BlackRock, the world’s largest asset supervisor, considerably elevated its Bitcoin (BTC) holdings on Friday, December 6. This improvement got here briefly after one other asset supervisor, Grayscale, offered BTC value $150 million.

The daring acquisition signifies BlackRock’s rising confidence within the flagship cryptocurrency. With institutional gamers regularly shopping for after Bitcoin’s $100,000 milestone, here’s what could possibly be subsequent for the coin.

Bitcoin Continues to Get BlackRock’s Backing

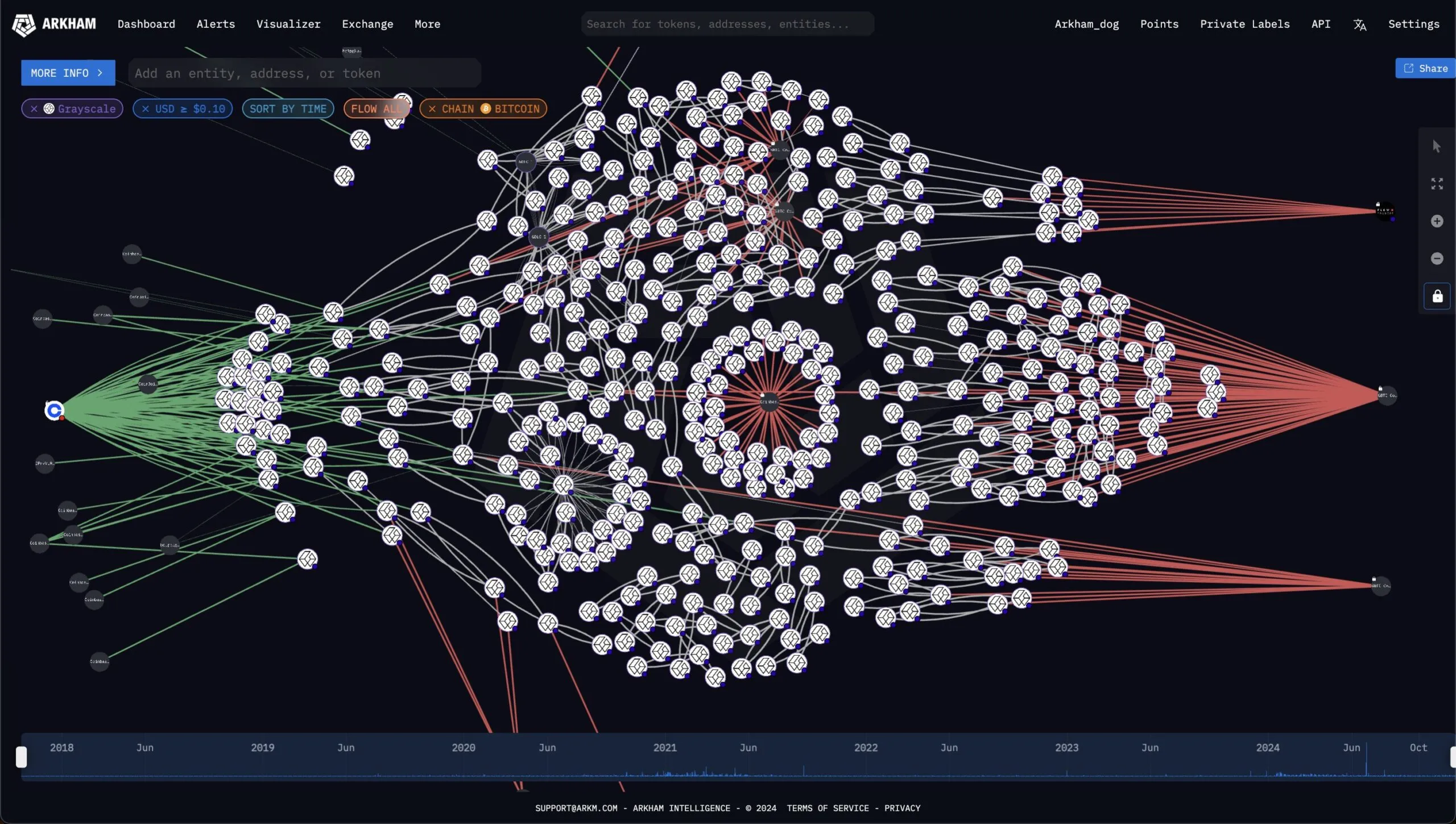

Bitcoin’s value surged to $100,000 for the primary time on Thursday, December 5. Arkham Intelligence reported that the milestone prompted Grayscale, a Bitcoin exchange-traded fund (ETF) issuer, to promote $150 million value of BTC.

In stark distinction, BlackRock, which is alleged to carry 500,000 BTC, took a distinct method. The funding large added $750 million to its Bitcoin holdings sooner or later later, signifying confidence within the asset’s long-term prospects regardless of current value swings.

In response to BeInCrypto’s findings, this large rise in BlackRock’s Bitcoin holding was very important in serving to the cryptocurrency to retest $100,000 after it briefly dropped to $97,000. However the query now’s: Will BTC proceed to rise?

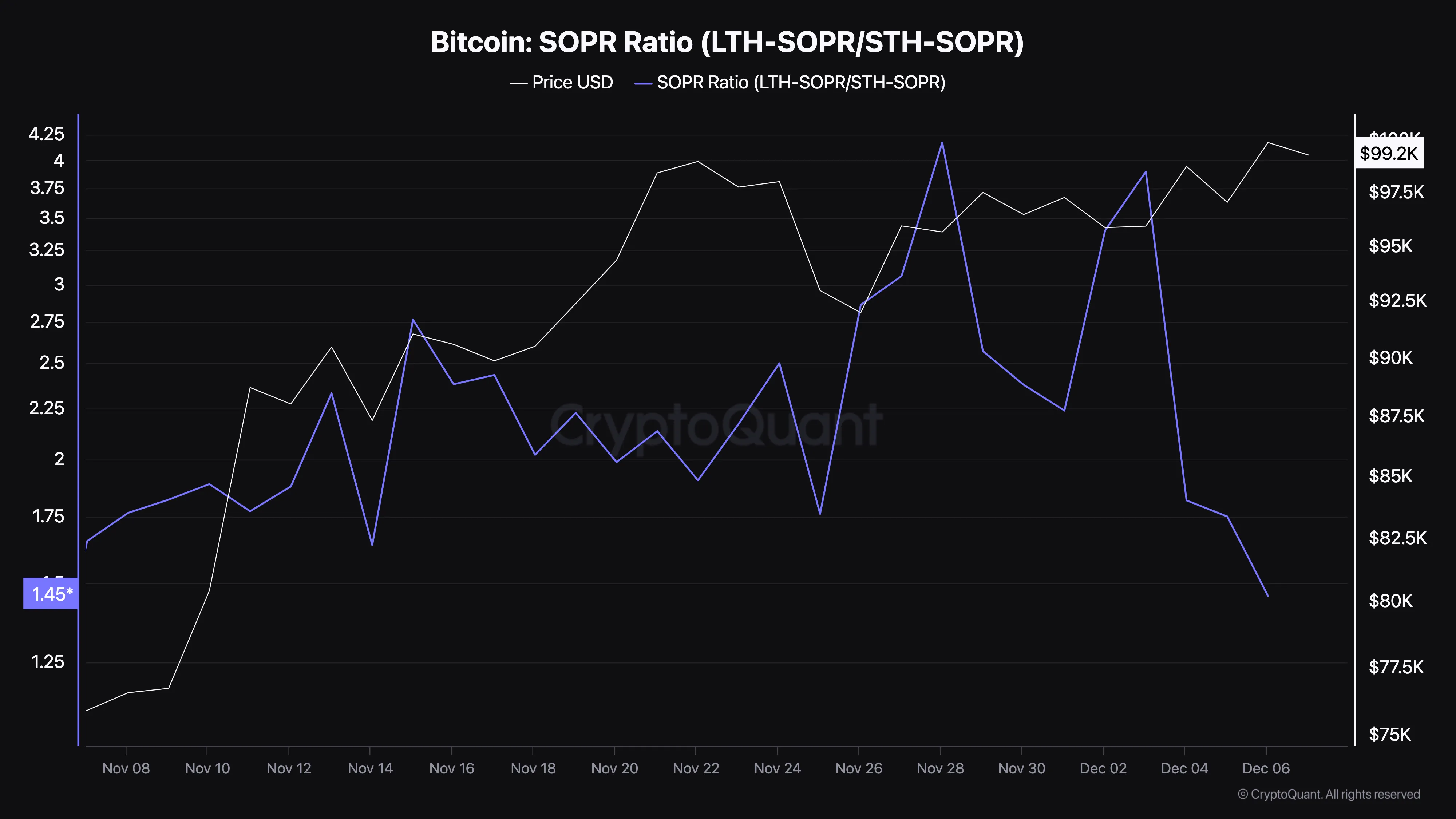

One option to know if Bitcoin’s value will proceed to leap is to have a look at the SOPR. The SOPR stands for Spent Output Earnings Ratio. It’s calculated by dividing the earnings held by Lengthy-Time period Holders (LTH) by those held by Quick-Time period Holders (STH).

When the ratio is excessive, it means LTHs have larger spent earnings than STHs. On this occasion, it implies that the value is near the native or market high. Nonetheless, in line with CryptoQuant, Bitcoin SOPR has dropped to 1.45, indicating that STHs have the higher hand, and the value is nearer to the underside than the highest.

If this development continues, then Bitcoin’s value may commerce larger than $100,000 throughout the coming weeks.

BTC Worth Prediction: $100,000 May Simply Be the Begin?

From a technical perspective, Bitcoin’s value is buying and selling inside a symmetrical triangle on the 4-hour timeframe. A symmetrical triangle sample alerts a interval of consolidation, the place the value tightens between converging trendlines earlier than a breakout or breakdown happens.

A breakdown beneath the decrease trendline typically signifies the start of a bearish development, whereas a breakout above the higher trendline sometimes marks the beginning of a bullish development.

Moreover, the Chaikin Cash Movement (CMF) is within the constructive area, indicating notable shopping for stress. Ought to this stay the identical and BlackRock Bitcoin holdings improve, BTC value may climb to $103,649.

In a extremely bullish situation, Bitcoin’s worth may rise to $110,000. Nonetheless, if establishments like Grayscale proceed to promote in giant volumes, this may not occur. As an alternative, Bitcoin’s value may decline to $93,378.

Disclaimer

According to the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.