Whole liquidations exceeded $1.7 billion as Bitcoin (BTC) worth dropped to ascertain an intra-day low of $94,150 on Monday. The profit-booking urge for food prolonged to Tuesday, with BTC nonetheless stunted beneath the $97,000 threshold as of this writing.

It comes as crypto markets brace for a wild week, with a number of key US financial occasions on the calendar.

Whole Crypto Liquidations Exceed $1.7 Billion

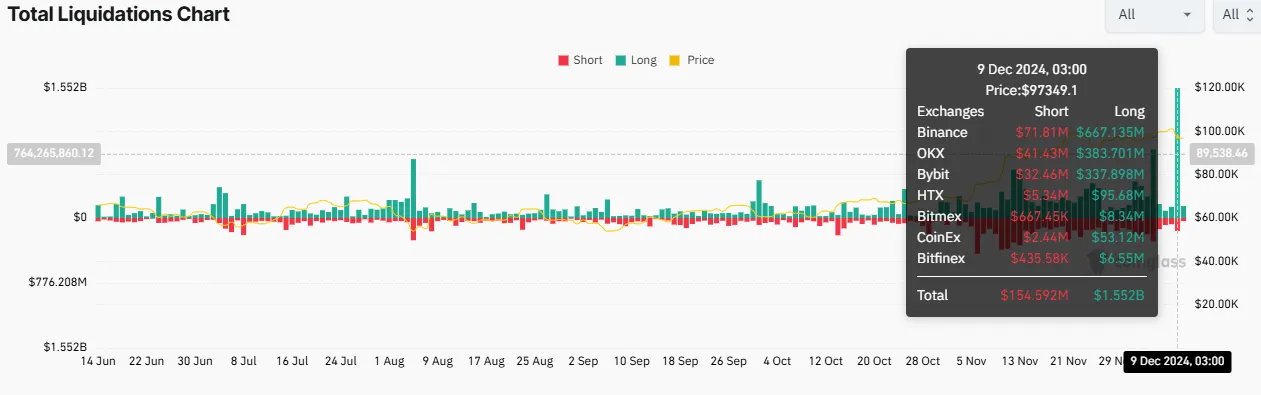

In keeping with information on Coinglass, 583,530 merchants have been blown out of the water within the final 24 hours. Whole liquidations exceeded $1.7 billion within the aftermath. Of those, not less than $1.552 billion had been taken lengthy positions, whereas $154.59 million have been quick.

The huge liquidations adopted Bitcoin’s latest correction. The pioneer cryptocurrency dropped to an intra-day low of $94,150 on Binance Exchange.

Whereas the liquidation occasion shocked merchants and traders, the market is equally optimistic and skeptical. Nonetheless, Unipcs, a preferred consumer on X, requires warning.

“… [It marked] the most important lengthy liquidation occasion since 2021. Large liquidation occasions like this nearly at all times mark a backside. This isn’t the time to panic promote. Additionally it is not the time to get too grasping or hasty piling on the leverage. It’s most likely a very good time to start out scaling into excessive conviction performs on spot in preparation for the following aggressive upward transfer,” the consumer mentioned.

Certainly, warning is warranted contemplating the anticipated affect of US financial information releases this week. As BeInCrypto reported, the US Client Value Index (CPI), weekly jobs information, and the Producer Value Index (PPI) might affect Bitcoin sentiment this week. These US macroeconomic information will reveal the state or well being of the US financial system.

To some, nevertheless, the huge liquidations offered a “wholesome flush,” wiping clear all altcoins’ funding charges. Because of this a major variety of leveraged positions have been forcefully closed because of the sharp decline of the market.

“All altcoins funding charge acquired cleaned. This was a wholesome flush,” Seth, a crypto analyst, quipped.

The funding charge is the mechanism by which exchanges make sure that the perpetual futures market worth stays in step with the spot market worth. The liquidation of many leveraged positions can result in excessive volatility and worth dislocations out there. In lots of situations, this causes the funding charge to reset again to impartial ranges.

Analysts consider that such occasions assist shake out extreme leverage, speculative positions, and weak arms from the market. This paves the way in which for a more healthy and extra sustainable worth motion sooner or later. By clearing out overleveraged positions, the market can doubtlessly discover a extra steady floor for progress with out the burden of extreme hypothesis driving costs.

BeInCrypto information reveals that BTC was buying and selling for $96,682 as of this writing, a drop of just about 3% for the reason that Tuesday session opened.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.