BNB worth reached a brand new all-time excessive on December 4 however is now going through a downtrend, as indicated by a number of technical indicators. The surge in BNB’s ADX to 31, up from simply 12 the day earlier than, means that the bearish momentum is gaining energy, signaling the potential for extra downward motion within the quick time period.

The worth is at present under the Ichimoku Cloud, with weakening bullish indicators and elevated promoting strain. If this pattern continues, BNB may expertise additional corrections, with the potential to check decrease help ranges within the coming days.

BNB Present Downtrend Signifies Extra Corrections Forward

BNB’s ADX has surged to 31, up from 12 only a day in the past, indicating that the present pattern is gaining energy. The rise in ADX means that the pattern has develop into extra outlined, and a studying above 25 usually indicators a robust pattern.

Since BNB worth is at present in a downtrend, this greater ADX signifies that the bearish momentum is intensifying, and the value may expertise additional downward strain if this pattern continues.

ADX, or the Common Directional Index, measures the energy of a pattern no matter whether or not it’s bullish or bearish. Values above 25 point out a robust pattern, whereas values under 20 counsel weak or non-defined traits.

With BNB ADX at 31, this confirms that the downtrend is strengthening. Until a reversal happens, the market is prone to see continued promoting strain within the quick time period.

BNB Ichimoku Cloud Reveals Bearish Indicators

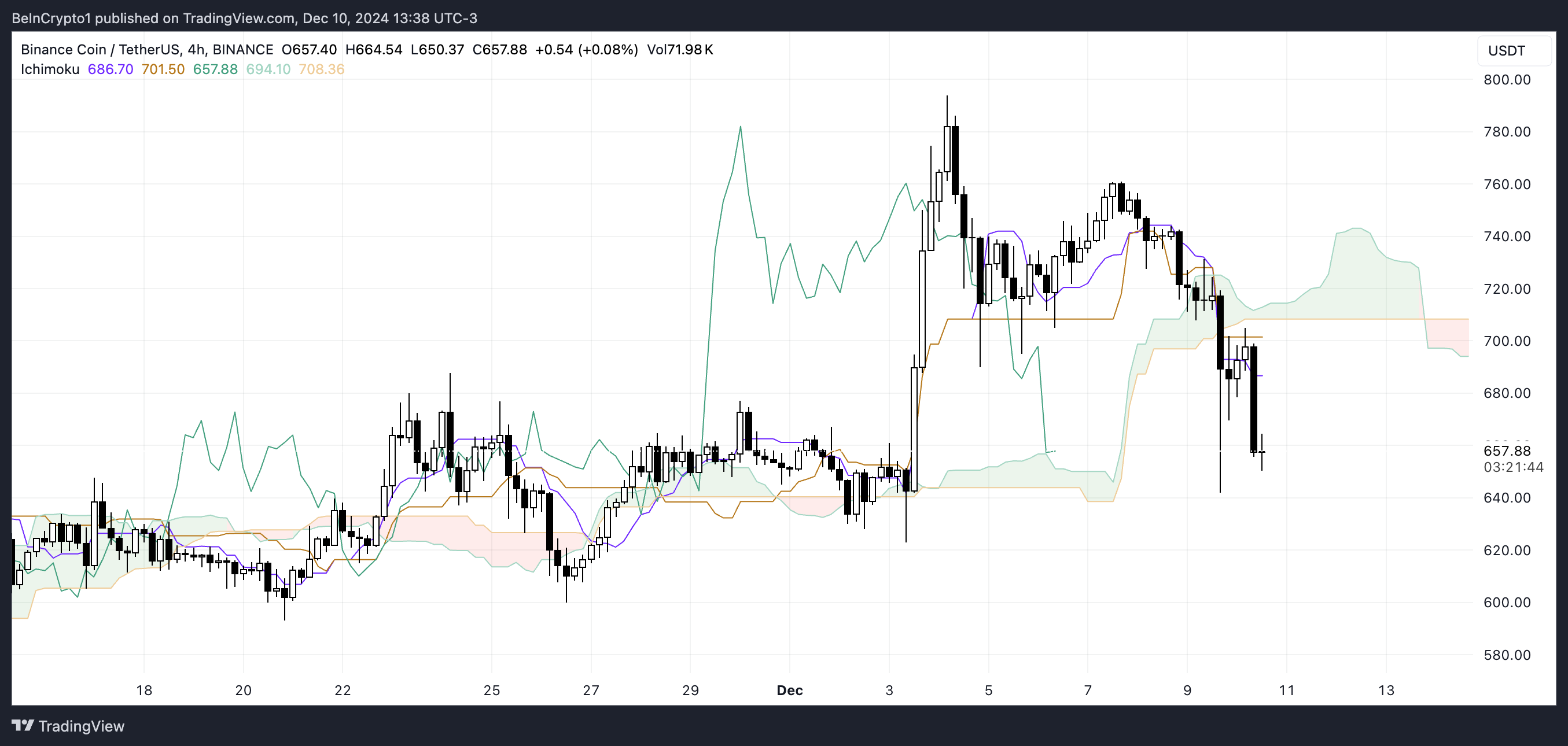

BNB worth is at present under the Ichimoku Cloud, suggesting that it’s in a bearish part. The inexperienced span of the cloud has turned skinny and is dropping its momentum, whereas the main span strains seem like flat.

This situation factors to a weakening uptrend, and the value may face resistance if it tries to get well and transfer above the cloud. Moreover, the value falling under the cloud indicators elevated promoting strain, which may push the value additional downward within the quick time period.

Wanting on the indicator strains, the Tenkan-sen (blue line) is under the Kijun-sen (crimson line), confirming that bearish momentum is current. The hole between the 2 strains means that the downward pattern is gaining energy, because the shorter-term Tenkan-sen continues to stay beneath the slower Kijun-sen.

The cloud’s crimson shade additional helps this bearish outlook, indicating that market sentiment is destructive. If BNB fails to interrupt above the cloud, it could proceed to face promoting strain, and its worth may take a look at decrease help ranges within the close to future.

BNB Value Prediction: Can BNB Fall Beneath $600 In December?

The BNB EMA Traces point out a bearish sign with the formation of a dying cross, because the shortest line has crossed under the others. This technical sample is often seen as an indication of weakening bullish momentum and means that BNB may face additional declines.

If the present downtrend persists and the $647 help stage fails to carry, BNB worth might even see a extra important drop, probably testing $622 and even $593. These ranges symbolize key help zones that shall be vital for figuring out the energy of the downtrend and the opportunity of additional losses.

Nevertheless, if the market sentiment shifts and the downtrend reverses, BNB may discover help on the $647 stage and rise towards resistance at $687.

A break above this stage may sign a reversal of the present downtrend and pave the best way for BNB to check greater ranges, such because the $761 resistance.

Disclaimer

In keeping with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.