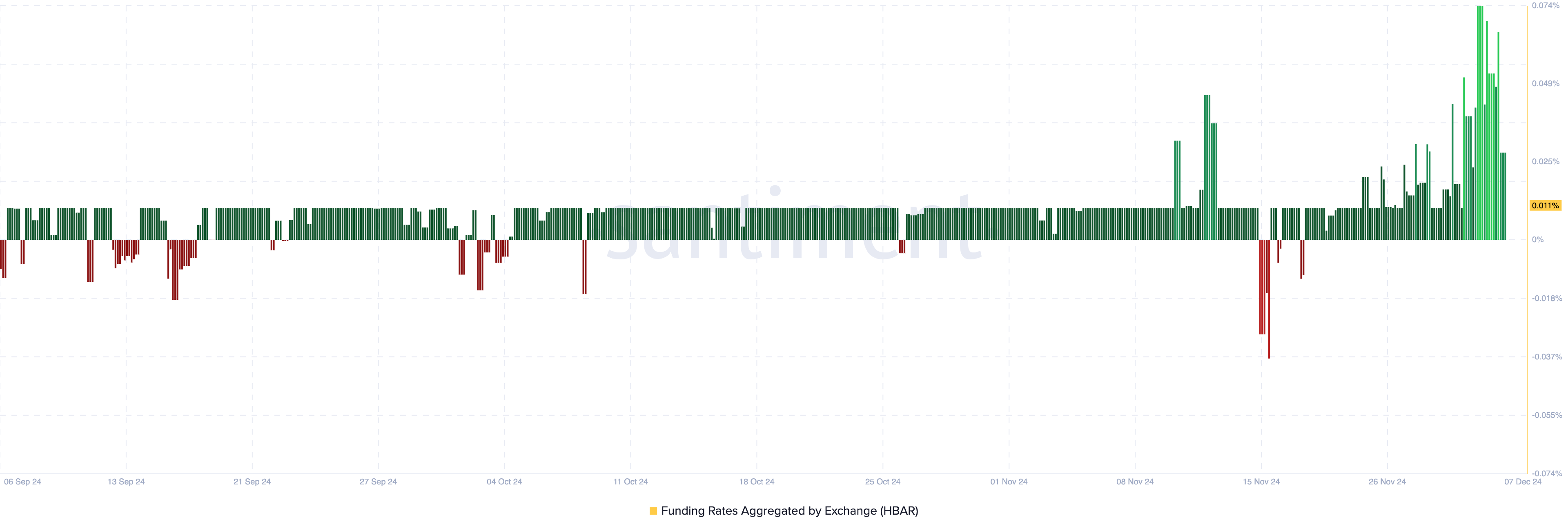

Subsequently, the rise within the altcoin’s OI with the current rally means that HBAR’s worth may quickly commerce larger. In the meantime, the token’s funding price has additionally remained within the constructive area.

A constructive funding price signifies that the contract worth is buying and selling at a premium to the index worth, with lengthy positions paying funding to quick positions. Conversely, when the funding price is unfavourable, the perpetual contract worth trades at a reduction to the index worth, which means quick positions pay funding to lengthy positions.

Contemplating the present place, longs are paying a funding price to shorts, suggesting that merchants are betting on an additional worth enhance.

HBAR Worth Prediction: Rally to Speed up

On the 4-hour chart, HBAR’s worth has damaged out of a descending triangle that shaped between December 3 and 6. A descending triangle is a sample that usually signifies a possible downtrend.

It types with a descending higher trendline, indicating decrease highs, and a flat horizontal trendline at a decrease stage, performing as help. As the worth approaches the apex of the triangle, a breakdown beneath the help stage usually suggests a continuation of the downtrend.

Nonetheless, HBAR didn’t break beneath the help stage. As an alternative, it surged above the bottom stage of the falling channel. With this pattern, the token’s worth will possible rise to $0.42 within the quick time period.

In the long run, HBAR’s worth could possibly be larger. Nonetheless, retracement beneath the help line at $0.28 may ship the cryptocurrency additional down. If that occurs and HBAR Open Curiosity drops, the worth may decline to $0.22.

Disclaimer

In keeping with the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.