Helium (HNT) value is up greater than 8% within the final 24 hours, drawing consideration because it makes an attempt to regain its current momentum. Regardless of the short-term features, technical indicators counsel combined alerts for its future development.

The ADX highlights weakening development energy, whereas the RSI factors to a impartial zone. With EMA traces exhibiting potential for a bullish crossover, HNT faces a pivotal second that might decide whether or not it surges towards $9.53 or exams important help ranges close to $6.86.

HNT Present Development Is Shedding Its Steam

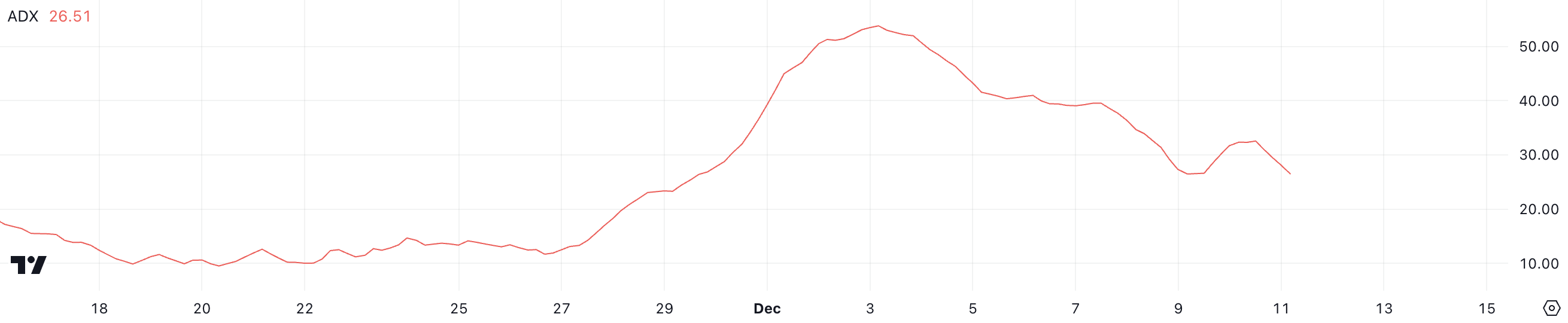

Helium Common Directional Index (ADX) is at the moment at 26.5, a big drop from over 50 only one week in the past. Throughout that point, its value reached ranges above $9, marking the primary time it hit these highs since March 2024.

The decline in ADX displays a discount within the energy of its current uptrend, doubtlessly signaling a pause or slowdown in momentum.

The ADX measures the energy of a development however not its route. Values above 25 point out a powerful development, whereas readings beneath 20 counsel a weak or no development.

At 26.5, HNT ADX hovers simply above the sturdy development threshold, indicating that whereas the development stays intact, it’s weakening. If HNT value goals to recuperate its uptrend, the ADX should climb increased, signaling renewed momentum and stronger shopping for curiosity.

Helium RSI Is Presently Impartial

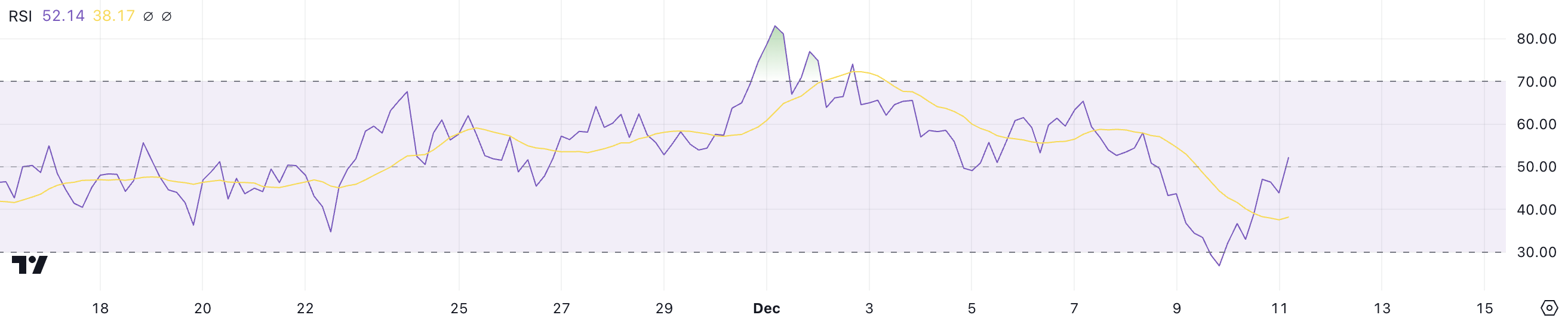

HNT’s Relative Power Index (RSI) is at the moment at 52, a decline from over 70 earlier in December when its value skilled a pointy surge. This drop signifies decreased shopping for momentum in comparison with the sooner overbought circumstances.

Whereas the RSI stays within the impartial zone, it displays a cooling off in market enthusiasm following the current rally. It’s additionally necessary to notice that HNT RSI reached 28 on December 10, exhibiting that purchasing stress might be returning.

The RSI measures the pace and magnitude of value adjustments, starting from 0 to 100. Values above 70 point out overbought circumstances, typically signaling a possible reversal or correction. Readings beneath 30 counsel oversold circumstances, the place costs may rebound.

With an RSI at 52, the HNT value is neither overbought nor oversold, suggesting it’s consolidating. To renew its uptrend, the RSI would want to climb, reflecting renewed shopping for energy. Conversely, a drop beneath 50 may trace at additional weakening momentum.

HNT Worth Prediction: Can It Attain $9 Once more?

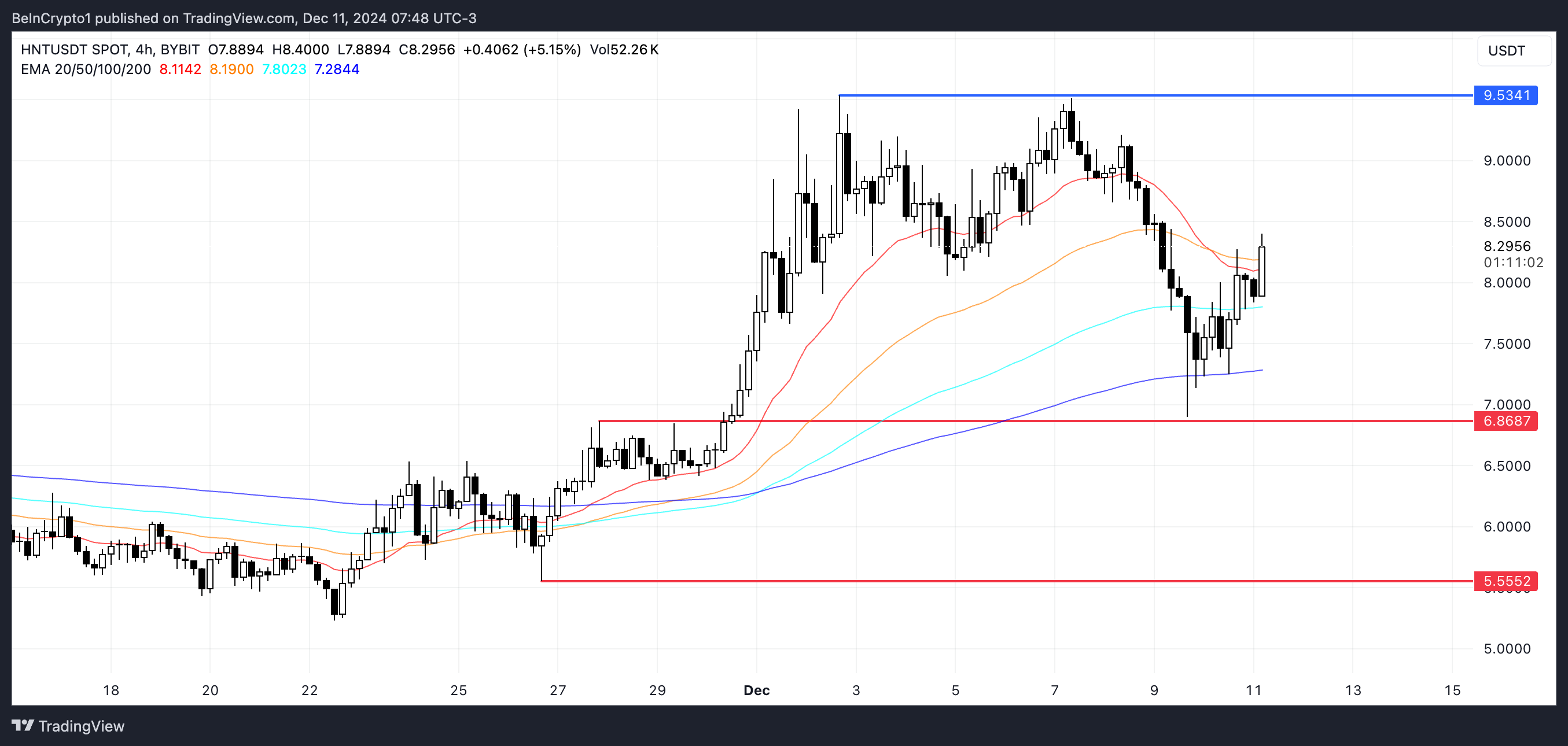

Helium Exponential Transferring Common (EMA) traces are exhibiting combined alerts. Lately, its shortest EMA crossed beneath one other, signaling bearish momentum.

Nonetheless, the shortest EMA has began rising once more. If it crosses again above, it may point out renewed bullish power and doubtlessly spark a value surge because the DePin (Decentralized Bodily Infrastructure) narrative tries to maintain constructing traction.

If a bullish crossover happens, Helium value may retest resistance round $9.53. Nonetheless, the weakening development highlighted by ADX suggests warning. If a downtrend develops as an alternative, HNT value may take a look at help at $6.86.

If that stage fails to carry, the worth may drop additional to $5.55, representing a potential 33% decline.

Disclaimer

Consistent with the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.