On December 6, Aptos (APT) boasted a market cap of almost $8.25 billion. Nevertheless, as of now, the market cap has plunged to $6.36 billion, shedding virtually $2 billion in simply 5 days.

This sharp decline coincides with anticipation surrounding the upcoming token unlock, an occasion prone to set off vital volatility for APT.

Aptos Loses a Lot with Provide Shock Coming

Aptos’ market cap rose above $8 billion as the worth rallied to $15.25. For context, the market cap is calculated because the product of value and circulating provide. Due to this fact, when the worth will increase, the market cap additionally jumps.

Additionally, if a cryptocurrency’s value stalls however the tokens in circulation rise, then the market cap additionally jumps. In Aptos’s case, the decline out there cap might be attributed to the market-wide decline, which has seen many altcoin costs drop from the height they hit final week.

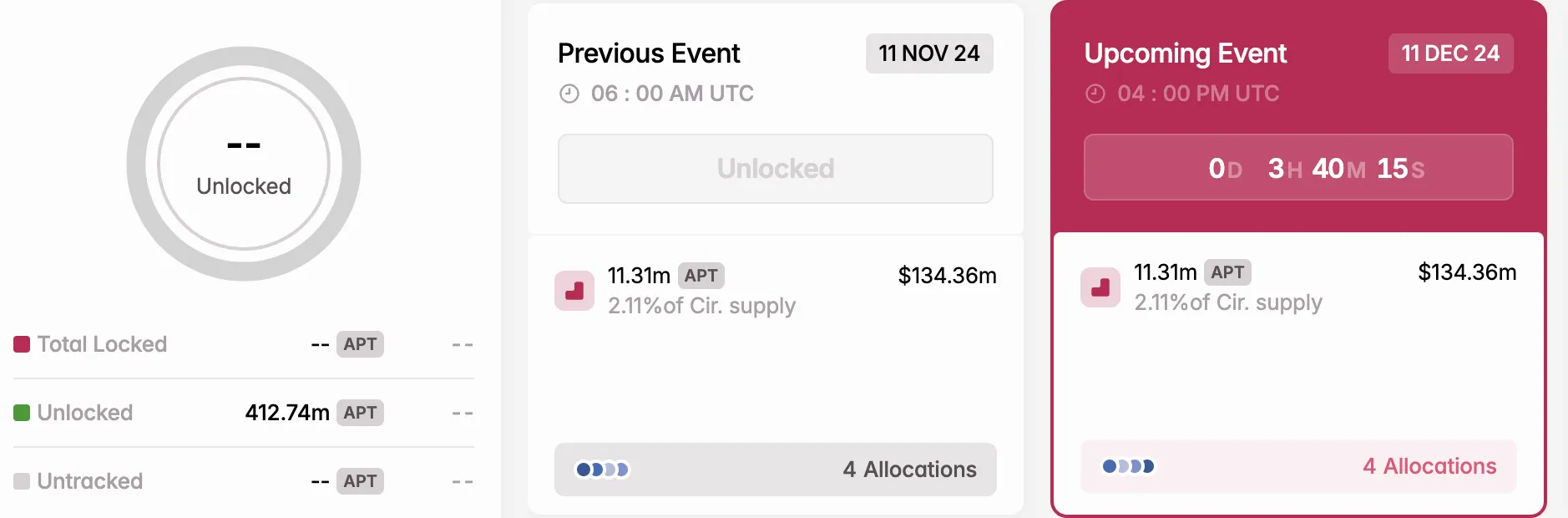

In addition to that, the decline is also linked to the token unlock scheduled to occur right now. Token unlocks check with the discharge of beforehand locked cryptocurrency tokens to the general public, usually as a part of a vesting schedule or promotional occasion.

This mechanism performs a vital position within the crypto market, guaranteeing a managed and strategic distribution of tokens to handle circulation and market stability successfully. Based on Tokenomist (beforehand Token Unlocks), Aptos will launch 2.11% of its complete provide, valued at $134.47 million right now.

As soon as unlocked, this occasion may trigger excessive volatility round APT. Additional, if shopping for strain doesn’t counter the upcoming provide shock, the upcoming provide shock may also result in a drawdown in Aptos’ value.

APT Value Prediction: Token to Slide Under $10

Some days again, Aptos value was buying and selling inside an ascending triangle. Ascending triangles are usually bullish, suggesting that an uptrend would possibly proceed. Nevertheless, as of this writing, the altcoin has dropped notably under the neckline of the technical sample, indicating that the bullish breakout has been invalidated.

Moreover, the Cumulative Quantity Delta (CVD) has dropped to the adverse area. The CVD measures the distinction between shopping for quantity and promoting quantity. When it’s constructive, it signifies extra shopping for than promoting.

Then again, whether it is adverse, it signifies extra promoting strain which is the case with APT. With this place, Aptos value would possibly drop to $9.65 within the brief time period. But when demand surges, that may not occur, and the worth may climb to $15.33.

Disclaimer

Consistent with the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.