A dozen Wall Road corporations together with JPMorgan Chase, Wells Fargo and Financial institution of America are revealing their 2025 targets for the S&P 500.

The monetary corporations collectively count on the US inventory market to succeed in contemporary all-time highs subsequent 12 months amid expectations {that a} Trump presidency will create a positive macroeconomic setting for equities, stories Yahoo! Finance.

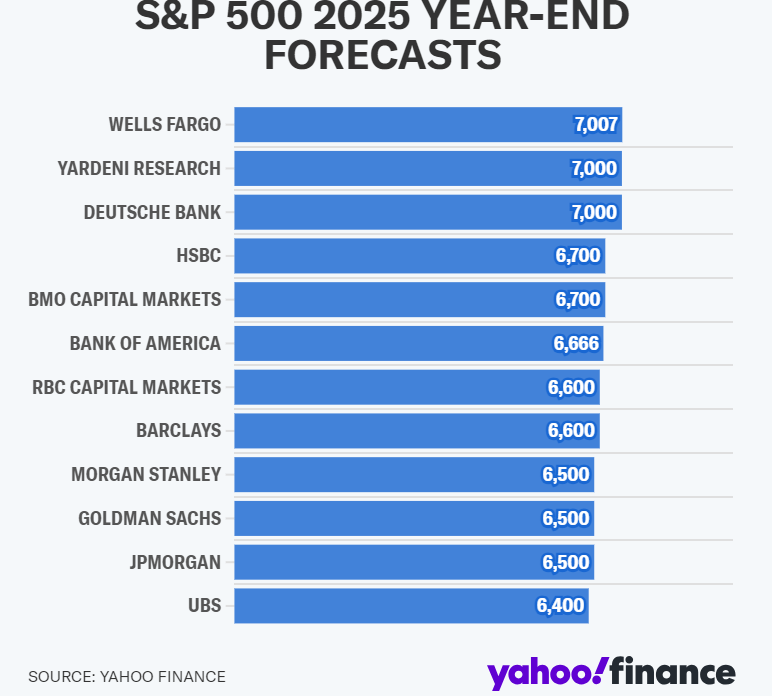

Wells Fargo is probably the most bullish among the many group, believing that the S&P 500 might skyrocket to as excessive as 7,007 by the tip of subsequent 12 months.

Says Wells Fargo fairness strategist Christopher Harvey in an investor word,

“On steadiness, we count on the Trump Administration to usher in a macro setting that’s more and more favorable for shares at a time when the Fed will likely be slowly lowering charges.

In brief, a backdrop the place equities proceed to rally.”

Harvey additionally notes that the inventory market will likely be boosted by rising company earnings in addition to the US economic system rising quicker than anticipated and a supportive regulatory setting.

“2025 is more likely to be a solid-to-strong 12 months.”

In the meantime, market analysis agency Yardeni Analysis and Deutsche Financial institution see the SPX climbing to a excessive of seven,000 subsequent 12 months. HSBC and funding banking agency BMO Capital Markets count on the inventory market to extend to six,700 in 2025.

Different Wall Road corporations have a extra conservative goal for the S&P 500 subsequent 12 months. BofA believes the index can rise to six,666. RBC Capital Markets and Barclays have a goal of 6,600.

JPMorgan Chase, Morgan Stanley and Goldman Sachs predict the SPX ascending to six,500 inside the subsequent 12 months. UBS has the bottom goal among the many group, forecasting 6,400 for the S&P 500 subsequent 12 months.

As of Friday’s shut, the S&P 500 is buying and selling at 6,090.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Value Motion

Observe us on X, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl will not be funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any losses you could incur are your accountability. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney