Monero (XMR) has emerged because the top-performing altcoin among the many prime 100 cryptocurrencies within the final 24 hours. This improvement comes amid the market’s sideways motion, as most altcoins, which had double-digit positive factors final week, have needed to cope with consolidation or decline.

As of this writing, the forty fifth most respected cryptocurrency trades at $201.75 and has elevated by solely 2%. Will the value proceed to climb?

Monero Will increase Barely, however Merchants Keep Bullish

All by way of final week, BeInCrypto’s each day evaluation of the most important altcoin gainers noticed double-digit surges. However right this moment, because of the low shopping for strain, this has modified, making XMR the top-performing altcoin.

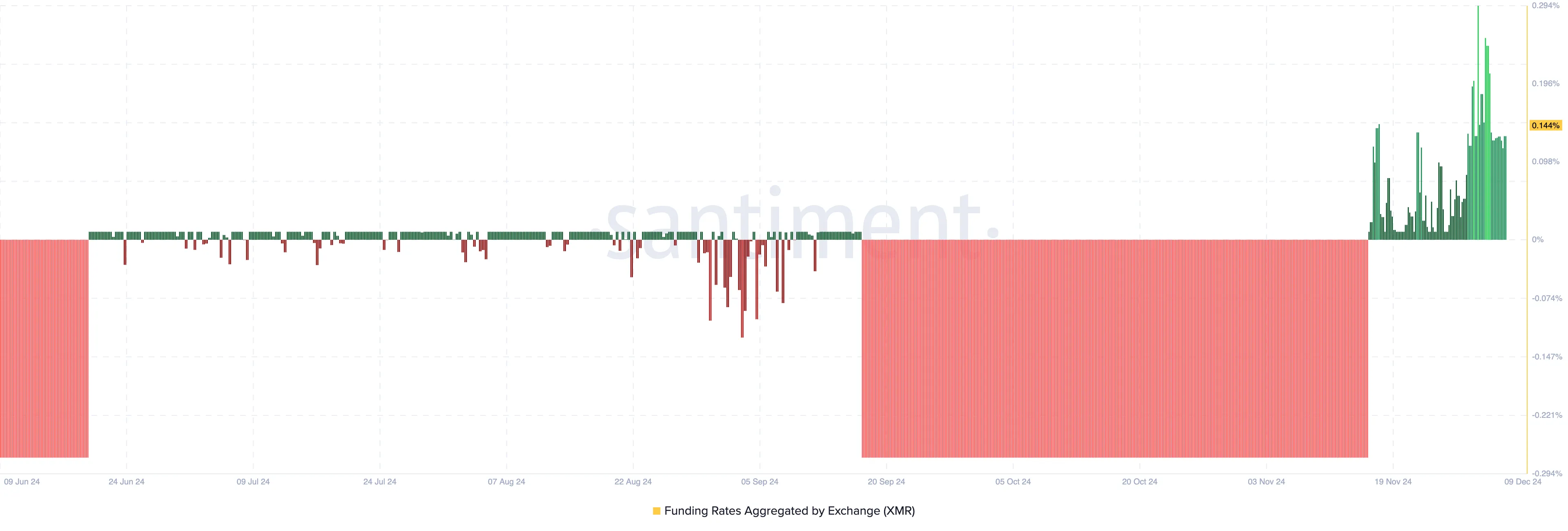

Regardless of the slight enhance, it seems that merchants anticipate XMR’s value to commerce greater, in line with the funding charge. The funding charge is the price of holding an open place within the derivatives market.

When the studying is optimistic, it means longs are paying shorts a charge to maintain their place open. On this occasion, the broader sentiment is bullish. However, unfavourable funding signifies that shorts are paying longs, and the sentiment is bearish.

Primarily based on Santiment’s information, Monero’s funding charge is 0.14%, indicating that the majority positions tilt towards the bullish facet. If this stays the identical, then the XMR value is more likely to rise because of the rising demand within the derivatives market.

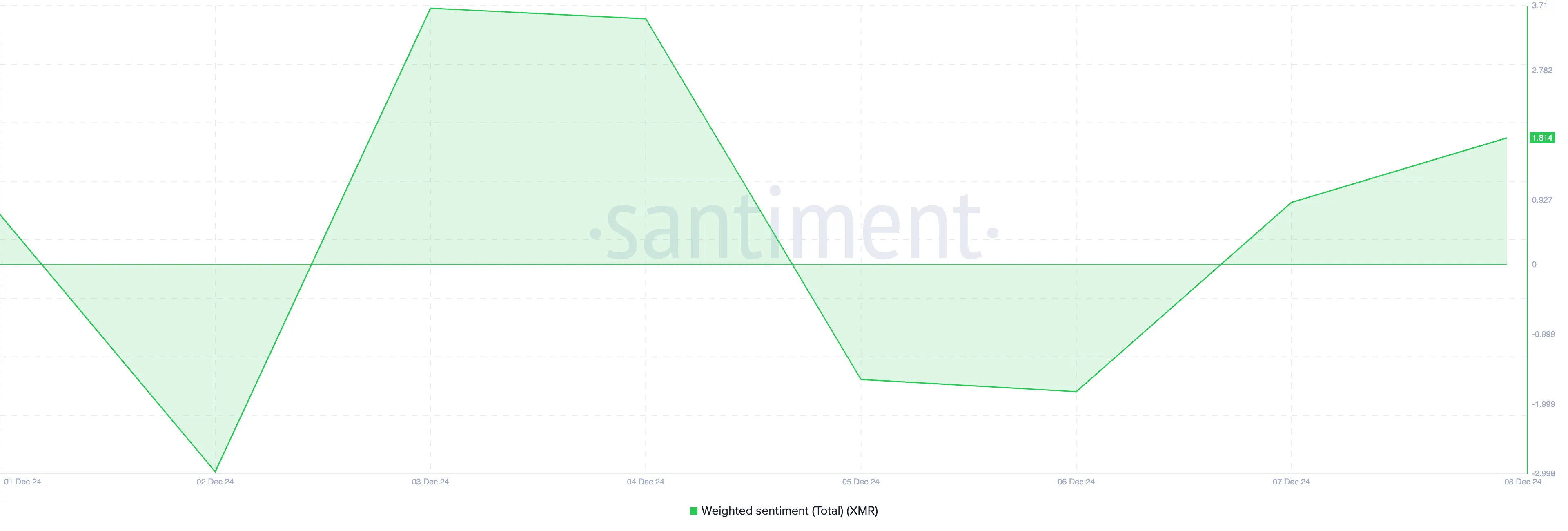

Moreover, the Weighted Sentiment, which measures the market’s notion of a cryptocurrency, has jumped to the optimistic zone. When the sentiment is optimistic, it means most remarks in regards to the asset are bullish.

However, a unfavourable studying signifies that the common sentiment surrounding the asset is bearish. Given the optimistic sentiment studying for XMR, this means that rising optimism might drive elevated demand for the altcoin.

XMR Value Prediction: Again to the High?

The each day chart additionally seems to agree with an XMR value enhance, notably due to the Bull Bear Energy (BBP). The BBP measures the energy of bulls in comparison with that of bears.

When the BBP rises, it implies that bulls are in management, and the value can enhance. Conversely, a drop within the indicator signifies that bears have the higher hand, and the value may fall. A more in-depth evaluation of the XMR value chart reveals that it just lately dropped from a peak of $222.44.

Nonetheless, with bulls in management, the altcoin’s worth may reverse this pattern. If validated, then the token’s value can climb to $227.48 or past that. Nonetheless, if XMR fails to carry the $201.30 assist, the worth may decline to $186.64 and exit the top-performing altcoin spot

Disclaimer

In keeping with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.