AI16z DAO is flipping the script on how crypto communities make investments, govern, and function—whether or not for the memes or for the untapped potential of counting on AI to make data-driven, non-subjective monetary selections.

The decentralized autonomous group undertaking, that includes its personal token, guarantees to “flip a16z,” certainly one of Silicon Valley’s premier enterprise corporations, and “redefine what it means to be a enterprise capitalist within the age of synthetic intelligence.”

As of this writing, the undertaking’s AI16Z token has a market cap of over $500 million, per CoinGecko information.

Launched in October 2024, the undertaking has nothing to do with Marc Andreessen or the remainder of the a16z crew aside from the identify. Nevertheless, the VC large is probably going conscious of and royally pissed off by doable confusion created by the identify.

In any occasion, right here’s the fascinating half. The DAO principally emulates a hedge fund: DAO members put their cash within the palms of an knowledgeable—on this case, an AI agent named “Marc AIndreessen”—who makes use of it to put money into totally different tasks and belongings to extend the worth of the belongings beneath the fund’s administration.

The important thing distinction, in fact, is that in meatspace enterprise, solely accredited traders are allowed to place their cash right into a fund like a16z, the place the fund managers determine what to put money into (and take out administration and different charges for the privilege.) In ai16Z, any particular person can make investments through the token, and AI brokers handle the fund—on this case, the AI model of Marc Andreessen.

If the scheme finally ends up working, the undertaking may really do to Silicon Valley VCs what Silicon Valley VCs have accomplished to the remainder of us: Disrupt us, in some instances, out of existence.

As a facet word, simply as revolutionary is what AI is doing to the DAO mannequin. Not like conventional DAOs, the place token holders vote on every determination, AI Marc serves as each the brains and the operational engine of the group, making selections autonomously. Actual Marc most likely envies that authority.

AI Marc was created utilizing “Eliza,” an open-source framework that lets customers and builders create autonomous AI brokers able to executing duties in the actual world, equivalent to searching the online, debugging code, and analyzing methods.

The DAO members can work together with AI Marc. The more cash they make investments, the extra the Agent will take the person’s recommendations into consideration. Nevertheless, AI Marc at all times has the ultimate phrase within the monetary selections.

In observe, simply as Eliza eliminates inefficiencies in programming, ai16z DAO’s system goals to remove inefficiencies widespread in conventional DAOs. AI Marc skips extended debates, avoids the affect of human biases, and focuses purely on the numbers. It analyzes recommendations, scrapes information, works on a marketing strategy, and executes its selections.

I don’t suppose folks notice that Ai16z shouldn’t be a daily meme coin, the DAO can purchase $Ai16z…. it has roughly 6 million AUM. It may be its personal purchaser and pump its personal baggage, thus boosting the $$$ of the AUM($ai16z), thus pumping its baggage ect.

NFA pic.twitter.com/Nvf398wkDf

— Skely (@123skely) December 5, 2024

So, how’s it doing? It’s too quickly to inform.

Whereas the undertaking presently holds over $10 million in belongings beneath administration, AI Marc has not but purchased something with the DAO’s treasury as a result of it’s nonetheless within the testing section.

The “first section, the place we implement and check performance, is in progress. The “Second section, the place AI Marc gathers information in a testnet atmosphere, will start quickly and run for a few weeks to collect information, discover flaws, check assumptions,” says the official ai16z FAQ. The “third section, with on-chain execution with real-world stakes, will start shortly after that.”

The AUM comes from all of the brokers that use Eliza for video games, totally different buying and selling methods, and tasks exterior of the crypto world and even initiatives adjoining to the Eliza ecosystem.

Every AI agent donates 10% of its tokens to the DAO, which now holds a whole bunch of digital belongings. Most of its funds are invested in Solana, its personal AI16Z token, and different meme cash equivalent to ELIZA, FXN, and DegenAI.

For sure, there’s a number of expectation round Eliza’s potential, even exterior of the crypto business.

For instance, the official GitHub web page mentions AI-powered NPCs as a use case, chatbots of various flavors, and in the end any AI agent you possibly can think about, and the proficiency of AI Marc because the supervisor of AI16Z’s treasury. As of immediately, the value of the AI16z token has grown by over 1660% since November 2024.

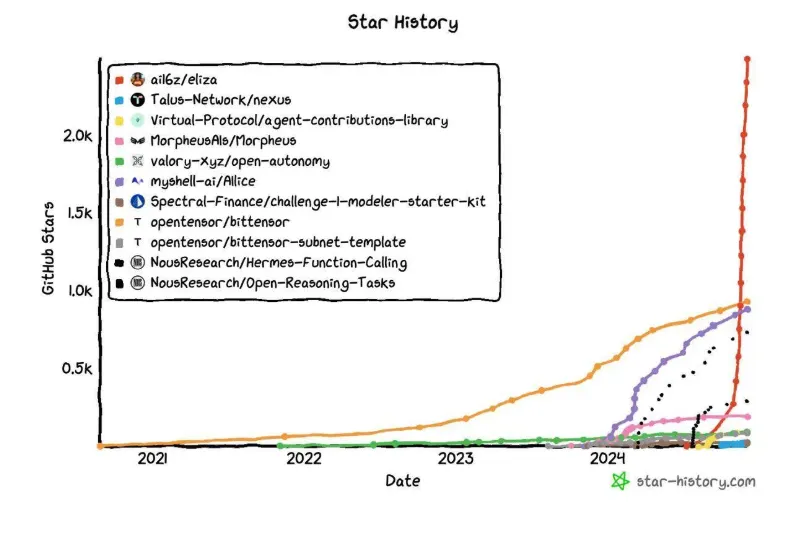

You may most likely determine that this is not simply one other silky crypto experiment. Eliza is a strong framework, with builders praising it throughout social media and awarding it 3.5K stars on Github—which means it has been marked as a favourite by over 3.500 builders.

All the pieces from AI Marc’s codebase to its monetary actions is totally open supply, with data saved on the blockchain. This stage of transparency ensures that customers have full perception into the undertaking’s operations, providing a level of belief that few tasks can match.

The token’s worth surged over 50% instantly after the CTO of the actual a16z, Eddy Lazzarin, advised “Shaw”–the obvious mastermind behind Eliza and ai16z—to direct message him.

Decrypt contacted Lazzarin and Shaw for remark however has but to obtain a response.

In the meantime, ai16z’s valuation provides to the rising investor curiosity in AI-driven endeavors and the potential of brokers taking part in enterprise selections.

Whether or not that future is utopian or dystopian stays to be seen—it most likely hinges on whether or not you suppose the Frankenstein monster ought to disrupt VCs we’re all hellbent on creating.

Edited by Josh Quittner and Sebastian Sinclair

Typically Clever E-newsletter

A weekly AI journey narrated by Gen, a generative AI mannequin.