Hyperliquid (HYPE) value surged by 60% after its billion-dollar airdrop, which distributed 310 million HYPE tokens to customers. This surge was adopted by a short interval of overbought situations, as indicated by its RSI rising above 70.

Nevertheless, the momentum shortly waned, and the RSI has since declined to 44.8, signaling a impartial or barely bearish sentiment. Regardless of fluctuating web flows, which reached an all-time excessive of $181 million on November 29, HYPE’s value stays below strain, with current drops in each web flows and value ranges.

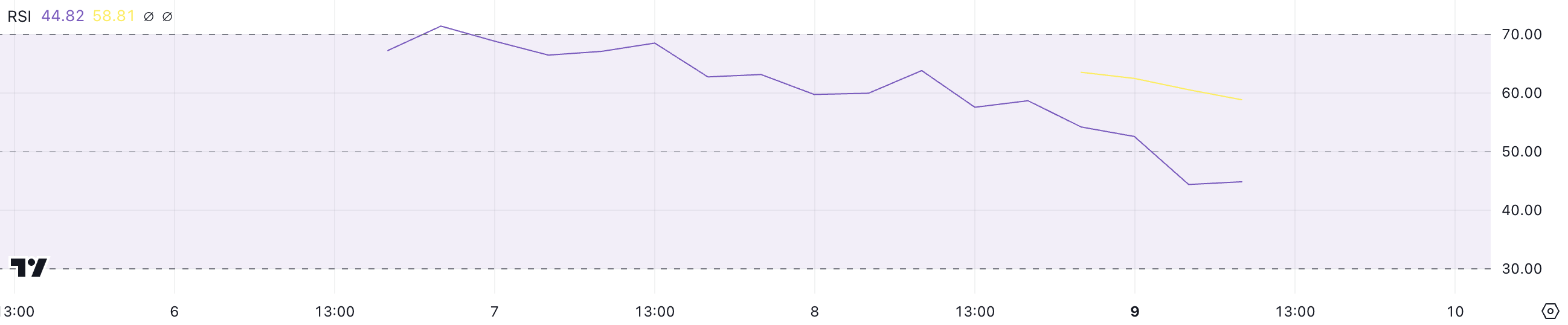

HYPE RSI Is At present Impartial

After its airdrop, HYPE RSI briefly surged above 70, indicating that the asset was overbought.

Nevertheless, this momentum didn’t final, and the RSI began to say no. It’s at the moment sitting at 44.8, suggesting a impartial or barely bearish sentiment.

RSI, or Relative Power Index, is a momentum oscillator that measures the velocity and alter of value actions. It ranges from 0 to 100.

An RSI above 70 is taken into account overbought, whereas an RSI under 30 signifies oversold situations. An RSI of 44.8 means that HYPE is neither overbought nor oversold. Within the brief time period, this might suggest that HYPE’s value might stay secure or see slight downward strain if momentum continues to weaken.

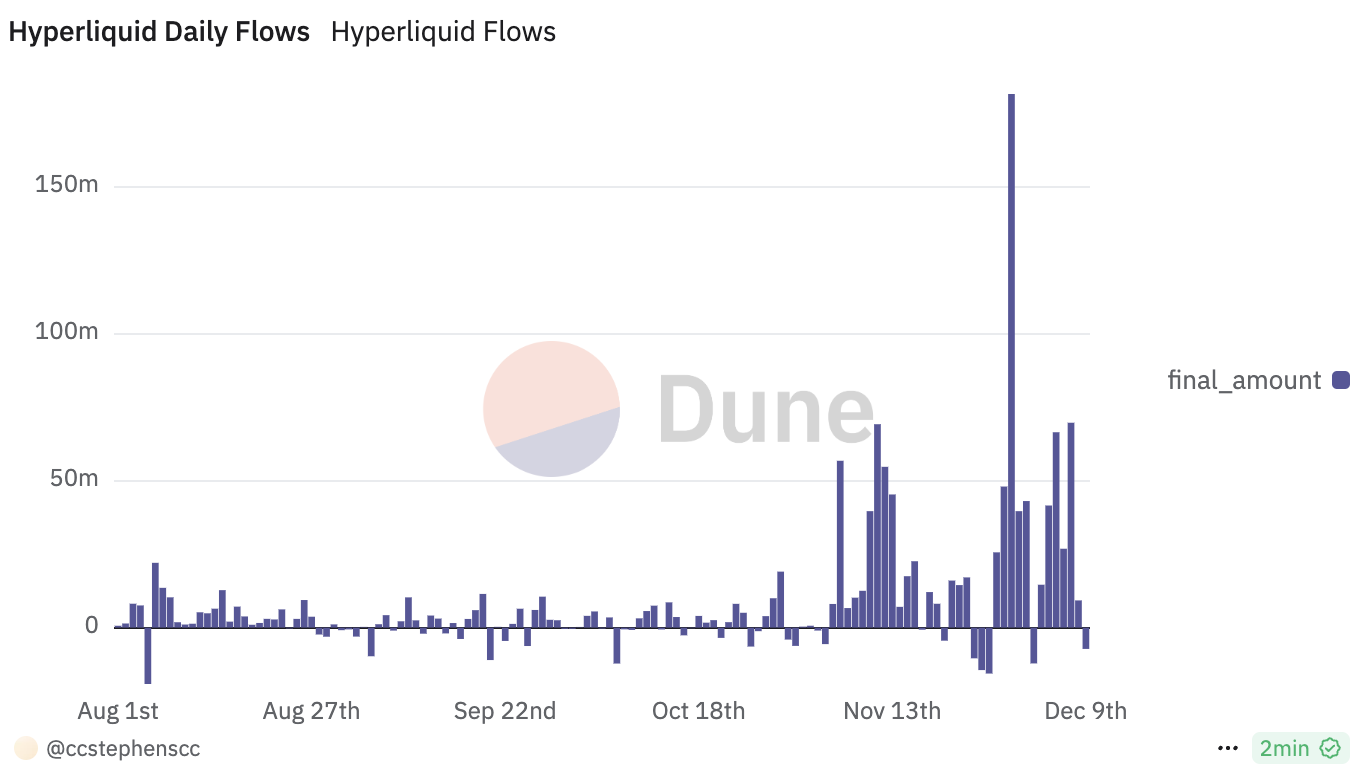

Hyperliquid Flows Reached An All-Time Excessive On November 29

Hyperliquid web flows chart reveals a major enhance, reaching an all-time excessive of over $181 million on November 29. Afterward, it dropped to $66 million on December 5, then rose barely to $69 million on December 7.

Nevertheless, on December 8, the online flows dropped dramatically to $9 million, and at the moment, it stands at roughly -7 million {dollars}.

Internet flows discuss with the distinction between the overall inflows and outflows of an asset or funding inside a given interval. Constructive web flows point out extra funds are coming into than leaving, whereas unfavorable web flows present the alternative.

Regardless of nonetheless having extra inflows than outflows general, the sharp decline in web flows to unfavorable ranges may sign a lack of investor confidence or a shift in market sentiment. This drop may point out potential value instability or downward strain within the brief time period, as outflows surpass inflows, signaling a possible reversal in market sentiment.

HYPE Value Prediction: Can HYPE Go Beneath $10 In December?

After its airdrop, HYPE value skilled a major surge, reaching a excessive of $14.99 on December 7. This enhance was adopted by a interval of consolidation, the place the value stabilized, earlier than it started to say no regularly.

The market appears to be in a state of uncertainty, with a slight downward momentum taking maintain.

If HYPE manages to recuperate its earlier bullish momentum, it may doubtlessly rise once more and problem resistance ranges close to $15. This might set the stage for an additional upward transfer, with the following goal being $16, as perpetual DEX platforms proceed to draw consideration.

However, if the present downtrend continues to realize power, HYPE value may check its first main assist degree at $11.29. If this assist proves weak, the value might proceed to drop, doubtlessly reaching $10.44, signaling a deeper bearish pattern.

Disclaimer

According to the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.