Solana (SOL) merchants appear assured that the latest decline within the altcoin’s value is barely a quick decline as a substitute of a long-haul uneven interval. That is evident from the place Solana longs has taken for the reason that broader market liquidation, which bumped into lots of of 1000’s of {dollars}.

However do indicators agree with this sentiment? Here’s a thorough evaluation of the potential SOL value motion.

Solana Merchants Assured within the Altcoin’s Restoration

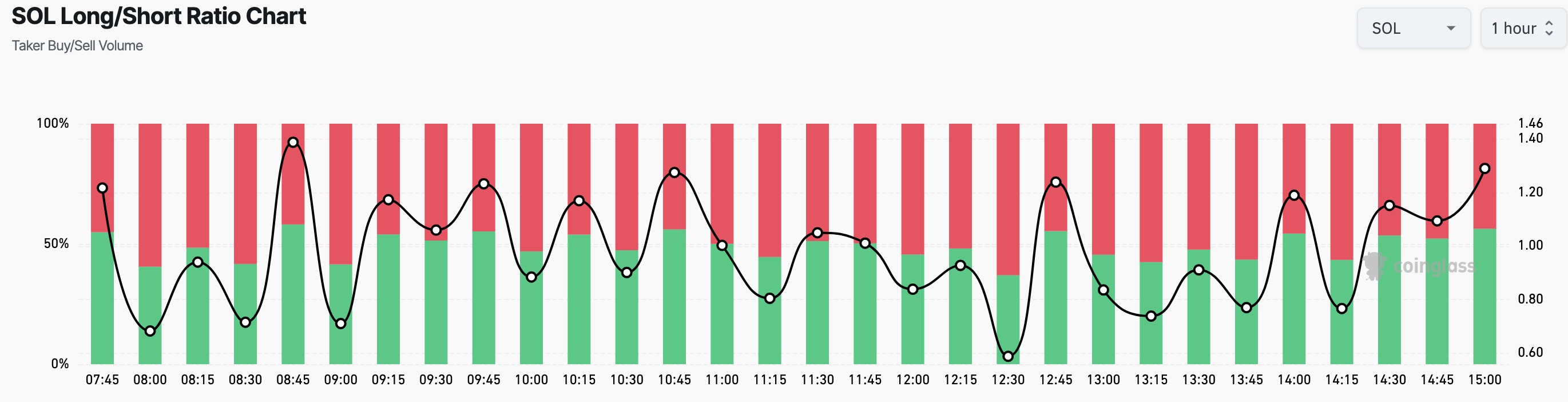

In response to Coinglass, the Solana Lengthy/Quick ratio is 1.14. Because the identify implies, the lengthy/quick ratio acts as a barometer of merchants’ expectations out there. When the ratio is under, it means there are extra shorts than longs out there.

A studying above 1, nevertheless, signifies extra longs than shorts. For context, longs are merchants with positions anticipating a value improve. Shorts, however, are merchants anticipating a lower.

Due to this fact, the present ratio signifies that Solana longs are dominant out there. Therefore, the common sentiment is bullish and, if validated, might flip worthwhile for these merchants. Curiously, that is occurring at a time when the market confronted the best variety of liquidations in the previous couple of days.

Over the previous 24 hours, SOL liquidations have totaled roughly $60 million. Of this quantity, lengthy positions accounted for over $57 million, whereas shorts made up the remaining. Liquidations happen when a dealer’s margin falls quick, prompting the trade to shut the place to forestall additional losses.

This wave of liquidations was triggered by Solana’s value dropping under $215, sparking a cascade of margin calls and compelled closures.

SOL Value Prediction: Not But Time for a Rebound

On the each day chart, the SOL value has dropped under the 20 and 50 Exponential Shifting Averages (EMA), that are technical indicators that measure pattern path.

When the worth is above the EMA, the pattern is bullish. However, if the worth is under the EMA, the pattern is bearish, which is the case with the SOL value.

One other noticeable pattern on the chart under is that the SOL value is buying and selling under the demand zone at $210. If the altcoin fails to recuperate above this zone, the correction may intensify, and the token’s worth may decline to $189.36.

Nevertheless, if Solana sees elevated shopping for stress, the pattern may reverse, and it might rally towards $264.66.

Disclaimer

Consistent with the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.