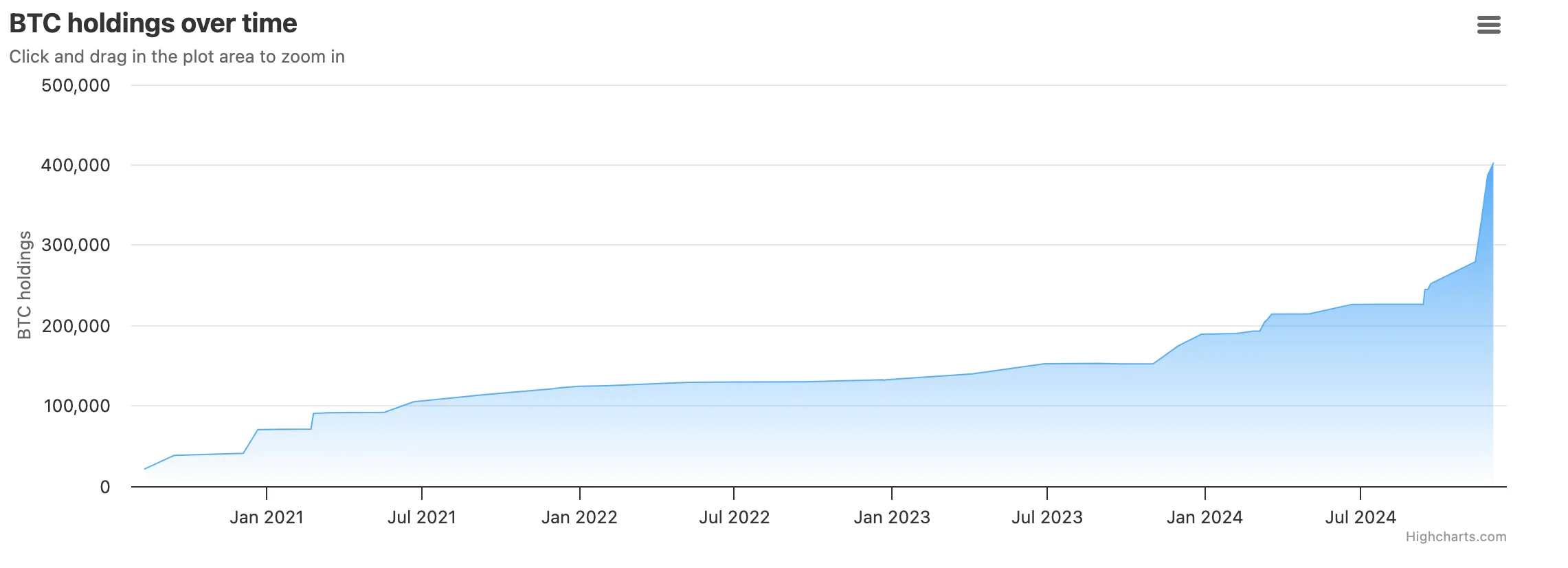

MicroStrategy purchased 21,550 extra Bitcoin in the present day, spending $2.1 billion. That is the corporate’s second buy in December, spending $98,783 per BTC.

Since November, Michael Saylor’s agency has remodeled $15 billion value of BTC purchases.

MicroStrategy Buys Extra Bitcoin

Earlier in the present day, MicroStrategy launched a press assertion confirming the acquisition. Saylor’s continued technique is hardly stunning, as two days in the past, he advocated a “Bitcoin accumulation plan,” defending the asset as a long-term funding.

“Satoshi gave us a sport we are able to all win. Bitcoin is that sport,” Saylor mentioned in an interview in the present day.

The agency additionally bought an identical quantity early in December, spending $1.5 billion on BTC. Saylor has been a dedicated Bitcoin advocate for years, however his purchases have elevated considerably.

On account of this speedy new consumption, MicroStrategy is definitively one of many world’s largest Bitcoin holders. These holdings have considerably impacted the agency’s inventory value this yr. Bitcoin’s bullish cycle because the ETF approval in January has additionally been mirrored in MSTR’s value, because the inventory surged by almost 450% year-to-date.

General, 2024 has been Bitcoin’s most profitable yr, with a value lastly reaching $100,000. This bull market has inspired ravenous BTC purchases from different main institutional traders.

For instance, BlackRock, the main ETF issuer, elevated its Bitcoin purchases after the $100,000 milestone. Collectively, the issuers at the moment personal extra Bitcoin than Satoshi Nakamoto, which is an astounding feat. MicroStrategy has an extended historical past of Bitcoin purchases and advocacy, however BlackRock’s complete AUM is over 100 occasions bigger because of the web influx in IBIT.

Whereas Michael Saylor considers this Bitcoin-first strategy infallible, stories counsel that its underlying capital flows are nonetheless tiny in comparison with spot ETF issuers. Nevertheless, these scrutinies haven’t stopped different public corporations from following in MicroStrategy’s shadow.

As BeInCrypto reported earlier, smaller public corporations equivalent to MARA and Metaplanet have additionally elevated their holdings all through this bull market. These accumulations counsel that public corporations see Bitcoin’s goal value to be a lot greater, as they think about these peak costs as shopping for alternatives.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.