Este artículo también está disponible en español.

The crypto market has seen the most important leverage flush out since April 2021 yesterday, December 9, as reported earlier immediately. Amidst the market shakeout, Dogecoin (DOGE) is among the altcoins which is displaying vital indicators of power. In a publish on X, crypto analyst CRG (@MacroCRG) argues that the DOGE value is displaying “unbelievable” indicators of resilience in comparison with the broader altcoin market.

Right here’s Why Dogecoin Seems ‘Unimaginable’

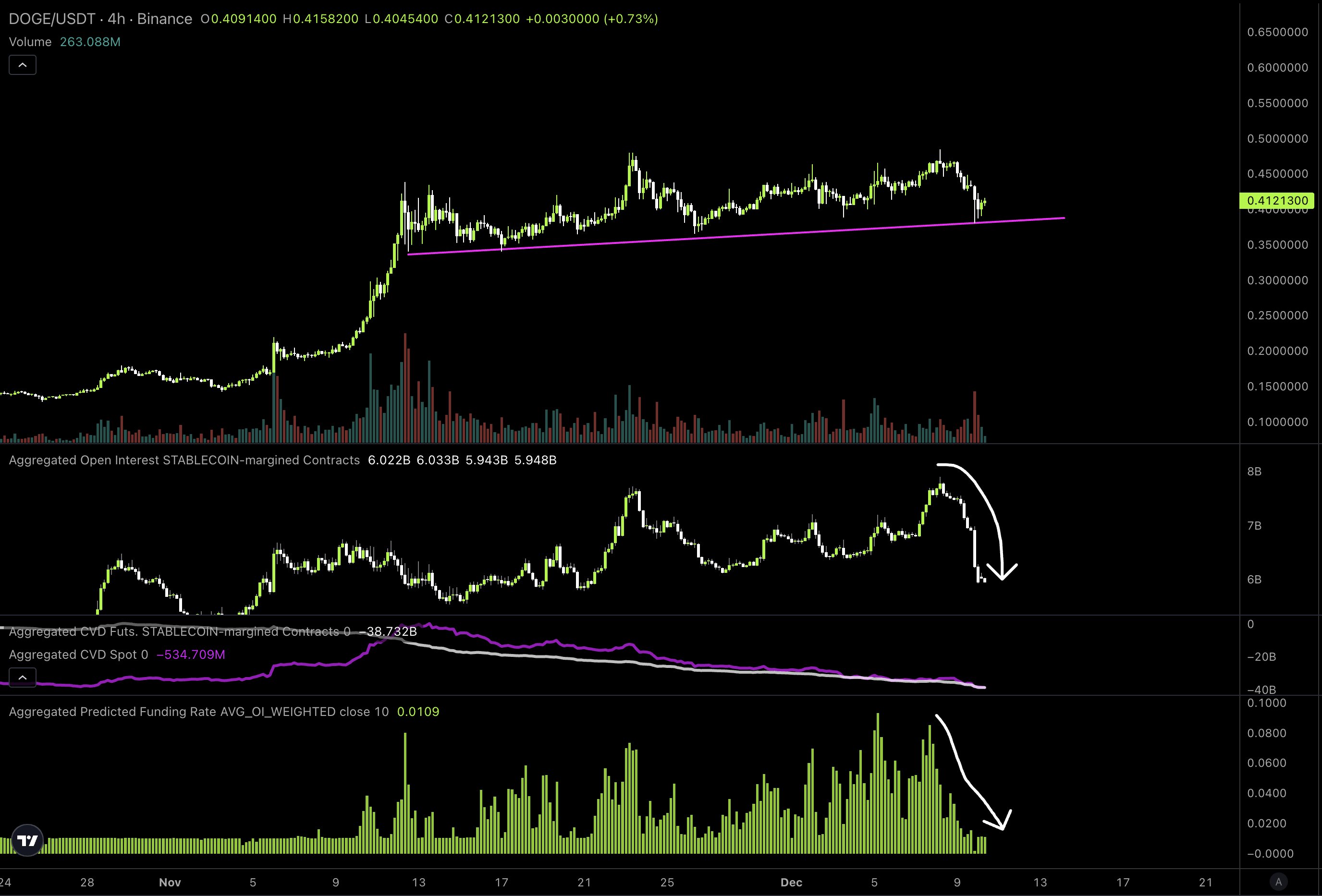

Regardless of the market downturn, Dogecoin managed to keep up essentially the most essential assist degree. CRG shared the beneath chart and commented, “DOGE appears to be like unbelievable. Entire market shat itself but it surely barely flinched + didn’t break construction. Now funding has utterly reset and a ton of OI has been washed out. Gained’t be lengthy till that is trending laborious once more IMO.”

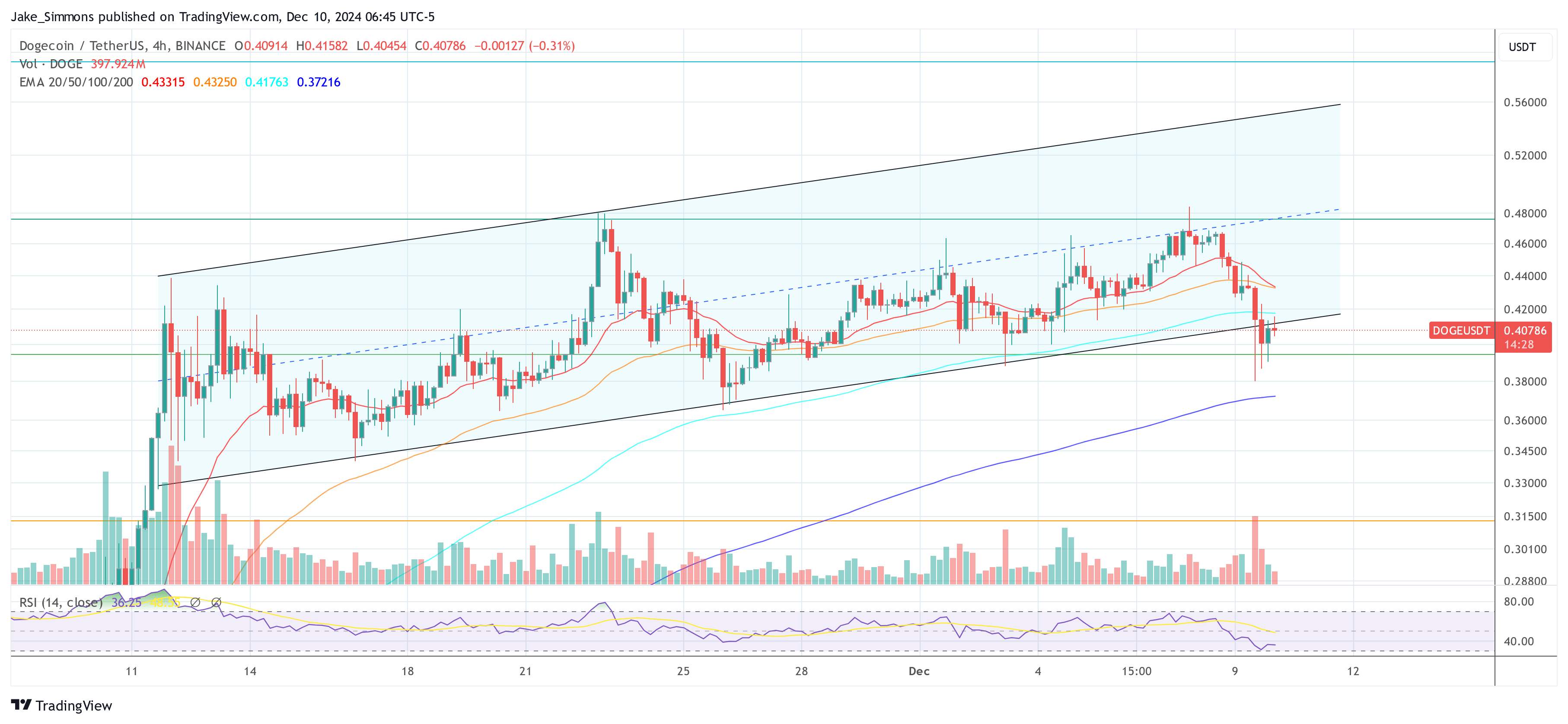

The chart reveals a number of crucial insights that assist his optimistic outlook for DOGE. Firstly, Dogecoin maintained an important uptrend line within the 4-hour chart (DOGE/USDT). This development line has acted as a dynamic assist degree which the Dogecoin value has touched however not fallen beneath on three separate events since mid-November.

Associated Studying

Every contact of this development line triggered a rebound for the Dogecoin value, suggesting robust purchaser curiosity at these ranges. This alignment with the uptrend line is essential as a result of it signifies not solely assist but in addition rising confidence amongst buyers every time the worth dips to this line and subsequently recovers.

Resistance, alternatively, shaped close to the $0.47 mark. This degree has been examined a number of instances, and every try to interrupt via has been met with resistance. The repeated checks of this resistance degree with out a breakthrough might sometimes counsel a consolidation part, probably increase for a stronger transfer upward if the market sentiment shifts positively.

Moreover, the chart reveals a notable discount in open curiosity in stablecoin-margined contracts. In response to Coinglass knowledge, $86.29 million in DOGE lengthy positions had been liquidated on December 9, the best for the reason that bull run of 2021.

Associated Studying

This discount in open curiosity presents a significant ‘washout’ of speculative positions, sometimes considered as a market reset the place weaker palms exit, and the surplus leverage is decreased. Notably, this cleaning of market contributors might be one other trace {that a} extra sustainable upwards transfer is brewing.

One other important facet proven within the chart is the reset of funding charges to decrease ranges, which is critical because it reduces the price of holding lengthy positions. Decrease funding charges can encourage new shopping for exercise, particularly from contributors who had been beforehand sidelined as a result of excessive prices related to sustaining leveraged positions.

CRG’s evaluation additionally contains an commentary on the Cumulative Quantity Delta (CVD) for each futures and spot markets. The CVD for futures has moved beneath that of the spot market, indicating that futures merchants is likely to be taking extra bearish positions or closing present positions extra aggressively in comparison with spot merchants. This divergence means that the spot market, which is mostly much less speculative, retains bullishness, whereas appearing as a buffer in opposition to the bearish futures markets.

At press time, DOGE traded at $0.40.

Featured picture created with DALL.E, chart from TradingView.com