The crypto business has skilled a surge in funding, with startups elevating over $1 billion from Enterprise Capital (VC) funds since Donald Trump’s election victory.

This inflow of capital displays rising optimism a few extra favorable regulatory surroundings underneath the incoming administration.

Crypto Startups Appeal to Over $1 Billion in Funding

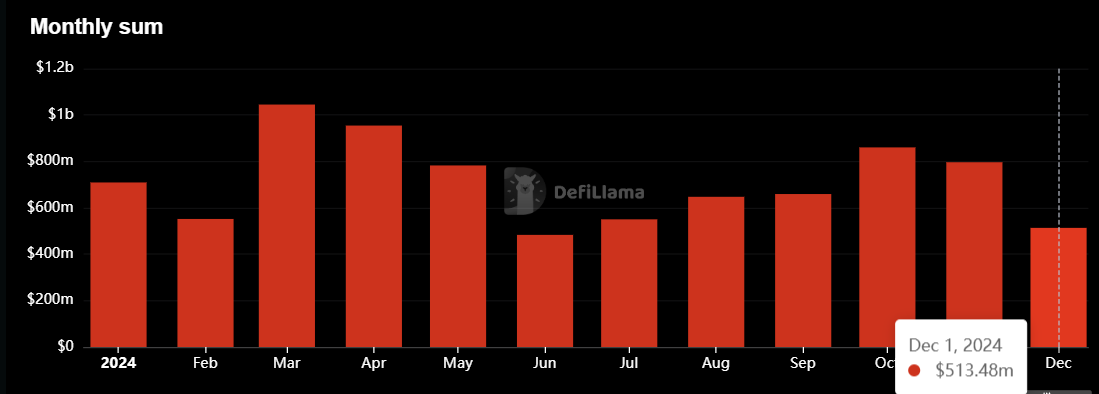

Since Trump’s election victory on November 6, crypto startups have attracted roughly $1.3 billion in funding. DefiLlama knowledge reveals that VCs contributed $796 million in November and a further $511 million in December.

The Avalanche Basis emerged as the biggest fundraiser throughout this era, securing $250 million by a personal token sale. This funding aligns with the community’s upcoming Avalanche9000 improve, scheduled for December 16, which guarantees to boost blockchain scalability and cut back prices.

Enterprise capitalists have considerably elevated their curiosity in crypto infrastructure tasks. They directed over $500 million towards infrastructure builders, with Zero Gravity Labs elevating $40 million and Bitcoin miner Canaan Artistic securing $30 million in notable funding rounds.

In the meantime, the DeFi sector additionally noticed a lift, receiving greater than $150 million in funding. Key investments included $45 million for USDX Cash and $30 million for World Liberty Monetary. This resurgence follows a restoration within the DeFi market, with the sector now attracting curiosity from each retail and institutional traders.

The funding spike is linked to anticipation of a pro-crypto stance within the upcoming administration. Trump has expressed sturdy help for the crypto business, pledging to deliver long-awaited regulatory readability and set up a Strategic Bitcoin Reserve (SBR) in the US.

Since his election win, Trump has introduced a number of pro-crypto appointments. These embody Paul Atkins because the proposed chair of the Securities and Change Fee (SEC) and David Sachs because the White Home’s first crypto czar.

Specialists imagine these appointments might drive regulatory readability, take away obstacles to institutional adoption, and foster higher funding within the sector.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.