America Treasury Division has acknowledged Bitcoin as a “digital gold,” emphasizing its main function as a retailer of worth.

Alongside this recognition, the Treasury highlighted the rising significance of stablecoins, that are driving demand for Treasury payments within the evolving monetary panorama.

Treasury Acknowledges Bitcoin and Stablecoins

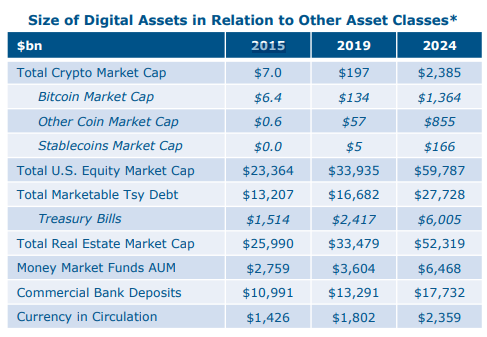

The Treasury’s report underscores the swift enlargement of digital belongings, together with Bitcoin, Ethereum, and stablecoins, however notes that the market stays small in comparison with conventional monetary devices like US authorities bonds.

“Major use case for Bitcoin appears to be a retailer of worth aka ‘digital gold’ in a decentralized finance (DeFi) world,” the Treasury said.

The monetary regulator famous that Bitcoin has established itself as a retailer of worth akin to gold. Based on the report, Bitcoin’s market worth surged from $6.4 billion in 2015 to $134 billion in 2019 and additional skyrocketed to roughly $1.3 trillion in 2024. This development displays heightened curiosity in decentralized finance (DeFi) and digital tokens.

Certainly, the report arrives amid rising comparisons of Bitcoin to gold, together with current remarks by Federal Reserve Chairman Jerome Powell. This has bolstered optimism inside the crypto market, which sees Bitcoin as a key element of the monetary future.

Nonetheless, the US Treasury famous that the majority people interact with cryptocurrencies as speculative investments, aiming for future worth appreciation. As such, digital currencies haven’t but supplanted conventional belongings like Treasury bonds, which stay in excessive demand.

“Structural demand for Treasuries could enhance because the digital asset market cap grows, each as a hedge in opposition to draw back worth volatility and as an ‘on-chain’ safe-haven asset,” Treasury said.

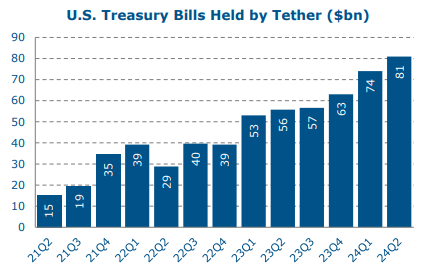

For context, the Treasury report spotlighted the fast enlargement of stablecoins and their rising function within the crypto ecosystem. Over 80% of all cryptocurrency transactions contain stablecoins, which act as key intermediaries in digital markets.

Fiat-backed stablecoin suppliers, resembling Tether, primarily depend on US Treasury payments and different treasury-backed belongings as collateral. These holdings account for roughly $120 billion in US Treasuries. Because the stablecoin market grows, the demand for Treasury securities is predicted to rise. This is able to be pushed by their use as a hedge in opposition to worth volatility and as a safe-haven asset inside blockchain networks.

General, the Treasury’s recognition of Bitcoin and stablecoins indicators an rising intersection between conventional finance and blockchain-based improvements. Whereas the division maintains a cautious stance, its acknowledgment of digital belongings suggests a willingness to discover their potential.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.