Spot Bitcoin exchange-traded funds (ETFs) have seen almost $10 billion inflows since Republican presidential candidate Donald Trump received the US elections, as traders flocked into the cryptocurrency sector because the outcomes have been revealed.

The 12 spot Bitcoin ETFs from numerous main asset managers, together with BlackRock and Constancy Investments, attracted $9.9 billion in web inflows following Election Day on November 5, in accordance with Bloomberg, lifting their belongings to round $113 billion.

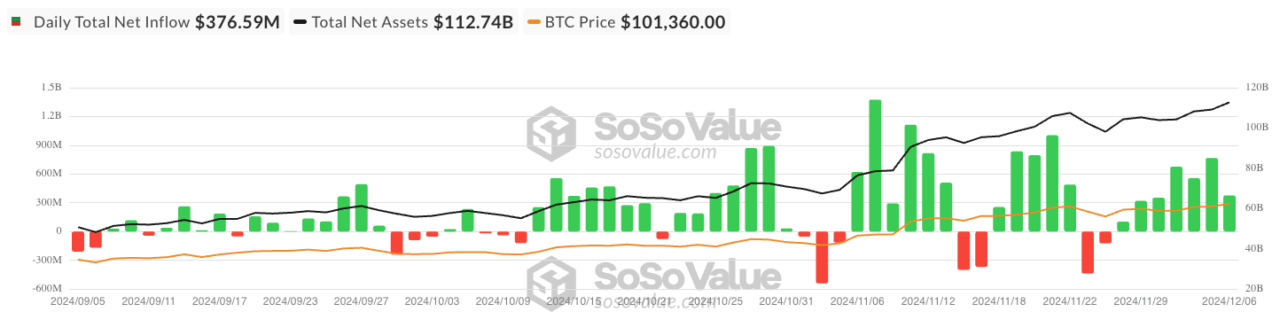

In response to knowledge from SoSoValue, spot Bitcoin ETFs presently have $112.7 billion in whole web belongings, equal to round 5.62% of the flagship cryptocurrency’s whole market capitalization. These inflows got here amid a wider cryptocurrency market rally, which noticed the worth of Bitcoin briefly high the $100,000 mark earlier than correcting to now commerce at $98,000.

Over the past 30 days, the worth of the flagship cryptocurrency is however up by greater than 28.5%. The entire market capitalization of the cryptocurrency house, over the identical interval, rose by round $1 trillion.

Trump notably picked David Sacks, a former PayPal chief working officer, because the White Home’s new AI and Cryptocurrency czar. Sacks, in accordance with Trump, is about to “information coverage for the Administration in Synthetic Intelligence and Cryptocurrency, two areas vital to the way forward for American competitiveness.”

Bitcoin’s worth rise noticed numerous traders step up their accumulation efforts with Nasdaq-listed enterprise intelligence agency MicroStrategy, the most important company holder of Bitcoin, earlier this month including an extra 15,400 cash for $1.5 billion, at a median worth of $95.976 per coin.

The transfer noticed MicroStrategy’s Bitcoin holdings high the 400,000 mark for the primary time, with the corporate reaching a BTC Yield of 38.7% up to now this yr, and 63.3% year-to-date. It now holds 402,100 BTC that have been acquired for $23.4 billion.

The transfer comes at a time wherein Bitcoin whales have been benefiting from the flagship cryptocurrency’s latest worth dip to carry on accumulating BTC after short-term holders moved almost $4 billion within the cryptocurrency to exchanges.

In response to CryptoQuant analyst Cauê Oliveira, Bitcoin whales took benefit of the “panic promoting” to build up, with 16,000 BTC value almost $1.5 billion entered whale reserves in a single day after short-term holders’ gross sales.

In a submit, the analyst famous that the determine was “mirrored in institutional addresses on the community” however urged extra BTC was accrued, because the funds that weren’t withdrawn from cryptocurrency exchanges and stay in customers’ accounts aren’t counted.

Per his phrases, the whale accumulation hasn’t been ample to reveal a “extra widespread buy-the-dip” sample,” which he stated stays concentrated amongst institutional traders.

Featured picture through Unsplash.