Crypto market contributors have three US financial information to observe this week that would affect Bitcoin (BTC) sentiment and trigger volatility. The curiosity comes amid the numerous affect of US macroeconomic information on Bitcoin and crypto markets on the whole this yr, after a dried-up interval in 2023.

In the meantime, Bitcoin worth stays simply shy of $100,000, hovering throughout the $99,000 vary all through the weekend.

3 US Financial Information That Might Affect Bitcoin Value This Week

This week guarantees to be very event-rich, with the next US financial information anticipated to drive volatility within the Bitcoin and altcoin markets.

US CPI

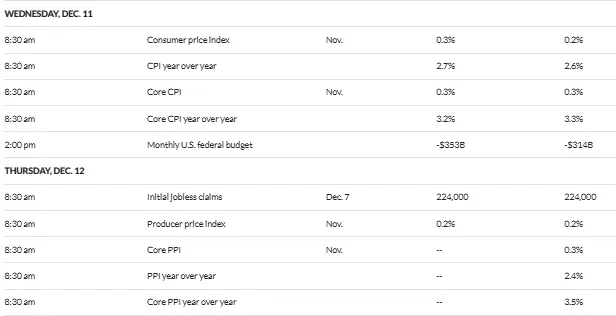

The US CPI (Shopper Value Index) is a key watch amongst US financial information this week. It’s due for launch on Wednesday, December 11, at 8:30 A.M. Jap Time. Launched by the US Bureau of Labor Statistics (BLS), this macroeconomic information measures the month-to-month change in costs paid by customers, successfully monitoring inflation over time.

Through the earlier US CPI information launch, the BLS revealed rising inflation to 2.6%. Particularly, inflation held regular at 0.2%, matching September’s determine. Nonetheless, the annual improve of two.6% marked the primary uptick in eight months.

This raised hypothesis of Federal Reserve (Fed) tightening. Nonetheless, institutional curiosity in BTC buoyed the worth of the pioneer crypto because it continues to enchantment as a retailer of worth, thereby attracting demand.

There’s a median forecast of 0.3%, which implies costs are anticipated to rise 0.3% on a month-over-month foundation, per economist projections. This may be above the 0.2% month-over-month improve in September. There’s additionally a consensus of two.7% amongst Wall Road economists.

All eyes might be on the Labor Division this Wednesday as US inflation information comes into focus. Along with the headline information, the core CPI inflation may also be a key watch this week, providing a extra steady studying on inflation as a result of it strips out meals and vitality costs from the calculation.

Core CPI inflation is of key curiosity as a result of the costs of products are likely to see sizable and unpredictable modifications month to month which have little to do with shopper demand. In November, the core CPI is predicted to have risen 3.3% over final yr. If it occurs this fashion, it might mark the fourth straight month of a 3.3% studying.

In the meantime, month-to-month core worth will increase are anticipated at 0.3%, additionally consistent with the October acquire.

Attributable to its decentralized nature and restricted provide, Bitcoin is taken into account a hedge in opposition to inflation. On Wednesday, BTC may benefit from a rising pattern in US CPI and core CPI.

For the layperson, if buyers understand rising inflation as a risk to the buying energy of conventional currencies just like the US greenback, they could flip to different belongings like Bitcoin as a retailer of worth. This elevated demand might doubtlessly drive up the value of Bitcoin.

Preliminary Jobless Claims

The US jobless claims report for the week ending December 7 is due for launch on Thursday. The info will present insights into the labor market’s well being and total financial situations.

Sometimes, excessive ranges of jobless claims point out financial misery and uncertainty. Alternatively, low ranges recommend a powerful job market and financial stability.

For the week ending November 30, functions for unemployment insurance coverage elevated to 224,000. This print got here in above preliminary estimates of 215,000. It was additionally greater than the earlier week’s tally of 215,000, revised from 213,000.

In line with the BLS employment information, nonetheless, the American job market picked up barely in November. The unemployment charge rose to 4.2%.

Particularly, the US added 227,000 nonfarm payroll (NFP) jobs in November after the labor market faltered in October. This was amid the Boeing strike and Hurricane Milton’s aftermath.

“The most recent jobs information says the labor market continues to be going robust. After the softer numbers in October from the climate and placing employees, November bounces again with robust job development together with upward revisions. On common, the financial system added 173,000 jobs within the final 3 months,” Senior Economist with the Financial Coverage Institute Elise Gould shared.

Excessive ranges of jobless claims on Thursday could contribute to unfavorable market sentiment and uncertainty. This might lead buyers to hunt safe-haven belongings like gold or Bitcoin. This elevated demand for Bitcoin as a retailer of worth might doubtlessly drive up its worth.

In the identical approach, excessive jobless claims might recommend weakening shopper spending and financial development. This might affect central banks to implement expansionary financial insurance policies. Such an end result could improve considerations about inflation and forex devaluation, prompting buyers to show to different belongings like Bitcoin to guard their wealth.

US PPI

Additionally, on Thursday, the BLS will launch the Producer Value Index (PPI), a studying on wholesale inflation. The info measures the typical change over time within the promoting costs obtained by home producers for his or her output.

The CPI and PPI worth information this week would be the most important determinant of the Fed’s rate of interest resolution this month. What the info will present will mark important milestones within the Fed’s coverage adjustment calculus. Of word is that this marks the ultimate week of inflation information earlier than the December Fed assembly.

“All eyes are on CPI and PPI inflation information as markets hope to solidify one other 25 bps charge reduce,” The Kobeissi Letter mentioned.

In the meantime, BeInCrypto information reveals that markets are down right this moment, with Bitcoin buying and selling for $99,147 as of this writing, a 0.68% decline.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.