Este artículo también está disponible en español.

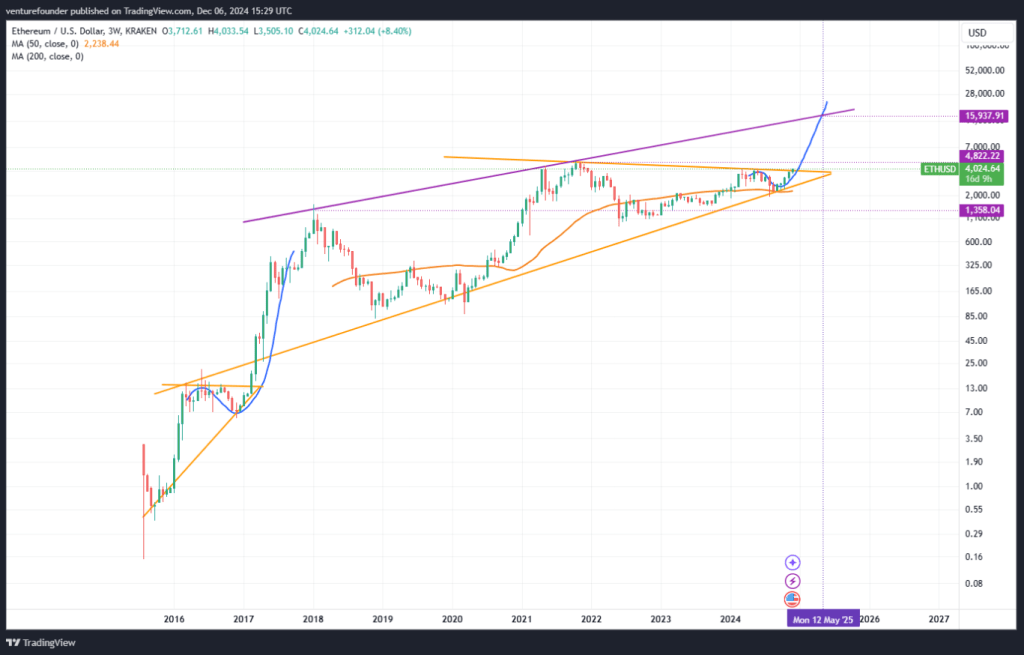

Ethereum (ETH) continues to spark bullish discuss within the cryptoverse, as well-known analysts see massive worth strikes forward. Based on Enterprise Founder, Ethereum is forming a rising three-year triangle sample, which might set the stage for a attainable breakout. Based mostly on comparable comparisons to information from 2016-2017, the altcoin will hit $15,937, most likely by Might of 2025.

Associated Studying

Such an increase would take Ethereum’s market capitalization past $1 trillion, a historic first for the blockchain behemoth. Analysts view a weekly shut above $3,800 as a big milestone. From there, Ethereum would possibly intention for its all-time excessive of $4,878 earlier than transferring on to increased grounds. However is the market ready for this upswing?

This $ETH breakout out of the triangle consolidation could be very vital.

Now #Ethereum solely has to shut this weekly candle bullish, and we could by no means revisit this sub $4,000 degree once more on this bull cycle.

The impulse transfer from 2016-2017 is repeating.

PT: $15,937 by Might 2025 pic.twitter.com/dNzcO3mPe1

— venturefounder (@venturefounder) December 6, 2024

Institutional Curiosity Drives Optimism

Extra establishments have gotten fascinated with Ethereum, which makes folks extra optimistic about its long-term prospects. Spot Bitcoin ETFs obtained a variety of consideration at first of the 12 months, and now Ethereum-based funds are following swimsuit.

Notably, for the reason that center of November, spot Ether ETFs have gotten greater than $1.3 billion in contemporary inflows. The iShares Ethereum Belief from BlackRock has made essentially the most returns, $500 million in only one week.

Past simply numbers, these investments present a rising belief within the Ethereum ecosystem. Based on analysts, this institutional funding stream will pave the best way for ETH’s anticipated meteoric rise. With institutional buyers persevering with to pour cash into the cryptocurrency, Ethereum’s worth proposition as a long-term funding seems stronger than ever.

Technical Indicators And Forecast

The current weeks’ worth habits of Ethereum has additionally been somewhat favorable. Following a little bit setback, the altcoin has recovered, climbing 30% beginning in November 18. With analysts underlining its resilience towards market swings, it’s buying and selling at $3,686 proper now, which is a stable determine.

Technical markers of consolidation level to ETH preparing for its subsequent motion. Shifting averages present stability, therefore the Relative Power Index (RSI) stays impartial. Forecasts present ETH maybe rising by 43% in six months and 22% in three months, information from CoinCheckup reveals.

Associated Studying

Trying Forward

The alerts level favorably despite the fact that Ethereum’s route to achieve $15,937 is undetermined. With favorable technical circumstances, institutional inflows, and robust ecosystem growth, the altcoin is primed for main will increase.

Featured picture from INX, chart from TradingView