Within the final seven days, the value of Chainlink (LINK) has climbed by 36.55%, bringing the token’s worth to its highest stage since January 2022. This enhance coincides with a broader altcoin rally that has seen many cryptos erase a giant bunch of the losses accrued over the previous couple of months.

However that’s not all. Based mostly on this evaluation, LINK will not be executed with the upswing, with indicators suggesting the next worth within the coming weeks.

Chainlink Bearish Sentiment Is Not Completely Unhealthy Information

The latest Chainlink value rally has ensured that the altcoin now trades at $25. This milestone might be linked to rising shopping for strain, particularly from crypto whales.

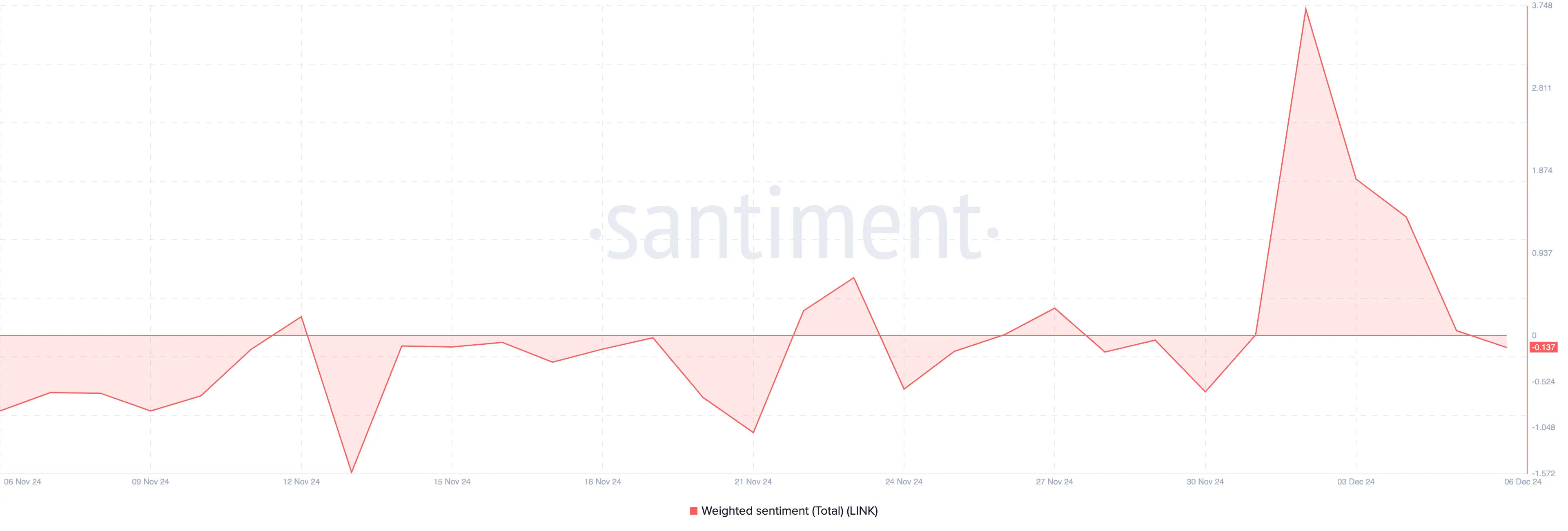

Nonetheless, in accordance with Santiment, retail traders haven’t but joined the bandwagon, suggesting that LINK’s worth nonetheless has room for additional development. One indicator that proves that is the Weighted Sentiment.

Weighted Sentiment measures the notion the broader market has a couple of cryptocurrency. When the studying is unfavorable, it means the typical comment on-line in regards to the asset is bearish. Alternatively, when the studying is constructive, it means most feedback are bullish.

Right this moment, Chainlink’s Weighted Sentiment is within the unfavorable zone. This means that retail Worry Of Lacking Out (FOMO) has not hit the token. Traditionally, when value will increase and sentiment stays bearish, the crypto has not but hit its peak.

Santiment, in a submit on X earlier at this time, additionally agrees with this thesis, saying that little bullish expectations from the group are a very good signal for LINK.

“It’s encouraging that there’s little or no retail FOMO towards LINK. Markets transfer in the wrong way of the group’s expectations, so the group’s disbelief will solely assist gasoline this rally additional,” the on-chain analytic platform highlighted.

Moreover, BeInCrypto’s analysis of Chainlink’s Cash Holding Time metric reveals a notable development: most LINK holders are refraining from promoting their tokens. Sometimes, a decline in holding time suggests elevated promoting exercise as extra cash are transacted or offered.

Nonetheless, in LINK’s case, the metric has risen, signaling rising investor confidence. This enhance displays a notable bullish conviction, suggesting that holders are opting to retain their tokens as a substitute of cashing out.

If sustained, such sentiment typically lays a powerful basis for potential upward value momentum.

LINK Worth Prediction: Time for $30 to Present

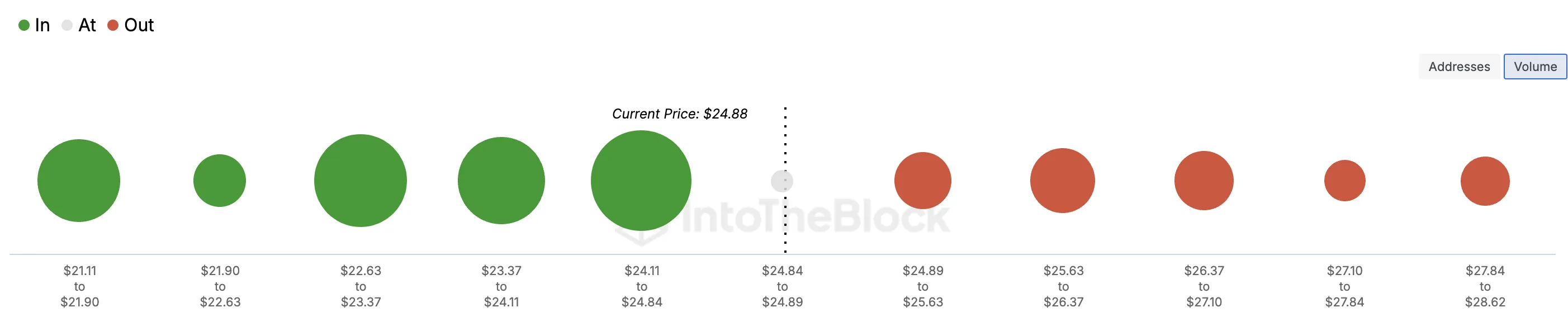

From an on-chain perspective, Chainlink’s In/Out of Cash Round Worth (IOMAP) reveals that 79% of LINK holders are at the moment in revenue. Past figuring out worthwhile addresses, the IOMAP highlights key resistance and assist ranges primarily based on token quantity.

Bigger token clusters at particular value ranges signify stronger ranges of assist or resistance. In response to IntoTheBlock knowledge, the quantity of tokens “within the cash” between $22 and $25 outweighs the quantity between $26 and $28. This means a powerful assist zone that would assist propel LINK towards $30 within the brief time period.

Nonetheless, this bullish outlook depends upon sustained shopping for momentum. If promoting strain begins to outweigh shopping for exercise, Chainlink’s value may break beneath the $20 mark. However for now, the stability of possibilities leans towards a Chainlink value enhance.

Disclaimer

In keeping with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.