Cardano (ADA) worth breakout

ADA has surged from $0.33 to $1.22 in simply 30 days, marking a 181.5% enhance. Whereas it confronted a minor correction in early December, the general month-to-month development stays strongly upward.

The final time ADA reached this worth was April 2022, although it nonetheless lags behind its all-time excessive of $2.85 in August 2021.

As of immediately, ADA has outperformed friends like Solana and Ethereum, closing increased on 17 of the previous 20 buying and selling days. November 2024 noticed a 230% acquire for ADA, its finest month since August 2021. Futures open curiosity hit a 40-month excessive of $1.18 billion on Dec. 3, signaling sturdy market curiosity.

In line with Santiment, ADA’s current 25% spike is more likely to appeal to extra retail buyers.

ADA reached a big milestone on Nov. 23, surpassing $1 and pushing its market capitalization above $40 billion for the primary time in three years. This surge displays rising confidence amongst buyers and elevated buying and selling exercise on main exchanges.

Regardless of ADA’s current rally and notable restoration, its present worth stays considerably beneath its all-time excessive of over $2.80.

The broader crypto market downturn that adopted severely impacted costs, leaving ADA and different main tokens nonetheless working towards reclaiming their earlier peaks.

Cardano spot ETFs

After the approval of Bitcoin and Ethereum ETFs, a number of specialists have speculated that ADA, XRP and Solana could possibly be the following cryptocurrencies to obtain approval for their very own ETFs.

Whereas a number of asset managers have already filed with the SEC for ETFs tied solely to Solana and XRP, Cardano has but to see an identical submitting.

This has led to discussions about whether or not Cardano might comply with swimsuit and ultimately be included in an ETF, doubtlessly boosting its publicity and legitimacy within the broader market.

Cardano blockchain

The Cardano blockchain has demonstrated a strong efficiency in current months. A standout achievement consists of surpassing 100 million whole transactions, as reported by U.At present. These developments underscore Cardano’s rising adoption and investor optimism.

Cardano, an open-source blockchain platform, was designed to beat the scalability, interoperability and sustainability challenges of earlier applied sciences like Bitcoin and Ethereum.

It employs a proof-of-stake consensus mechanism and encompasses a layered structure, separating settlement and computation layers.

Just lately, Cardano’s Hydra protocol, a Layer 2 scaling resolution, achieved 1 million transactions per second (TPS). This milestone displays the platform’s rising capabilities.

As customers more and more deploy belongings and conduct DeFi transactions on Cardano, the demand for ADA rises attributable to its function in transaction charges and gasoline funds.

Charles Hoskinson to guide U.S. crypto coverage?

Charles Hoskinson, founding father of Cardano, has introduced the institution of a coverage workplace inside Enter Output to interact in cryptocurrency coverage improvement within the U.S.

In a video shared on X, Hoskinson emphasised his dedication to working intently with lawmakers, administration officers and trade leaders in Washington, D.C., to form favorable crypto laws.

“I’m going to be spending fairly a little bit of time working with lawmakers in Washington DC and fairly a little bit of time with members of the administration to assist foster and facilitate crypto coverage alongside different key leaders within the trade,” Hoskinson mentioned.

In a parallel improvement, the Cardano ecosystem marked a big milestone with the adoption of the primary draft of the Cardano Structure through the Constitutional Conference held in Buenos Aires, Argentina, on Dec. 5-6, 2024.

The occasion introduced collectively Cardano fans, builders, researchers, buyers and group members from all over the world.

The structure establishes a framework of “provisions and guardrails” designed to information Cardano’s long-term evolution and governance, reflecting its decentralized ethos.

Cardano versus Bitcoin

Charles Hoskinson has lately predicted in a YouTube look that Bitcoin might soar to $250,000-$500,000 inside the subsequent 12 to 24 months, pushed by substantial funding inflows and rising institutional curiosity.

Hoskinson highlighted the potential ripple results on the broader crypto market. Bitcoin’s rise to report highs might set off a domino impact, lifting Cardano (ADA) and different cryptocurrencies alongside it.

This optimistic outlook is supported by the sturdy correlation between Bitcoin and different digital belongings, together with ADA, which at the moment stands at 0.87, in response to knowledge from IntoTheBlock.

Moreover, the rising curiosity in decentralized finance (DeFi) inside the Bitcoin ecosystem might create synergies for Cardano. As Cardano continues to evolve, its give attention to scalability, sustainability and a developer-friendly atmosphere positions it to draw progressive initiatives and builders keen to construct cutting-edge options.

This alignment of Bitcoin-driven market momentum and Cardano’s ongoing platform developments might amplify the expansion and adoption of each ecosystems.

Can Cardano crash once more?

Cardano’s Complete Worth Locked (TVL) throughout DeFi functions surged dramatically in December 2024, climbing from $230 million to over $705 million in only a month.

Investor confidence in Cardano stays excessive, with CoinGlass reporting vital ADA outflows from exchanges, totaling $98.37 million, as holders transfer their belongings to non-public wallets.

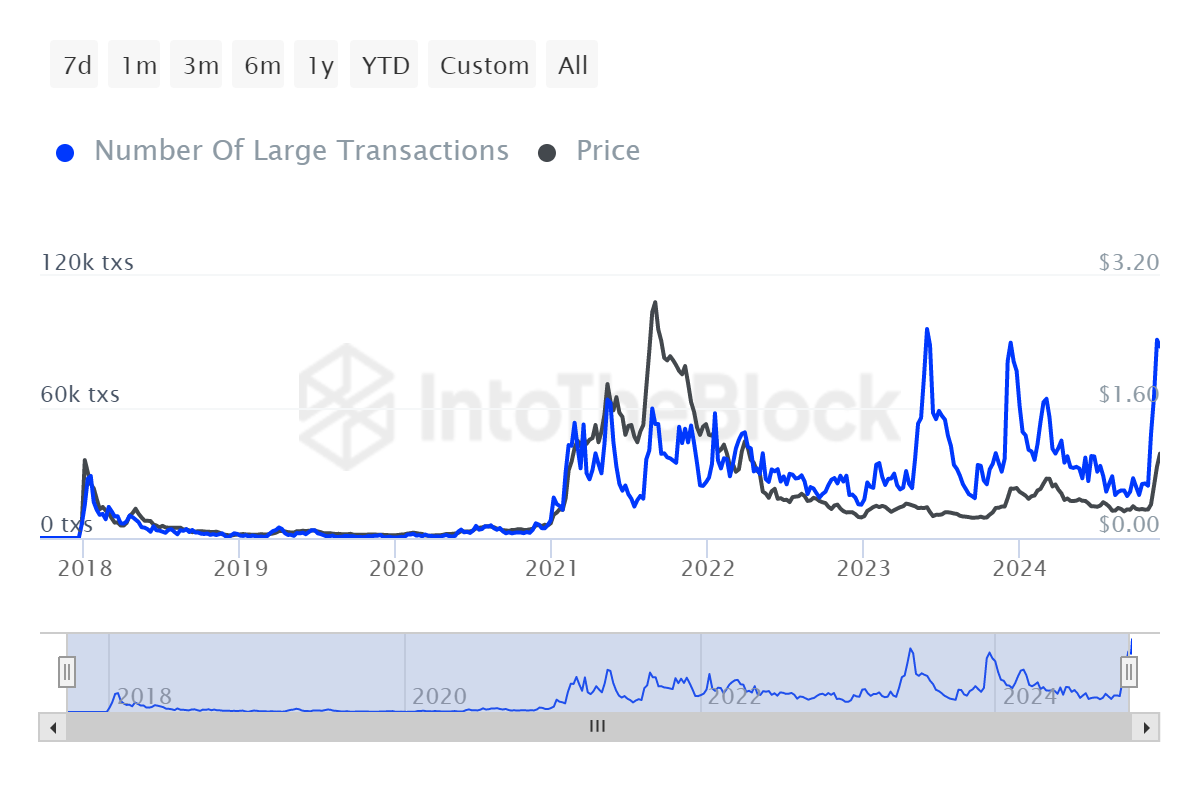

The variety of massive transaction has additionally skilled a serious spike in December.

Moreover, IntoTheBlock knowledge highlights a pointy enhance in whale addresses holding 10 million to 100 million ADA throughout November, suggesting substantial accumulation by massive gamers.

This momentum has pushed ADA’s worth above the $1.30 psychological stage, with massive holders anticipating additional good points.

General, on-chain knowledge doesn’t at the moment sign a chance of ADA declining beneath $1, reinforcing optimism within the asset’s upward trajectory.

Worth forecast: How excessive can Cardano go?

An X consumer, in response to the veteran dealer, recalled his prediction in 2021, by which Brandt predicted that ADA would dip to $0.10. However as a substitute, it went forward to set all-time highs of practically $3.

Cardano’s (ADA) technical and market indicators recommend a cautiously optimistic outlook.

Contracts dominate at 88.57% of ADA holdings, representing $37 billion, indicating sturdy profitability amongst holders.

-

ADA: OutTheMoney

Contracts are at 3.62% ($1.53 billion ADA), whereas AtTheMoney Contracts comprise 7.81% ($3.29 billion ADA), reflecting a market poised for potential upward motion.

Bollinger Bands present widening, signaling heightened shopping for momentum. MACD reveals a bullish crossover, with the MACD line crossing above the sign line, indicating upward momentum.

RSI at round 50 factors to impartial momentum, with room for ADA to rise additional earlier than getting into overbought territory.

Dan Gambardello, the founding father of Crypto Capital Enterprise, has speculated that Cardano might surge to $3 if it had been to obtain favorable information, comparable to an exchange-traded fund (ETF) approval just like the one XRP lately achieved.

Gambardello based mostly his evaluation on constant patterns from earlier market cycles and up to date developments in Cardano’s expertise.

This might doubtlessly drive a big worth rally, as institutional curiosity typically follows such developments, boosting the token’s legitimacy and market confidence.

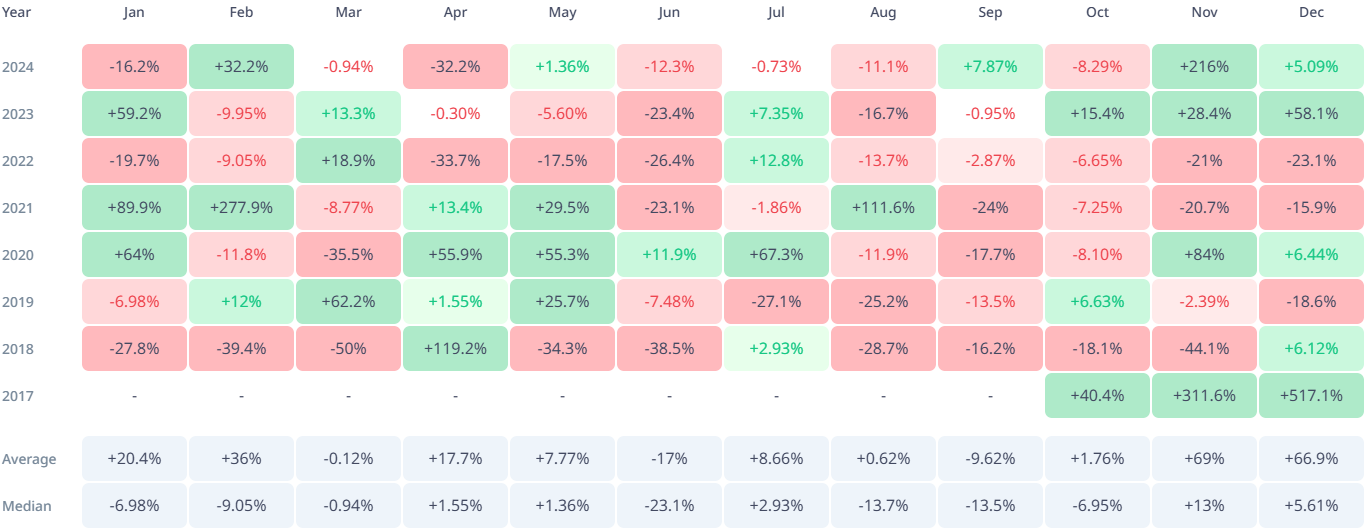

Based mostly on Cryptorank knowledge, ADA might attain a median progress fee of 66.8% for December, offering a usually bullish month for the coin.

Utilizing the Fibonacci indicator, some analysts recommend that the following main goal could possibly be above $2.4, which corresponds to the 1.618 Fibonacci stage. If this stage is breached, the two.618 Fibonacci stage at $8.30 is perhaps the following key goal.

Outstanding analyst Ali Martinez thinks that the Cardano worth is following a sample just like its 2020 efficiency.

If historical past repeats, the ADA worth would possibly doubtlessly hit $6, in response to Martinez.

Most analysts don’t see the ADA worth gaining double-digit progress throughout this cycle. The $10 mark stays a long-term goal. Nevertheless, surpassing the ATH in 2025, buying and selling above $3 appears lifelike at this level.