The Bitcoin market has lengthy been characterised by cyclical actions and adoption-driven development, and traders continuously search instruments to higher perceive and anticipate these cycles. One such device is the Golden Ratio Multiplier—a Bitcoin-specific indicator developed by Philip Swift, Managing Director of Bitcoin Journal Professional. This text delves into the intricacies of the indicator and analyzes the latest Chart of the Day, which supplies a data-driven outlook on Bitcoin’s value trajectory.

The #Bitcoin Golden Ratio Multiplier 1.6x stage, at present at ~$100,000, has as soon as once more acted as resistance for #BTC value motion! 🐻

If we will rally by means of this stage, then ~$127,000 is our subsequent main goal! 🎯 pic.twitter.com/RCRKYFDAZt

— Bitcoin Journal Professional (@BitcoinMagPro) December 10, 2024

Click on right here to view the dwell Golden Ratio Multiplier chart on Bitcoin Journal Professional totally free.

Understanding the Golden Ratio Multiplier

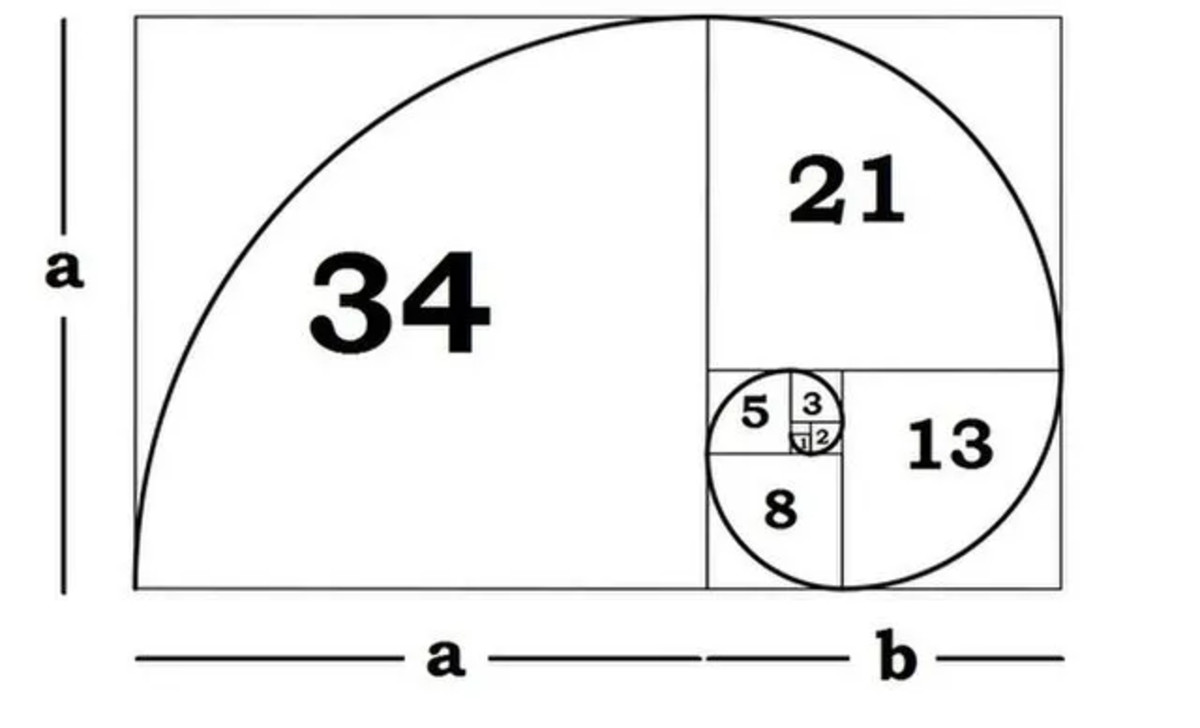

The Golden Ratio Multiplier is a charting device designed to look at Bitcoin’s long-term adoption curve and market cycles. At its core, the indicator makes use of multiples of the 350-day shifting common (350DMA) to pinpoint areas of great value resistance or market cycle peaks. These multiples are primarily based on two foundational mathematical ideas:

- The Golden Ratio (1.6)

- The Fibonacci Sequence (0, 1, 1, 2, 3, 5, 8, 13, 21, and so on.)

The Golden Ratio and Fibonacci sequence have constantly proven relevance in nature, finance, and buying and selling, making them preferrred for modeling Bitcoin’s logarithmic value development over time. Traditionally, Bitcoin’s value intracycle highs and main market cycle peaks align with Fibonacci-based multiples of the 350DMA. This makes the Golden Ratio Multiplier a useful device for figuring out factors of value resistance as Bitcoin’s adoption progresses.

How It Works

The chart plots Bitcoin’s value towards key Fibonacci multiples of the 350DMA, resembling 1.6x (the golden ratio), 2x, and 3x. These ranges have confirmed efficient at indicating:

- Intracycle highs: Factors the place Bitcoin’s value experiences short-term resistance throughout a market cycle.

- Main cycle peaks: Lengthy-term market tops that sign the top of a bull run.

The lowering Fibonacci sequence multiples replicate Bitcoin’s maturing market. As adoption expands and Bitcoin’s market capitalization grows, its value volatility and exponential development naturally diminish. Consequently, the best Fibonacci multiples (e.g., 21x) are much less related in in the present day’s market, whereas decrease multiples like 2x and 3x develop into extra vital for evaluation.

Chart of the Day Evaluation: $100,000 Resistance

The Chart of the Day, revealed on Bitcoin Journal Professional’s X profile, highlights Bitcoin’s present interplay with the 1.6x a number of of the 350DMA, which is roughly $100,000. As seen within the chart, this stage has repeatedly acted as a powerful resistance zone for Bitcoin’s value.

Key Observations from the Chart

- Historic Significance of the 1.6x Degree: This stage has served as a vital resistance level in previous cycles, and its present standing as a psychological milestone ($100,000) additional reinforces its significance.

- Potential for Breakout: If Bitcoin manages to rally above the 1.6x stage, the subsequent vital goal is the 2x a number of, round $127,000. This aligns with the Golden Ratio Multiplier’s long-term prediction of lowering Fibonacci-level peaks.

Why $100,000 Issues

The $100,000 mark not solely represents a big Fibonacci a number of but additionally a serious psychological barrier available in the market. Breaking by means of this stage might reignite bullish sentiment, drawing in new traders and probably resulting in a parabolic value transfer towards the $127,000 resistance.

What Makes This Indicator Distinctive?

The Golden Ratio Multiplier stands out as a result of it integrates Bitcoin’s adoption curve into its calculations. As a device tailor-made for Bitcoin’s early adoption section, it accounts for the logarithmic nature of Bitcoin’s value development. By figuring out value ranges that align with pure adoption dynamics, the indicator presents:

- Readability on Market Cycles: Helps traders establish intracycle highs and cycle peaks.

- Danger Administration Steerage: Offers a framework for understanding when the market could also be overstretched and the place traders may contemplate adjusting their methods.

As adoption progresses, the Fibonacci multiples proceed to taper downward, suggesting the indicator’s utility will diminish as soon as Bitcoin achieves mainstream adoption.

Implications for Traders

For traders, the Golden Ratio Multiplier supplies actionable insights into the place Bitcoin’s value might encounter resistance or consolidation. Right here’s what the info suggests:

- Quick-Time period Outlook: The $100,000 stage is a vital resistance. If Bitcoin fails to clear this barrier, a interval of consolidation might observe.

- Medium-Time period Outlook: Efficiently breaking $100,000 might set the stage for a rally to $127,000, the 2x a number of. Traditionally, such breakouts have been accompanied by vital quantity and renewed investor curiosity.

- Lengthy-Time period Perspective: Whereas the Golden Ratio Multiplier stays efficient for analyzing Bitcoin’s adoption section, its predictive energy might wane as Bitcoin matures right into a steady asset class.

Conclusion

The Golden Ratio Multiplier, created by Philip Swift in 2019, has constantly demonstrated its worth as a predictive device for Bitcoin’s value actions. By analyzing Fibonacci multiples of the 350DMA, the indicator presents a roadmap for understanding Bitcoin’s long-term value trajectory and figuring out key resistance ranges.

Because the Chart of the Day reveals, Bitcoin is as soon as once more testing the $100,000 resistance stage. A profitable rally by means of this barrier might pave the way in which for a transfer towards $127,000, providing vital alternatives for traders who perceive the dynamics at play.

To discover dwell knowledge and keep knowledgeable on the newest evaluation, go to bitcoinmagazinepro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your personal analysis earlier than making any funding selections.