Sushi DAO, the group governing the Sushi Swap decentralized trade, has proposed diversifying its treasury belongings. Underneath the proposal, Sushi’s treasury will go from 100% SUSHI tokens to a mixture of stablecoins and different belongings.

This non-binding proposal will search neighborhood suggestions from the DAO, particularly on particular variables, earlier than an official vote.

SUSHI Tokens Might Face Liquidation

This proposal comes from Jared Gray, the “Head Chef” at Sushi. He plans to promote all the trade’s SUSHI tokens and use the proceeds to amass new belongings. Gery claims that this operation would cut back the platform’s volatility dangers, improve liquidity, and generate increased returns.

“Because the Sushi DAO continues to evolve, it’s essential to make sure the sustainability and progress of our treasury. The DAO in the end holds its treasury in SUSHI tokens, which exposes it to excessive volatility and liquidity challenges. This proposal outlines a technique for diversifying the treasury belongings to mitigate dangers and improve long-term stability,” Gray acknowledged.

Though this token was initially created for governance, the DAO operates beneath totally different guidelines at the moment. A governance vote will determine the proposal’s success or failure.

If applied, all these tokens will steadily bought, and the proceeds will purchase a brand new treasury: 70% stablecoins, 20% “blue chip” cryptoassets (BTC, ETH), and probably 10% different DeFi tokens.

The proposal additionally specifies that any remaining emergency fund will encompass stablecoins. These belongings may even cowl future strategic investments and operational bills of Sushi Swap.

In different phrases, it’s fairly clear that there isn’t any remaining proviso to retain any SUSHI token holdings. This entire liquidation would create a outstanding coverage shift.

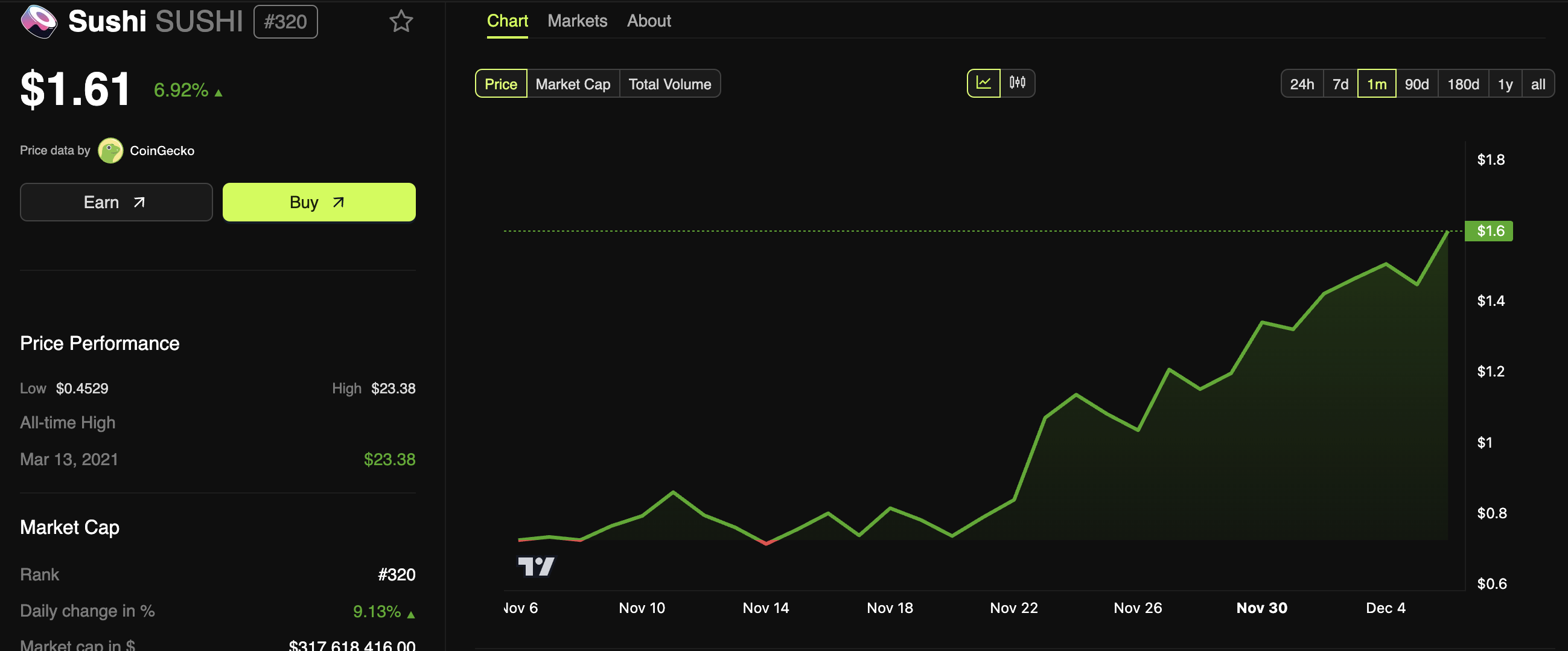

Gray additionally defended a controversial restructure at Sushi DAO in April this yr. Round this time, the value of the SUSHI token plummeted practically 20%, however it has been steadily recovering lately. The token is up practically 130% within the final month, and this proposal hasn’t arrested the development.

In the meanwhile, the coverage’s possibilities of success are unclear. This proposal is an try and obtain neighborhood suggestions to refine a fully-binding governance vote.

For instance, some variables, just like the SUSHI liquidation charge or the DeFi tokens’ inclusion, are at the moment unspecified. For now, these and different sensible questions are up for debate within the DAO.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.