In accordance with historic information, Cardano (ADA) could also be approaching overvalued territory. This comes after a formidable 180% worth improve over the past 30 days.

For some traders, the timing may appear untimely, particularly with the much-anticipated altcoin season simply starting. Nevertheless, on-chain indicators counsel that ADA may face a correction earlier than establishing new highs.

Cardano Metrics Flash Bearish Indicators

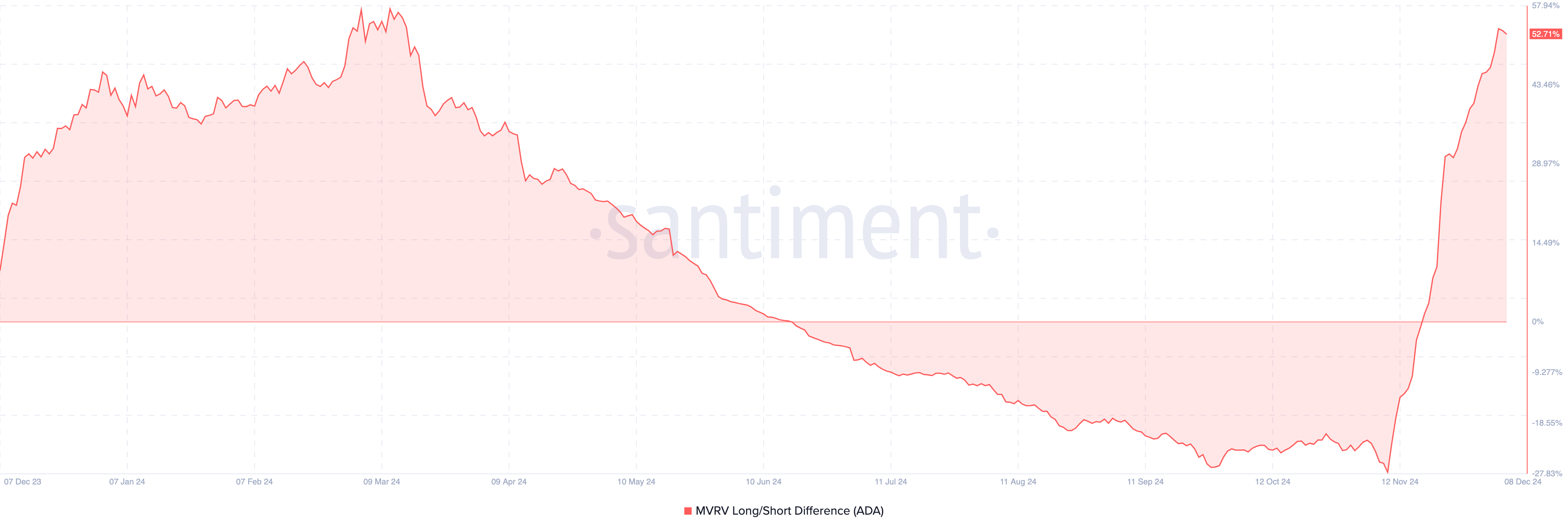

One key metric suggesting that Cardano may quickly be overvalued is the Market Worth to Realized Worth (MVRV) Lengthy/Quick Distinction. The MVRV Lengthy/Quick Distinction checks if long-term holders have extra unrealized income on the present worth or if short-term holders do.

When the metric will increase, it means long-term holders have made extra features. Alternatively, if it decreases or falls to the destructive area, it means short-term holders have the higher hand.

This distinction can even assist spot when a cryptocurrency is undervalued or overvalued. historic information, Cardano’s worth hit an overvalued level when the MVRV Lengthy/Quick distinction hit 57.94% in March.

As seen above, the metric’s studying has hit 52.71%, suggesting that ADA could possibly be near being overvalued once more. If validated, then the altcoin’s worth may bear a notable correction.

Other than this, IntoTheBlock information exhibits a spike within the Community Worth to Transaction (NVT) ratio. The NVT ratio is a metric used to evaluate a cryptocurrency’s valuation relative to the worth being transmitted on the community.

When the ratio drops, it signifies that transaction quantity has outpaced market cap progress, indicating that the token is undervalued. Alternatively, an increase within the NVT ratio, as it’s presently, signifies that Cardano’s market cap has grown quicker than the worth transacted. If this stays the case, the ADA is likely to be tagged overpriced, and the worth may lower.

ADA Worth Prediction: Decrease Than $1

From a technical perspective, the each day chart exhibits that the Bollinger Bands (BB) has expanded. This notable enlargement signifies excessive volatility round ADA, suggesting that worth swings within the coming days could possibly be large.

However moreover that, the higher band of the BB tapped ADA’s worth at $1.30. When the higher band of the indicator hits the worth, it means it’s overbought. Alternatively, when the decrease band does that, it signifies an oversold standing.

Subsequently, it seems that the Cardano token is overbought. Contemplating this situation, then Cardano’s worth may lower to $0.92. On the flip aspect, if shopping for strain will increase, this may not occur as ADA may rise above $1.40.

Disclaimer

Consistent with the Belief Venture pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.