Este artículo también está disponible en español.

Bitcoin has remained range-bound between $99,000 and $102,000 since breaking above the psychological $100,000 stage. Whereas the breakout initially sparked pleasure amongst buyers, the present value motion displays market indecision, with no clear path for the weeks forward. Considerations a few potential correction linger because the broader market awaits stronger indicators to substantiate the following pattern.

Associated Studying

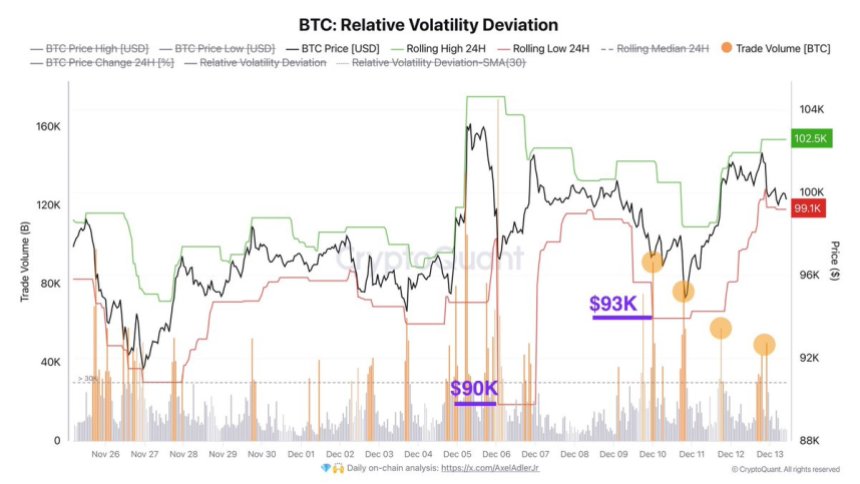

Prime analyst Axel Adler just lately shared insights on X, supported by information from CryptoQuant, highlighting two essential assist ranges at $90,000 and $93,000. These ranges signify key demand areas, underscoring that the market flooring has moved larger—a constructive signal of resilience even amid the uncertainty. In accordance with Adler, these helps might act as security nets, absorbing promoting strain if Bitcoin fails to maintain its momentum above $100,000.

Regardless of the hesitation, Bitcoin’s means to carry above $100,000 for consecutive days has supplied some optimism amongst buyers. It stays unsure whether or not the market will escape of its present vary to proceed the bull run or face a correction. For now, all eyes are on Bitcoin’s value motion close to these essential ranges as merchants search for clues that would set the tone for the rest of the yr.

Bitcoin Technical Particulars Defined

Bitcoin has confronted uneven value motion just lately, leaving the market in anticipation of the following huge transfer, whether or not upward or downward. Merchants and buyers stay cautious, carefully watching key technical and macroeconomic indicators. The uncertainty has stored Bitcoin buying and selling between $99,000 and $102,000 as market individuals look ahead to a decisive breakout.

Prime analyst Axel Adler just lately shared an in depth macro evaluation on X, shedding mild on Bitcoin’s present place. In accordance with Adler, the market has established two essential assist ranges at $90,000 and $93,000, signaling that the general market flooring has shifted larger.

These ranges might act as sturdy security nets if Bitcoin experiences a short-term pullback. Adler emphasised that these helps replicate rising confidence in Bitcoin’s long-term potential regardless of the present indecision.

One notable commentary is the decline in buying and selling quantity peaks, which presents a impartial sign. This means that merchants keep away from extreme threat, preferring to attend for clearer market indicators earlier than getting into vital positions. The declining quantity additionally suggests a lowered probability of utmost value volatility within the rapid time period.

Associated Studying

With Bitcoin caught in its present vary, the market stays extremely delicate to exterior components. Any vital information or occasions might shortly set off a breakout or breakdown, setting the stage for Bitcoin’s subsequent main transfer.

BTC Value Motion

Bitcoin is buying and selling at $100,100 after failing to interrupt above its all-time excessive of $103,600. The present consolidation displays market indecision whereas the value stays above key demand ranges. Bitcoin’s resilience above $100,000 suggests bullish momentum should still be in play, as patrons search for alternatives to push the value larger.

Nevertheless, the following few days shall be essential. A correction might be imminent if Bitcoin fails to carry above the psychologically vital $100,000 stage and struggles to seek out the momentum to surpass $103,600. Analysts warn {that a} break beneath $100,000 might set off a wave of promoting strain, pushing the value towards decrease assist zones.

The $93,000 stage is an important space to observe throughout a downturn. Shedding this key assist would considerably heighten bearish dangers, because it represents a essential demand zone for the market. A failure at this stage might end in a sharper correction, doubtlessly difficult Bitcoin’s bullish construction.

Associated Studying

Bitcoin’s means to carry above $100,000 supplies a cautious sense of optimism. If bulls can preserve assist and gas a breakout above the all-time excessive, Bitcoin might enter a brand new value discovery part. Nevertheless, the excessive stakes make each transfer above or beneath these ranges pivotal for short-term path.

Featured picture from Dall-E, chart from TradingView